Presented by:

[Editor's note: A version of this story appears in the April 2021 issue of Oil and Gas Investor magazine. Subscribe to the magazine here.]

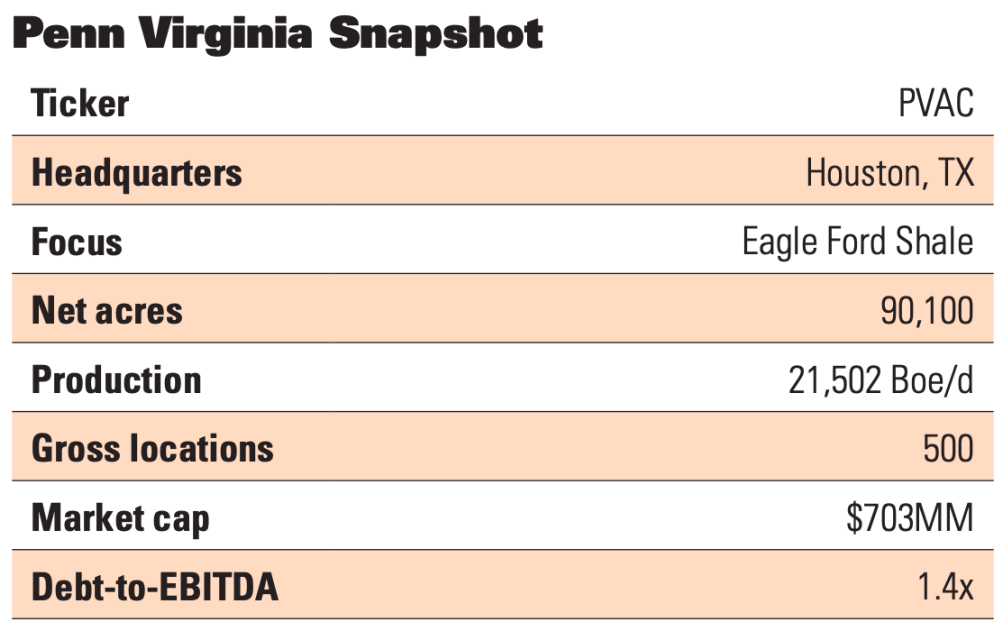

In January, NASDAQ-listed Penn Virginia Corp. closed a deal with private equity firm Juniper Capital Advisors LP in which the Houston financier took a nearly 60% majority ownership position in the small, public independent that calls the Eagle Ford Shale home. In exchange, Penn Virginia’s heavy-laden balance sheet was relieved of approximately $130 million in debt, simultaneously almost tripling the producer’s liquidity under its credit facility and more than doubling its market capitalization.

It was a much-needed lungful of green oxygen.

The reflation partnership was announced in November, but had been in the making since before the COVID-related shutdowns and shut-ins last March. Juniper’s Eagle Ford portfolio company, Rocky Creek Resources, was surrounded by Penn Virginia’s acreage block straddling the Gonzales-Lavaca county border in Texas, and its leaders liked the assets across the fence line. Juniper launched the discussions.

In fact, early negotiations considered a take-private scenario by Juniper, but the volatility of the markets fueled by COVID-19 demand destruction swamped that option. In the end, Juniper contributed $150 million of cash and assets, including Rocky Creek’s 4,100 net acres, to Penn Virginia.

Penn Virginia’s corporate lineage dates back to the late 1800s, when it was formed as an Appalachian coal company. It eventually evolved into a natural gas producer and then oil with assets in various shale basins until it narrowed its focus solely to the Eagle Ford over the past decade. More recently, it emerged from a Chapter 11 bankruptcy in 2016 and brushed itself off from a busted merger with Denbury Resources in 2019.

Darrin Henke joined Penn Virginia as CEO in mid-negotiations with Juniper in August, following the retirement of its previous CEO. Henke hails from Gary Permian, a private equity-backed E&P in which he was CEO, and before that as vice president of southern operations with Encana Corp., which included its Eagle Ford assets.

Henke spoke with Oil and Gas Investor from his corporate office in Houston.

Investor: Where are you from? How did you get into oil and gas?

Henke: That’s a fun story. I was born in Iowa and moved to Amarillo, [Texas], when I was seven, as my dad was transferred there with his career as a mechanical engineer in the nuclear weapons industry. I graduated high school in ’85, and all my buddies’ dads were in oil and gas, so I saw a lot of layoffs in the ’80s, and there was no way I was going to work in the oil and gas industry. I went to college paying for my own school at Texas Tech. I’m a mechanical engineer by degree, and while interviewing for internships, mechanical engineering internships were paying $7 to $8 an hour, and Amoco was paying $11 an hour. I’m like, yeah, I’ll go work for this Amoco company and see what that’s about. I worked for Amoco one summer and for Arco the next summer.

I worked for Amoco in Sundown, west of Lubbock and a beautiful part of the world in Slaughter Field. They are old, conventional, vertical fields where they were doing water injection and CO2 flooding. The natural gas plants I worked in stripped the water and the CO2 out of the gas, and then reinjected it. That was my first foray into oil and gas.

The Arco internship was in Alaska. I was up there the summer of ’89, the same year the Exxon Valdez oil spill happened, so I got to see the impacts of that to the economy and society.

Oil and gas just gets in your blood, and if it’s for you, you can’t shake it. So I went off to college thinking there’s no way I’m ever going to work oil and gas and, looking back, that’s all I’ve done.

Investor: What brought you to Penn Virginia?

Henke: When you get into your late 40s, early 50s, you get an itch to do something different. I left a great company, Encana Oil & Gas, back in November of 2015, and with some colleagues in Denver, collectively we formed Gary Permian with Old Ironsides Energy out of Boston as our private equity backer. We put together an exceptional position in the Delaware Basin north of 35,000 acres, drilled some good wells, and like most of the industry, we went on pause as commodity prices fell due to the COVID pandemic.

During our pause, I got a call from one of Penn Virginia’s board members who had watched my career for a while. He introduced me to the idea of the position and invited me to interview. As soon as I dug into the asset base and its potential, I fell in love with it immediately. After a few meetings with the board, here we are.

Investor: What prompted the investment from Juniper?

Henke: Juniper has been investing in private companies in the oil and gas sector for a number of years and seeks assets or companies that offer solid cash flows and high-quality drilling inventory. They have a database of well-level returns across all major basins and have told me many times that they view Penn Virginia’s inventory as some of the highest return, lowest risk, development potential in North America. Juniper had been drilling next to us for a few years, so were very familiar with the operations and well-level returns. What I think got them most interested, beyond their familiarity, was our balanced portfolio of flowing wells and attractive inventory. That was first and foremost.

They saw an opportunity to come in and infuse a significant amount of equity into the company and help us strengthen our balance sheet so that we can go about harvesting our inventory.

Investor: Was Penn Virginia under financial constraints prior to the funding?

Henke: There was uncertainty around the election and uncertainty around oil demand. We were starting to see another wave of COVID, and the vaccines were not out yet. We didn’t know where crude oil pricing was going to go, so it was an uncertain time relative to the direction of commodity prices and our industry.

This was a great deal for our shareholders. To get a premium on our stock and to have $150 million of equity infusion and another plus or minus $40 million of assets that fit really well with our asset base already, it was just a great deal. Deals get done when they’re a win-win for both parties, and clearly it was a win for Juniper as well.

Investor: What makes it transformational for Penn Virginia?

Henke: Paying down $50 million of our term-loan debt, nearly tripling our liquidity, extending the maturity dates into the future a couple of years—just all of the things it did to strengthen our balance sheet and make us much stronger regardless of future commodity prices.

Access to capital back then was nonexistent. You couldn’t do it. All of the small- to mid-size independents were capital starved, and there’s still very limited access to capital today. Unless you’re a large independent or a major, you just don’t have access to capital markets. So having this much capital infusion coming in for equity was good, and it’s definitely a novel deal.

“We don’t have to drill if prices really pull back. Our balance sheet is in such a great position that we can let all the rigs go and hold onto our inventory.”

Investor: With the change in ownership structure, how did your strategy change post-closing?

Henke: The strategy hasn’t changed. Our strategy has been to focus on cash-on-cash returns and develop our inventory, and that strategy has not changed. Our ability to implement our strategy has changed materially because our balance sheet is in such a better position.

We are in the fortunate position where we don’t have to drill but can choose to do so when the economics make sense. A lot of companies will get in a position where they have to drill to maintain cash flow and all of the metrics relative to the credit facility and term loan. Now we have tremendous flexibility to execute the development of our inventory in a way that maximizes returns. And so when oil prices are high, like they are today, we can run two rigs, bring on production and layer on hedges. And we can do that well inside of cash flow and continue to pay down debt and make the balance sheet even stronger. If commodity prices weaken, we can slow down and preserve our high-quality inventory, preserving returns across the cycle.

Our independent reserve auditor, DeGolyer and MacNaughton, estimates we have about 500 future wells on the books and currently 250 of those wells are estimated to exceed an average 40% well-level rates of return at a $50 flat oil price. So in today’s environment, we expect to make a great return on our wells. At today’s pace, we have over six years of that premium quality inventory. My focus is to continue improving our operations and cost structure to make those additional 250 locations just as economic over time, and we’re already seeing evidence of that with recent well results exceeding D&M type curves.

Also, Penn Virginia has about 500 producing wells. Not a lot of small public companies have our depth of inventory relative to their existing PDP base. That is an incredible inventory. Plus, because of where our assets are located and our high oil content, we generate some of the highest margins per barrel produced. It’s an enviable position.

Investor: What is your current activity?

Henke: We have two rigs running currently that we picked up in the fourth quarter of last year. The plan for this year is to keep those two rigs running. We have a dedicated frac crew that we plan to run for most of the year, and occasionally our schedule will likely allow us to pick up a second frac crew. We plan to turn in line 40 wells this year and believe we can do that while still producing free cash flow, using that cash flow to further pay down debt.

Investor: With oil rising above $60 recently, will you consider increasing activity this year?

Henke: It’s not something we’ve talked about seriously. Our goal is not production growth or growth for growth’s sake. We intend to stay very disciplined in our pace of development. It’s all about cash-on-cash returns. A two-rig program will get production back up to more of a sustainable rate that we’ve had in the past, more like 2019 volumes, and it’s a great place to be. And at two rigs, we believe we can grow production going forward, so it’s a very manageable level of activity and it should deliver a great return for our shareholders.

Investor: Do you have a percentage growth target—or cap—that you’re aiming for?

Henke: We do not. There’s no growth target whatsoever. In fact, what we talk more about is, if service costs were to run up materially, we would consider pulling back the activity level to protect our returns. We don’t want to lower those return expectations trying to chase growth or maintain a two-rig program. If we can’t maintain the returns that we’ve set out to deliver this year, we will likely pull back the activity.

Investor: What is the plan for excess cash flow?

Henke: First and foremost, the plan is to use it to pay down debt. That’s the logical choice for us. We’re at 1.4x debt-to-adjusted-EBITDA today and our leverage target is to be in the 1.0x to 1.5x range. So we’re happy with where we’re at today, but if we don’t have other uses for the free cash flow, getting down toward a 1.0x ratio would be fine. We’ll give ourselves some room in case commodity prices do decline. After that, we intend to review what makes the most sense on a returns basis.

Investor: Do you have any desire to do acquisitions?

Henke: Absolutely. We would love to do accretive acquisitions that make sense. First of all, we’re focused on the Eagle Ford. If an opportunity came along that had some acreage outside the Eagle Ford in addition to something that’s really attractive to us in the Eagle Ford, we would look at that as well, but we’re not going to focus outside of the Eagle Ford individually or independently.

When we think about acquisitions, it first and foremost needs to be accretive to our stakeholders on a number of different metrics. In addition to typical accretion measures, we also think about relative margins, inventory to PDP ratios and the quality of that inventory relative to Penn Virginia.

Penn Virginia has one of the best margins in the business just because we have such a high oil cut, and we want to maintain those high margins, which we feel provides us with a major advantage if commodity prices were to drop again. We’re currently in the 78% range on oil relative to total production. We’ve forecast over the next couple of years the wells we drill will probably average around an 80% oil cut, which is pretty unique. So, when it comes to M&A, we think about how well the acreage opportunity fits in with ours.

But there’s no certainty M&A will happen, and with the depth of our inventory, we don’t have to do M&A. We’ve got over 10 years of inventory with a two-rig program. The number one thing we need to do is execute with excellence. There’s very little value baked into our share price relative to our inventory, and if we can get people to fully understand our inventory and value it accordingly, that’s going to be wonderful for our shareholders. It doesn’t require M&A.

“All of the small- to mid-size independents were capital starved [in 2020], and there’s still very limited access to capital today.”

Investor: Do you feel compelled to gain scale through mergers to attract more attention from Wall Street?

Henke: No, we don’t feel compelled because of our strong current position. However, we do see better trading multiples for larger entities, and we certainly would love to have those type of multiples. That being said, they have to be accretive deals and they have to be smart deals. When you get larger just for the sake of being larger, the multiples are not going to come your direction. So we’d love to enjoy those multiples via M&A, but they’ve got to be good deals.

Investor: Does the Eagle Ford need consolidation?

Henke: Our industry is ripe for consolidation across the board and the Eagle Ford is part of that. There is an opportunity for several players to consolidate, and there’s absolutely an opportunity for Penn Virginia to be a part of that.

Investor: Would you prefer to be consolidator or consolidated?

Henke: We’re agnostic. Let’s do what’s best for our shareholders. That’s what we’re here for. We’re not here to protect our jobs; we’re here to do what’s best for the shareholder.

Investor: Is there room in the public marketplace today for small-cap, growth-oriented E&Ps?

Henke: You certainly don’t hear it talked about much. When anyone talks about growth, that seems to be not-so-well received. At some point that will change. Our focus is cash-on-cash returns. We are a unique small cap that we can grow and produce free cash flow, maximizing shareholder returns given our high margins. The company that can grow while simultaneously producing free cash flow and do it repeatedly year after year should be rewarded by Wall Street over time.

Investor: If prices were to go south again, at what price does your acreage break even?

Henke: We believe we have a lot of wells that breakeven in the low $30s, and more in the mid-$30s.

But do you give it away at $30? Do you drill at all? Last year, we saw the price go below $30 into the $20s, and we shut in production and shut down rigs. So even if it’s economic at those levels, should we pursue that inventory at that point in time?

We don’t have to drill if prices really pull back. Our balance sheet is in such a great position that we can let all the rigs go and hold onto our inventory. We have very low G&A and are a very lean company. We feel we can absolutely weather quite a storm again, whenever it comes.

Investor: Considering the unprecedented circumstances, how did you manage to have free cash flow through every quarter last year?

Henke: Great hedges. Last year, we realized $93 million in cash from hedges. Obviously, I was not here, so it was the team that was here at the time, and our CFO Rusty Kelley was a big part of that.

Likewise, we’re being disciplined with how much capital we spend when the returns don’t justify the investment. When commodities dropped, the team had three rigs running and pulled back to zero pretty quickly, maintaining the commitment to returns based investment of capital.

Then the team secured storage, held onto the barrels and sold them when prices were up materially. Every barrel of oil we sold last year on average received over $50 per barrel realized price. I suspect if that’s not one of the highest in the industry, it’s got to be close.

Investor: What is your hedging strategy?

Henke: We hedge when we make decisions to spend capital to lock in attractive rates of return. We have a significant amount of hedges in place to protect those investments. First quarter, second quarter, we’re highly hedged, though we have done so with collars, allowing for downside protection but exposure to upside movements in oil prices. You’ll see us continue to layer in additional hedges as we get further into the year, locking in incremental returns as we invest additional capital.

Investor: As oil has bounced up significantly this year, are you missing out on the upside?

Henke: Absolutely—and there’s nothing wrong with that as that’s not the way we view hedging. The hedging program is all about risk management and locking in attractive returns. We saw what happened with commodity prices last year, and it’s easy to forget. It was not that long ago, right? It hasn’t even been a year yet. We’re proud of our hedging program and what it did for us last year. And we’re still proud of what it’s doing for the company today: locking in what we believe are great returns. If prices rise, it means we get to lock in even higher returns for the next wells we drill.

Investor: How is Penn Virginia addressing environmental, social and governance (ESG) concerns?

Henke: With my history in the industry, ESG is a particular focus. We assembled a task force last year of management representatives across the company, and they are first in understanding what ESG initiatives are already in place and what data will be discussed relative to Penn Virginia’s performance. In the next month or two, we will put on our website a synopsis of where we stand relative to ESG.

It will show emissions; we’re trying to quantify that. Things such as how many truck trips are we saving a day by moving water around the field via pipeline? When we move oil via pipeline, how many oil trucks have we taken off the road? Those are the things we’re trying to quantify. Later this year and in future years more goals will be wrapped around that, and we’ll look to benchmark ourselves versus our peers.

Investor: With gas assets gaining popularity in a world focused on lowering greenhouse-gas emissions, would you consider balancing your portfolio with more gas?

Henke: It all comes down to profitability and the margins, while operating in a safe and environmentally sound manner. We love the fact that we’re about the highest percentage oil producer of any Eagle Ford company. But that being said, if we can make a great Eagle Ford acquisition that is gassier and makes sense from all the other metrics, we’re open to that. However, our preference would be to keep our higher oil cut. In the end, though, it’s all about the economics and cash-on-cash returns.

“We take our social license to operate very seriously and strive to always operate responsibly. We also recognize there will be increasing focus on that aspect of our business as time goes on.”

Investor: Are you concerned that the social license to develop oil assets might be revoked in the coming years by the movement to effect an energy transition?

Henke: We take our social license to operate very seriously and strive to always operate responsibly. We also recognize there will be increasing focus on that aspect of our business as time goes on. When it comes to the future, being in the state of Texas and being in the Eagle Ford, close to the Gulf Coast markets with very little federal or state involvement relative to minerals or surface, we believe we are in the best place we could possibly be to execute our business plan.

Investor: How should the industry respond to negative sentiment it is currently facing?

Henke: Our industry needs to do a better job of making sure that consumers understand how much oil we use day in, day out, not only in Texas and in the U.S. but throughout the world. We are providing a product that our society demands and has demanded for a long time and likely will demand well into the future.

Our industry has made so many strides in the past 30 years, when it comes to our environmental footprint and the way we conduct our operations. Our society could not function without the energy that we all take for granted. I’m proud to be a part of the industry that supplies that, that allows us to afford the lifestyles that we do.

Investor: What is your outlook for 2021?

Henke: I’m excited about where commodity prices are at, about the asset base and inventory we’ve built, and about the team we’ve assembled—we’re off to a great start this year. I think as we deliver these returns and grow free cash flow, we’re going to bring investors back into the space.

It’s great to be in a position where, regardless of the future commodity price environment, we’re set up to be a long-term player. Our inventory will work at very low prices, but we don’t have to drill it at very low prices. We can wait for prices to come back, and that’s not where we were a year ago or even six months ago. It’s a much better place relative to our balance sheet and liquidity.

So it’s good to not be worried about the balance sheet and just go and execute. Good things will happen.

Recommended Reading

What's Affecting Oil Prices This Week? (Feb. 5, 2024)

2024-02-05 - Stratas Advisors says the U.S.’ response (so far) to the recent attack on U.S. troops has been measured without direct confrontation of Iran, which reduces the possibility of oil flows being disrupted.

What's Affecting Oil Prices This Week? (March 18, 2024)

2024-03-18 - On average, Stratas Advisors predicts that supply will be at a deficit of 840,000 bbl/d during 2024.

What's Affecting Oil Prices This Week? (March 11, 2024)

2024-03-11 - Stratas Advisors expects oil prices to move higher in the middle of the year, but for the upcoming week, there is no impetus for prices to raise.

What's Affecting Oil Prices This Week? (March 4, 2024)

2024-03-04 - For the upcoming week, Stratas Advisors expect the price of Brent will move sideways and will struggle to break through $85.

What's Affecting Oil Prices This Week? (March 25, 2024)

2024-03-25 - On average, Stratas Advisors are forecasting that oil supply will be at a deficit of 840,000 bbl/d in 2024.