Talos Energy’s $52 million acquisition of Apollo-backed Whistler Energy II follows a recent uptick in M&A activity in the Gulf of Mexico. (Source: Shutterstock.com)

[Editor's note: This story was updated at 11:26 a.m. CST Sept. 11.]

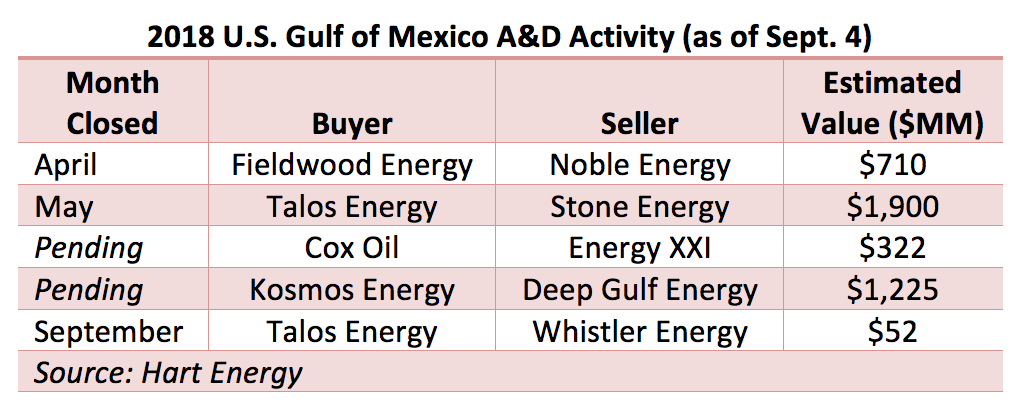

Months after Talos Energy Inc. (NYSE: TALO) closed its combination with Stone Energy, the Houston-based E&P returned with a $52 million bolt-on in the Gulf of Mexico (GoM)—a region that has seen a recent uptick in M&A activity.

Talos said Sept. 4 it acquired Whistler Energy II LLC, a privately-owned oil and gas company backed by Apollo Global Management with assets located in the Green Canyon area of the Central GoM. The company’s net production year-to-date is about 1,500 barrels of oil equivalent per day (boe/d), of which 82% is oil.

As part of the acquisition, Talos negotiated the release of roughly $77 million of cash collateral that had secured Whistler's surety bonds that the company will not need to replace. After backing out the $31 million of cash collateral reimbursements and Whistler’s $7 million cash balance, Seaport Global Securities estimates Talos paid only $14 million net cash.

The result is “an attractive multiple” before plugging and abandonment liabilities of roughly $9,300 per flowing boe based on production from the acquired assets, Mike Kelly, senior analyst with Seaport, said in a research note on Sept. 5.

Kelly added he believes Talos’ acquisition of Whistler illustrates the attractiveness of the current M&A environment for prospective buyers in the GoM.

“Post the industry’s recent exodus from the offshore basin, remaining GoM players can scoop up high-quality assets—such as Whistler—which possess existing production, in-place infrastructure, and de-risked/highly economic tieback opportunities,” he said.

Andrew G. Inglis, chairman and CEO of Kosmos Energy Ltd. (NYSE: KOS), echoed a similar sentiment when Kosmos announced the acquisition of Deep Gulf Energy Cos., a portfolio company of First Reserve with deepwater GoM assets, in early August.

“With many competitors leaving the Gulf of Mexico to chase onshore shale plays, a huge opportunity has opened in the basin,” Inglis said in a statement. “The best deepwater assets can compete with the best of shale, and now is a good time to enter the Gulf of Mexico.”

Kosmos’ acquisition of Deep Gulf, valued at about $1.23 billion in cash and stock, will mark the company’s entry into the U.S. GoM.

Other notable deals in the Gulf so far this year include the $710 million purchase of Noble Energy Inc.’s GoM business by Fieldwood Energy LLC in April and Cox Oil Offshore LLC’s acquisition of Energy XXI Gulf Coast Inc. (NASDAQ: EGC), which is expected to close in October.

RELATED: Fieldwood Energy: Voyage From Debt To The Deep

Whistler’s assets include a 100% working interest in the Green Canyon 18, Green Canyon 60 and Ewing Bank 988 blocks, which comprise 16,494 acres, and a fixed production platform in about 750 ft of water. All leases are HBP.

The Green Canyon 18 Field was originally developed by Exxon Mobil Corp. (NYSE: XOM) and sold to Whistler in 2012. The field has cumulative production of more than 117 million boe to date.

The Green Canyon 18 production facility is located roughly 18 miles north of the Talos operated Phoenix Field and Tornado discovery. The facility currently has a nameplate production capacity of about 35,000 boe/d, comprised of 30,000 barrels per day of oil and 30 million cubic feet per day of gas, with potential for additional expansions.

Talos President and CEO Timothy S. Duncan said the company plans to immediately engage in a detailed field study of Whistler’s assets to identify additional drilling locations.

Additionally, Talos acquired new leases in the latest federal lease sale in the GoM containing at least three drilling prospects that could be tied back to the Green Canyon 18 production facility, according to the company press release.

UBS Investment Bank was transaction adviser to Whistler.

Emily Patsy can be reached at epatsy@hartenergy.com. Mary Holcomb contributed to this article.

Recommended Reading

TGS, SLB to Conduct Engagement Phase 5 in GoM

2024-02-05 - TGS and SLB’s seventh program within the joint venture involves the acquisition of 157 Outer Continental Shelf blocks.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

StimStixx, Hunting Titan Partner on Well Perforation, Acidizing

2024-02-07 - The strategic partnership between StimStixx Technologies and Hunting Titan will increase well treatments and reduce costs, the companies said.

Tech Trends: QYSEA’s Artificially Intelligent Underwater Additions

2024-02-13 - Using their AI underwater image filtering algorithm, the QYSEA AI Diver Tracking allows the FIFISH ROV to identify a diver's movements and conducts real-time automatic analysis.

Subsea Tieback Round-Up, 2026 and Beyond

2024-02-13 - The second in a two-part series, this report on subsea tiebacks looks at some of the projects around the world scheduled to come online in 2026 or later.