Often during the ups and downs of the energy industry’s cycles, people dismiss the front-running offshore playsâ€"Gulf of Mexico and the North Seaâ€"as viable exploration and production arenas. But just when these offshore areas are thought to be passe, new discoveries prove them otherwise. On the U.K. Continental Shelf (UKCS), June oil and gas production was down 18% from the year before, according to The Royal Bank of Scotland. But activity is increasing. Last year, total investment in the UKCS for exploration, new-field development and operations rose 15% to 9.7 billion pounds from the prior year, according to the U.K. Offshore Operators Association (UKOOA). The number of wells drilled rose 30% to about 300. These were mostly development wells. But operators spudded 61 exploration and appraisal wells of that total, up from 49 in 2004. In the 24th UKCS licensing round, held in June, 121 companies applied for 255 blocks; awards are to be announced this fall. Twenty-four new E&P players participated in the round; some 28 newcomers bid last year. Several are start-ups that are newly public on London’s Alternative Investment Market (AIM). “We’re in a very attractive window right now. We’ve had a poor reputation for the past 10 years, but it’s changed,†says Jim Hannon, managing director of Hannon Westwood in Glasgow. The consulting firm, with an office in Houston, tracks UKCS merger and acquisition, licensing, farm-in and drilling activity as well as providing strategic business and geological advice. For more on this, see the October issue of Oil and Gas Investor. For a subscription, call 713-260-6441.

Recommended Reading

Novo II Reloads, Aims for Delaware Deals After $1.5B Exit Last Year

2024-04-24 - After Novo I sold its Delaware Basin position for $1.5 billion last year, Novo Oil & Gas II is reloading with EnCap backing and aiming for more Delaware deals.

EIA: Permian, Bakken Associated Gas Growth Pressures NatGas Producers

2024-04-18 - Near-record associated gas volumes from U.S. oil basins continue to put pressure on dry gas producers, which are curtailing output and cutting rigs.

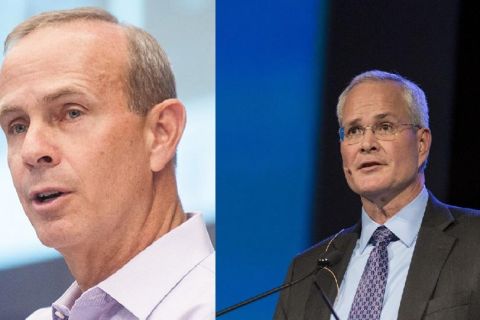

Chevron CEO: Permian, D-J Basin Production Fuels US Output Growth

2024-04-29 - Chevron continues to prioritize Permian Basin investment for new production and is seeing D-J Basin growth after closing its $6.3 billion acquisition of PDC Energy last year, CEO Mike Wirth said.

Enverus: Permian Gains Will Sustain US Oil Production Through 2030

2024-05-09 - Crude output gains from the Permian Basin will keep U.S. oil production relatively flat entering the 2030s, offsetting declines from mature oily basins, according to Enverus Intelligence Research.

CEO Darren Woods: What’s Driving Permian M&A for Exxon, Other E&Ps

2024-03-18 - Since acquiring XTO for $36 billion in 2010, Exxon Mobil has gotten better at drilling unconventional shale plays. But it needed Pioneer’s high-quality acreage to keep running in the Permian Basin, CEO Darren Woods said at CERAWeek by S&P Global.