Winter arrived fashionably late with heating demand finally showing up in late November and early December. But it arrived far too late to save the commodity price market.

For the oil and gas industry, 2015 was a lost year with low prices and high storage levels across liquids, gas and crude oil products. In December, prices were among the lowest they had been all year with West Texas Intermediate (WTI) crude trading below $40 per barrel (bbl) and Henry Hub natural gas prices trading just above $2 per million Btu.

Prices could be volatile as 2016 begins as there are fears over potential supply disruptions due to geopolitical events. While it is possible that prices could increase in the short term, the near-term outlook is still negative as prices are challenged due to oversupply.

A major headwind for crude oil came when OPEC in late 2015 announced it will stick with its policy of all-out production, which is causing hedge funds and money managers to increase their short positions in WTI and Brent futures near a record high.

The situation with NGL prices is a bit more certain as the over-supplied market is capped to how much it can grow until a greater sense of balance is restored.

Ethane has long been the NGL with the largest supply overhang, as it has been over-supplied for about three years despite steady rejection throughout the country.

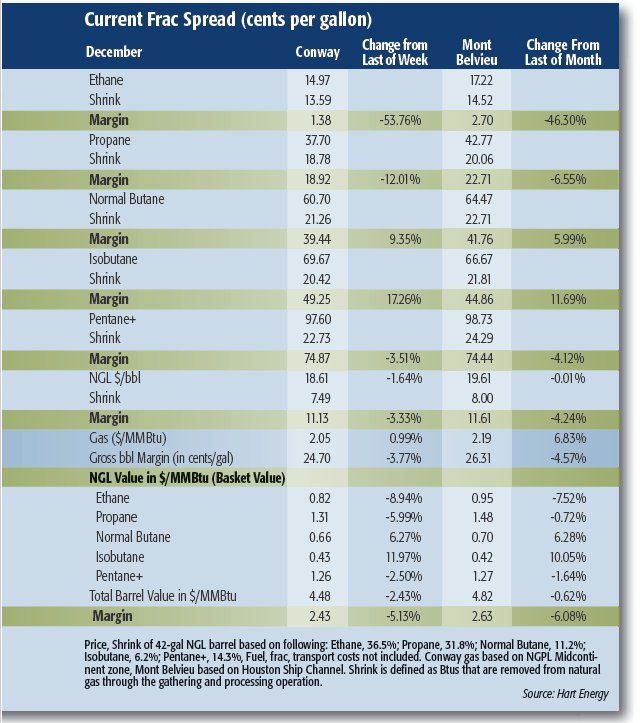

The good news is that ethane cracking capacity is increasing in the coming months and the widespread rejection has begun to have a positive impact on supplies as storage levels are well below what they were last year at this time. The bad news is that prices are still challenged at values under 20 cents per gallon (gal) with thin margins at both the Conway, Kan., and Mont Belvieu, Texas, hubs.

These prices are also capped by propane, which has supplanted ethane as the most over-supplied NGL despite record high LPG exports.

Lower prices put propane into direct competition with ethane as an ethylene feedstock, which lowers the ceiling for ethane prices to the level of propane’s floor price.

The theoretical NGL barrel price is $10 per bbl lower than it was last year at the same time with all but ethane losing more than 20 cents per gal in the same time frame.

Natural gas storage levels fell 4 trillion cubic feet in early December as the withdrawal season finally began. However, this will be a nearly impossible overhang to work off in a cold winter, much less the warmer season being forecast as the new year began.

Recommended Reading

BP’s Kate Thomson Promoted to CFO, Joins Board

2024-02-05 - Before becoming BP’s interim CFO in September 2023, Kate Thomson served as senior vice president of finance for production and operations.

Magnolia Oil & Gas Hikes Quarterly Cash Dividend by 13%

2024-02-05 - Magnolia’s dividend will rise 13% to $0.13 per share, the company said.

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

HighPeak Energy Authorizes First Share Buyback Since Founding

2024-02-06 - Along with a $75 million share repurchase program, Midland Basin operator HighPeak Energy’s board also increased its quarterly dividend.

Occidental Increases Annual Dividend by 22%

2024-02-11 - Occidental Petroleum Corp.’s newly declared dividend is at an annual rate of $0.88 per share, compared to the previous annual rate of $0.72 per share.