NextEra Energy Partners (NEP) said Oct. 24 it plans to repower 740 megawatts (MW) of wind facilities through 2026, which the company said provides an opportunity to deploy capital at attractive returns.

The Florida-based limited partnership is part of renewable energy powerhouse NextEra Energy Inc., which reported third-quarter 2023 earnings of $1.92 billion—up about 14% from about $1.68 billion a year earlier, on an adjusted basis. The results continue an earnings growth trend as the company’s utilities and renewable energy business units bolster the company.

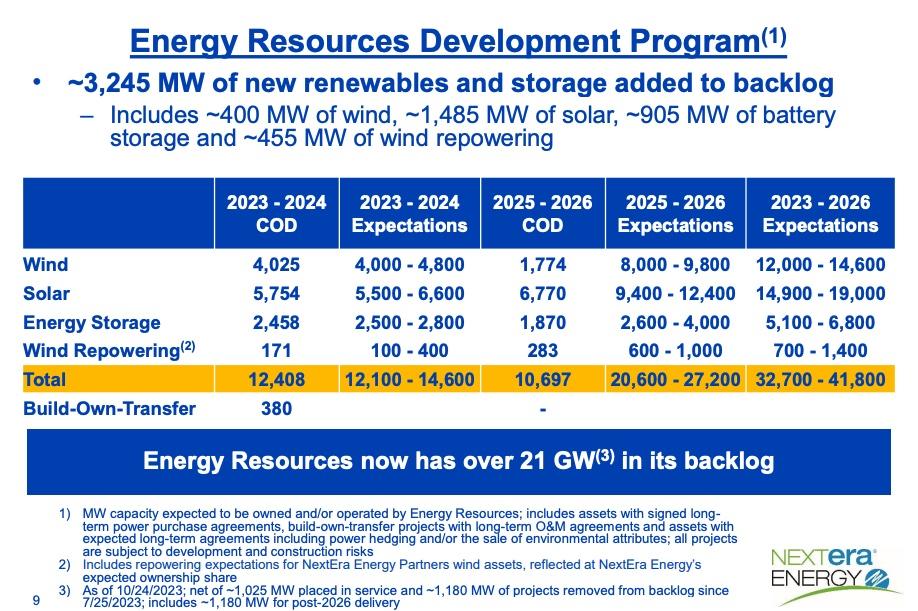

The parent company said its renewables arm, NextEra Energy Resources, saw a record quarter of new renewables and storage origination with more than 3.2 gigawatts (GW) added to its backlog. Led by about 1.5 GW of solar and about 900 MW of battery storage, the additional projects include about 400 MW of wind and about 455 MW of wind repowering, including NEP’s assets, the company said.

“We’re super excited about repowers as part of the longer-term growth plan within NEP. And with such an extensive pipeline of renewable projects, to pursue these repowers it will be a nice complement to continuing to acquire assets,” NextEra Energy Resources CEO Rebecca Kujawa told analysts on an Oct. 24 earnings call. “It doesn’t meet the entire growth plan but certainly is a nice part of it.”

Wind repowering is essentially refurbishing existing wind turbines with newer technology and commissioning new turbines amidst the use of existing infrastructure—instead of pursuing construction of a new greenfield development. The upgrades are expected to make way for cost, efficiency and production improvements.

“A 1% change in the wind production index equates to roughly $4[MM]-$6MM of adjusted EBITDA for the balance of 2023,” NEP said.

In a repowering project, NextEra invests about 50% to 80% the cost of a newbuild and is able to boost the performance of turbine equipment while also taking advantage of 10-year production tax breaks, NextEra Energy CFO Kirk Crews said.

Capital costs for the repowers are expected to be lower than greenfield projects because the repowers involve no new foundations, towers or interconnection facilities plus reduced scope of generating equipment, NextEra said.

“Energy Resources has previously repowered roughly 6 gigawatts of its approximately 23-gigawatt operating wind portfolio,” Crews said. “We believe we will be able to repower much of our existing wind portfolio in the coming years.”

The NEP repowering, if approved by the company’s board of directors, will be funded either with tax equity or project-specific debt.

Record set

NextEra Energy Resources added more than 3.2 MW of projects to its backlog during the third quarter, marking a quarterly company record amid the continued global push for cleaner energy. The additions pushed its backlog total to more than 21 GW.

“Although we will remind you that signings can be lumpy quarter [to] quarter, we do believe this is a terrific sign of strong underlying demand for new renewable generation,” Crews said.

The backlog includes about 1 GW of new projects placed into service since NextEra’s second-quarter 2023 call, but excludes about 1.2 GW.

About 800 MW of projects in New York were removed from the backlog following a decision by New York State Energy Research and Development Authority earlier this month. New York rejected requests from some renewable developers seeking increases to offtake contracts. Other megawatts were removed due to permitting challenges, Crews said, adding the company is still on track to develop about 30 GW to 42 GW of renewables through 2026.

“Our backlog is in good shape and benefiting from our interest rate swap, global supply chain management capabilities and the ability to procure equipment, materials and balance of plant services at scale across our portfolio,” Crews said. “The expected return on equity for our backlog are mid-teens for solar and over 20 for wind and storage. As we have done historically, we price our power purchase agreements commensurate with current market conditions, including our current cost of capital, in order to maintain appropriate returns.”

NextEra Energy Resources reported earnings of $882 million for third-quarter 2023, up from $729 million a year earlier.

NextEra’s Florida Power & Lighting, the largest electric utility in the U.S., also reported growth for the quarter as its customer count increased by 65,000. Net income for the quarter was $1.18 billion, up from $1.07 billion in the prior-year quarter.

Recommended Reading

US Oil, Gas Rig Count Falls to Lowest Since January 2022

2024-05-03 - The oil and gas rig count, an early indicator of future output, fell by eight to 605 in the week to May 3, in the biggest weekly decline since September 2023.

Pemex Reports Lower 2Q Production and Net Income

2024-05-03 - Mexico’s Pemex reported both lower oil and gas production and a 91% drop in net income in first-quarter 2024, but the company also reduced its total debt to $101.5 billion, executives said during an earnings webcast with analysts.

Chouest Acquires ROV Company ROVOP to Expand Subsea Capabilities

2024-05-02 - With the acquisition of ROVOP, Chouest will have a fleet of more than 100 ROVs.

SLB, OneSubsea, Subsea 7 Sign Collaboration Deal with Equinor

2024-05-02 - Work is expected to begin immediately on Equinor’s Wisting and Bay Du Nord projects.

SilverBow Makes Horseshoe Lateral in Austin Chalk

2024-05-01 - SilverBow Resources’ 8,900-foot lateral was drilled in Live Oak County at the intersection of South Texas’ oil and condensate phases. It's a first in the Chalk.