(Source: Shutterstock.com)

NextDecade Corp. has secured debt financing to support the build-out of the company’s $18.4 billion Rio Grande LNG project in South Texas., according to a Sept. 20 news release.

Houston-based NextDecade Corp. entered into a credit agreement with a group of lenders for $356 million in senior loans to finance a portion of the first three liquefaction trains at Rio Grande LNG.

The disbursement of the senior loans enabled NextDecade to reduce commitments under Rio Grande LNG’s existing term loan facilities for the project’s first phase to less than $10.8 billion from $11.1 billion, the company said.

“This financing transaction aligns with NextDecade’s long-term balance sheet strategy for Phase 1, which includes extending and staggering debt maturities, diversifying sources of capital, reducing bank capital over time to provide potential capacity for financing future LNG expansions, and mitigating interest rate exposure,” the company said.

NextDecade announced a final investment decision (FID) to go forward with developing Phase 1 of Rio Grande LNG in July. The first phase calls for three liquefaction trains with a nameplate capacity of 17.6 million tonnes per annum (mtpa).

A second phase of construction planned at Rio Grande LNG—being developed in Brownsville, Texas—could eventually add two more trains, boosting the export facility’s capacity up to 27 mtpa.

NextDecade’s LNG FID was the third in the U.S. this year. The others are the second phase of Venture Global’s Plaquemines LNG project in Louisiana and Phase 1 of Sempra’s Port Arthur LNG project.

RELATED: NextDecade Corp.’s FID to Fuel Second Wave of US Exporting Power

Recommended Reading

Tech Trends: QYSEA’s Artificially Intelligent Underwater Additions

2024-02-13 - Using their AI underwater image filtering algorithm, the QYSEA AI Diver Tracking allows the FIFISH ROV to identify a diver's movements and conducts real-time automatic analysis.

Subsea Tieback Round-Up, 2026 and Beyond

2024-02-13 - The second in a two-part series, this report on subsea tiebacks looks at some of the projects around the world scheduled to come online in 2026 or later.

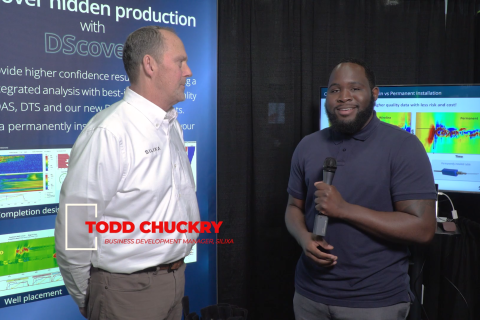

Exclusive: Silixa’s Distributed Fiber Optics Solutions for E&Ps

2024-03-19 - Todd Chuckry, business development manager for Silixa, highlights the company's DScover and Carina platforms to help oil and gas operators fully understand their fiber optics treatments from start to finish in this Hart Energy Exclusive.

CERAWeek: AI, Energy Industry Meet at Scary but Exciting Crossroads

2024-03-19 - From optimizing assets to enabling interoperability, digital technology works best through collaboration.

Cyber-informed Engineering Can Fortify OT Security

2024-03-12 - Ransomware is still a top threat in cybersecurity even as hacktivist attacks trend up, and the oil and gas sector must address both to maintain operational security.