Red Wolf Natural Resources LLC struck its first acquisition on May 20 with the purchase of a large acreage position in Oklahoma shale plays where management of the newly-formed E&P company already have a successful track record.

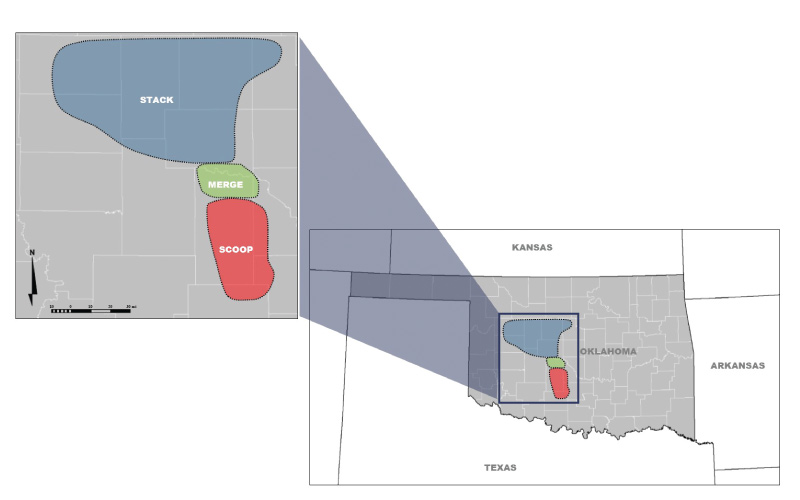

Red Wolf said it acquired roughly 56,000 net acres and associated production in Oklahoma’s Scoop, Stack and Merge plays as well as the broader Anadarko Basin. The Oklahoma City-based company didn’t disclose the seller and value of the transaction.

The acquisition, comprised of contiguous acreage positions that the company said support extended-lateral drilling, marks the return of Red Wolf’s founders to the Oklahoma resource plays.

Red Wolf was formed in February with an equity commitment from Dallas-based energy investment firm Pearl Energy Investments. The value of the commitment wasn’t disclosed.

The company’s founders, led by CEO Drew Deaton and COO Jeff Dahlberg, have experience in the Anadarko Basin region as well as the Denver-Julesburg Basin from when the pair previously worked together at Ward Energy Partners LLC.

“We are excited to announce our re-entry into Oklahoma’s prolific Scoop, Stack and Merge plays with the acquisition of these assets,” Deaton said in a statement on May 20. “Our leadership team has a successful track record in and deep knowledge of this area from our prior experience.”

Red Wolf’s acquisition includes proven well results in primary target zones plus existing infrastructure and agreements with “top-tier” midstream operators in the region, according to the company press release.

Deaton called Red Wolf’s acquisition as strategic and said the transaction represents both near-term and long-term value for the company.

“We think that the Scoop, Stack and Merge plays combine many important characteristics of top-tier hydrocarbon plays, including multiple benches of stacked pay which provide compelling economic returns and repeatable results,” he added.

Thompson & Knight LLP and Kirkland & Ellis LLP were legal advisers to Red Wolf for the acquisition.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

From Restructuring to Reinvention, Weatherford Upbeat on Upcycle

2024-02-11 - Weatherford CEO Girish Saligram charts course for growth as the company looks to enter the third year of what appears to be a long upcycle.

BP Pursues ‘25-by-‘25’ Target to Amp Up LNG Production

2024-02-15 - BP wants to boost its LNG portfolio to 25 mtpa by 2025 under a plan dubbed “25-by-25,” upping its portfolio by 9% compared to 2023, CEO Murray Auchincloss said during the company’s webcast with analysts.

Patterson-UTI Braces for Activity ‘Pause’ After E&P Consolidations

2024-02-19 - Patterson-UTI saw net income rebound from 2022 and CEO Andy Hendricks says the company is well positioned following a wave of E&P consolidations that may slow activity.

Kimmeridge Fast Forwards on SilverBow with Takeover Bid

2024-03-13 - Investment firm Kimmeridge Energy Management, which first asked for additional SilverBow Resources board seats, has followed up with a buyout offer. A deal would make a nearly 1 Bcfe/d Eagle Ford pureplay.

SilverBow Rejects Kimmeridge’s Latest Offer, ‘Sets the Record Straight’

2024-03-28 - In a letter to SilverBow shareholders, the E&P said Kimmeridge’s offer “substantially undervalues SilverBow” and that Kimmeridge’s own South Texas gas asset values are “overstated.”