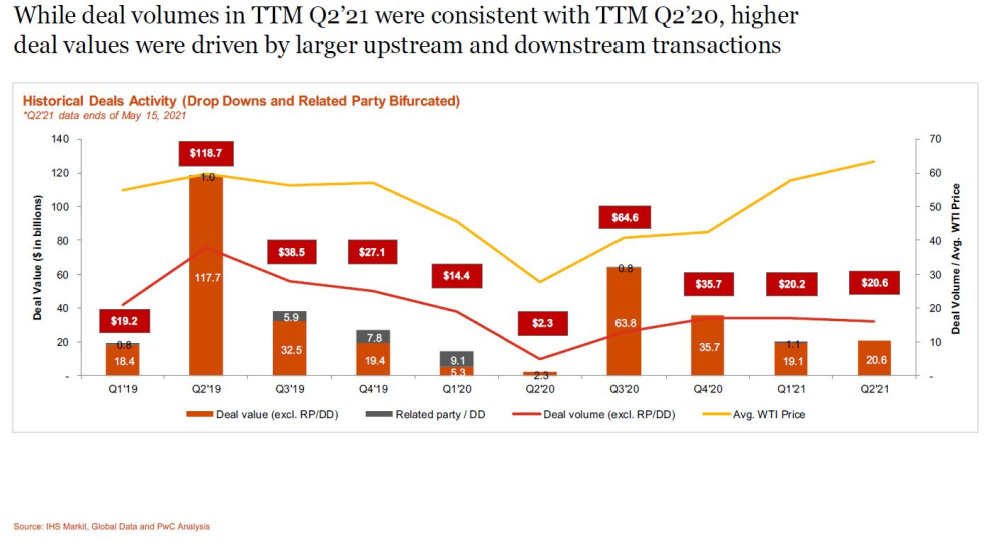

Amid the effects of the pandemic, deal values increased more than 70% to $141 billion in the trailing 12 months, led by upstream deals that contributed $38.6 billion in value, according to a PwC report. (Source: Hart Energy)

One surprising outcome of the recent large-scale consolidation in the oil patch seen the past 12 months has been the tendency of deals to produce actual savings and increased value.

While mergers in the past may have focused on increasing shale runway, more recent combinations have ridden on goodwill from investors, an easing of pandemic restrictions and rising commodity prices.

The industry has largely shaken off the abysmal first half of 2020, when upstream deal value dropped by 97% to their lowest levels since the first half of 2011, according to PWC’s midyear outlook. Amid the effects of the pandemic, deal values increased more than 70% to $141 billion in the trailing 12 months, led by upstream deals that contributed $38.6 billion in value.

Upstream deal value was largely driven by two megadeals: Chevron Corp.’s $13 billion acquisition of Noble Energy in July 2020 and ConocoPhillips’ deal to acquire Permian pure-play Concho Resources for $13.3 billion.

Analysis by PWC identified cost reductions as the primary incentive for dealmaking up to the midpoint of 2021. In the past 12 months, many consolidation transactions have been pinned to lower G&A, lease operating expenses and capital synergies.

Consolidation in the upstream sector has allowed operators to acquire neighboring acreage, lower well costs and increase lateral well lengths. In the past 12 months, operational savings accounted for about 39.4% of deal synergies followed by G&A savings that accounted for 39.1% of savings.

Seenu Akunuri, the leader for PwC’s U.S. energy and mining valuation practice, said the focus for companies in years past was to engage in deals that expanded inventory and replaced reserves. Transactions are now more comprehensive and consider other factors, such as shared midstream assets.

“And of course, as a way to strengthen the balance sheets, minimize debt and take advantage of the run-up in stock prices to do transactions using shares,” Akunuri added.

The focus for deals has shifted to not only to a longer-term perspective, but also as a way to create a stronger balance sheet that doesn’t allow for a company to be caught off guard if prices weaken two or three years out.

“In all of the deals that we have seen, companies have actually become stronger in terms of managing their balance sheet, their leverage ratio tools and ensuring that they continue to focus on breakeven prices,” Akunuri said.

For 2021, deals have also played out as energy indices have recovered in the past six months, primarily through commodity price increases and, so far for the year, are now outpacing the S&P 500.

Despite a healthier industry outlook, and the recovery of WTI crude prices, only a few oil and gas companies have recovered to pre-COVID market valuations.

As of June 22, year-over-year market cap is down for companies such as Royal Dutch Shell (-34%), BP (-29%), Eni (-21%), Repsol (-17%), Apache Corp. (-13%), and Exxon Mobil and Chevron (both -10%). Outliers includes ConocoPhillips, which has seen a 14% gain, and Equinor, with a 2% gain.

After a consolidation-heavy year, which largely relied on the exchange of shares rather than cash, “by the time they closed, the purchase consideration actually significantly increased 30%, 40%, 50% … [and] that resulted in much bigger returns for the holders of those shares of the target company,” Akunuri said.

“It has seen a great turnaround or the energy indices and much of the recovery from pre-COVID to post-COVID, year to date today, is primarily driven by what has happened over the past six months,” he said.

But the industry remains seemingly dogged by its past. Among second-quarter 2021 deals, the multiple for upstream production increased to at least 25x, compared to second-quarter 2020, which valued production at about 10x.

“Both from proved multiple versus a flowing multiple perspective, it's still tracking a little behind from 2019 multiples,” Akunuri said. However, “there is a positive trend that is continuing this year, as we are seeing more and more deals being done.”

Recommended Reading

Could Concentrated Solar Power Be an Energy Storage Gamechanger?

2024-03-27 - Vast Energy CEO Craig Wood shares insight on concentrated solar power and its role in energy storage and green fuels.

RIC Energy Sells 20 MW of Solar Plants to Luminace

2024-03-04 - RIC Energy says the facilities are expected to provide 100% clean energy to more than 5,000 homes participating in the utilities’ community solar programs.

Avangrid Begins Construction on its First California Solar Farm

2024-04-10 - Avangrid’s Camino Solar project will generate 57 megawatts of power, the equivalent of the power needs of about 14,000 U.S. homes.

CERAWeek: NextEra CEO: Growing Power Demand Opportunity for Renewables

2024-03-19 - Natural gas still has a role to play, according to NextEra Energy CEO John Ketchum.

Energy Transition in Motion (Week of Feb. 2, 2024)

2024-02-02 - Here is a look at some of this week’s renewable energy news, including a utility’s plans to add 3.6 gigawatts of new solar and wind facilities by 2030.