In the U.S., shale gas producers remain under shareholder pressure not to increase spending, despite the rising commodity price. (Source: Hart Energy; Shutterstock.com)

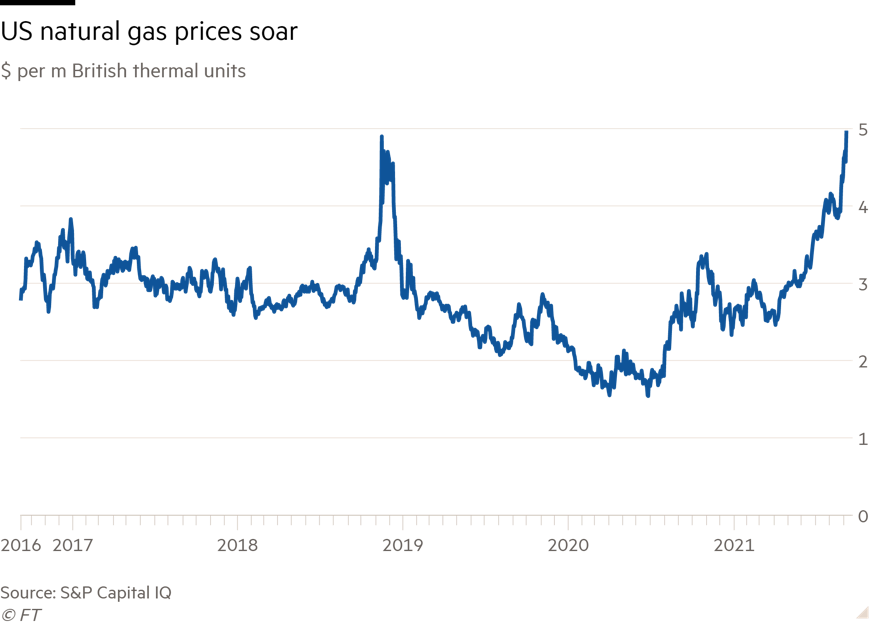

Back in July, natural gas prices, already on the up, were headed higher. Now, prices are soaring around the world.

In the U.K. and continental Europe prices have hit new all-time highs, driving up household bills and sparking warnings that some industries may need to ration gas use if there is a very cold winter.

In Asia, importers are paying some of the highest-ever prices for LNG gas cargoes.

In the U.S., the benchmark price—still far lower than elsewhere thanks to ample shale supply—rallied on Sept. 8 to $5 per MMBtu for the first time since 2014.

Why are prices skyrocketing?

The simple answer to why gas—after years of relatively low prices—is suddenly pricing at a premium to oil, is because there isn’t enough of it.

A long cold winter in Asia and Europe drained storage levels. Then high levels of maintenance, much of it delayed by the pandemic from 2020, hit supply this year, thwarting efforts to refill storage over the northern hemisphere summer—when gas is still widely used by industry and for electricity generation, but heating demand drops off.

In the U.K., for example, natural gas production is down almost 28 per cent year-to-date, according to consultancy Wood Mackenzie. Supplies from Norway and Algeria have also disappointed.

Russia, one of the world’s largest gas producers and a major supplier to both Europe and Asia, has also been exporting less gas than some might hope. The reasons—hotly debated in the market—range from the need to refill its own storage and possible production problems, to suspicions it is trying to make a point of not sending too much gas to Europe before the start up of the controversial Nord Stream 2 pipeline.

The growing LNG market has also helped to connect different regions and introduced heightened competition for supplies. Asia and Europe are both bidding for cargoes, with the majority sailing to Asia, where customers tend to be willing to pay marginally more. But Brazil has emerged as another big buyer in 2021, as droughts cut power supply from its hydroelectric facilities.

In the U.S., supply has been hit by the fall out from Hurricane Ida, with production still offline in the Gulf of Mexico and exporters rushing to send LNG to higher priced markets. Shale producers, meanwhile, remain under shareholder pressure not to increase spending, despite the rising commodity price.

The other side, as ever, is demand. Rising carbon prices in Europe have generally made coal less attractive for electricity generation this year—to gas’s benefit. However, coal is still profitable—even with carbon priced above 60 euros a tonne.

Wind power, which makes up a growing chunk of supply to European grids, has also disappointed over weeks of predominantly warm and still weather. Grids have turned to more traditional power sources, again boosting gas demand.

What does this mean for this winter? The first thing to note is that gas demand is seasonal and influenced by the weather. If it’s relatively mild in the northern hemisphere then prices may ease off (though few are yet betting on an outright collapse). But major industry players are worrying about what will ensue if a lengthy period of cold temperatures arrives.

The head of Centrica’s trading arm last week warned that gas prices, in a pinch, can essentially become unanchored in Europe as traders will need to lure LNG cargoes away from Asia to meet demand. The loser will resort to burning more coal for power generation. Consumer power and gas bills are also likely to climb—electricity prices are nearing new highs in Europe. While little is guaranteed in the gas market, there are reasons to worry about the months ahead.

This article is an excerpt of Energy Source, a twice-weekly energy newsletter from the Financial Times.

Recommended Reading

Supply Disruptions Ahead as Canadian Rail Workers Vote for Strike

2024-05-01 - The union, representing more than 9,000 employees at Canadian National Railway and Canadian Pacific Kansas City, announced that 95% of its members approved of a strike, which could happen as early as May 22.

Vision RNG Expands Leadership Team

2024-05-01 - Vision RNG named Adam Beck as vice president of project execution, Doug Prechter as vice president of finance and Beckie Dille as HR manager.

OGInterview: Building EIV Capital’s Midstream Investment Strategy

2024-05-01 - Midstream-focused EIV Capital has added non-operated assets and transition projects to its portfolio as a sign of the times.

NOG Lenders Expand Revolving Credit Facility to $1.5B

2024-04-30 - Northern Oil and Gas’ semi-annual borrowing-base redetermination left its reserved-based lending unchanged at $1.8 billion.

Imperial Oil Names Exxon’s Gomez-Smith as Upstream Senior VP

2024-04-30 - Cheryl Gomez-Smith, currently director of safety and risk at Exxon Mobil’s global operations and sustainability business, will join Imperial Oil in May.