In theory, Equitrans Midstream’s Mountain Valley Pipeline has the potential to open new markets for Marcellus and Utica shale producers but downstream constraints may mean it runs below half of its 2 Bcf/d, at least initially. (Source: Shutterstock.com)

After years of false starts, the Mountain Valley Pipeline (MVP) finally has a clear runway to complete construction. East Daley Analytics expects the 2 Bcf/d pipeline out of the Appalachian Basin to create a splash in regional natural gas markets, though in ways that may surprise some observers.

MVP and lead project developer Equitrans Midstream (ETRN) were thrown a lifeboat by Congress as part of the bipartisan debt-ceiling compromise. Signed into law by President Biden on June 3, the Fiscal Responsibility Act declares MVP in the national interest and directs federal agencies to issue all authorizations for the project. The bill also moves jurisdiction for MVP out of the US Fourth Circuit Court of Appeals, which has repeatedly struck down permits.

The pro-MVP language from Congress so far has stood up to legal scrutiny. The Supreme Court on July 27 granted an emergency request from MVP backers to lift a lower court order that had frozen construction while the project was under review. The Supreme Court decision cleared the way for ETRN to proceed with construction. On August 11, the Fourth Circuit dismissed another challenge to MVP, determining that appeals should now be heard by a District of Columbia appellate court as mandated by Congress.

Equitrans began building the 300-mile pipeline in 2018 before activity was halted by legal challenges to its trenching practices and compliance with environmental regulations. The pipeline is 94% complete, according to ETRN, which projects it can finish construction on MVP by year-end 2023.

‘Phantom takeaway’ for Appalachian producers

On paper, the massive pipeline from West Virginia has the potential to open new markets for Marcellus and Utica shale producers. However, due to downstream constraints, East Daley Analytics anticipates MVP will initially run below half its capacity of 2 Bcf/d when the project is finally built.

MVP would terminate in southern Virginia at Station 165 of the Transcontinental Gas Pipe Line (Transco) system, sending gas into the Transco Zone 5 market serving the Southeast region. As currently configured, Transco has limited spare takeaway at the Zone 5 interconnect. Were shippers to push 2 Bcf/d into the Transco system, MVP would mainly back out other flows from Appalachia and send natural gas prices lower within the basin.

In our Northeast Supply & Demand Forecast, EDA forecasts average throughput of ~700 MMcf/d when MVP is completed, or 35% utilization. Transco, owned by Williams (WMB), is effectively the only pipeline that can connect MVP shippers to end-users. The problem is Transco is fully contracted and often runs at or near capacity, leaving little room for the influx of gas. Were MVP to run full, the pipeline would have to displace other contracted Appalachian gas flowing south from the Zone 6 mid-Atlantic region on Transco. Until more downstream infrastructure is built, East Daley considers MVP mainly to be the “phantom takeaway” for Appalachian producers.

MVP a steppingstone to new pipeline investments

More takeaway is in the works to relieve the congestion MVP will bring. Williams and Equitrans are jockeying to push flows from MVP further south to meet growing demand in the Southeast. ETRN’s Southgate project would extend 75 miles from Transco Zone 5 into North Carolina, adding ~500 MMcf/d of egress. However, the Southgate project has been placed on indefinite hold after it was denied an air quality permit.

Transco is pursuing several projects to move Appalachian volumes south. The pipeline held an open season for the Southeast Supply Enhancement, offering 800 MMcf/d of additional pipeline capacity via three pipe pathways from Virginia to the Alabama-Mississippi border. The open season closed July 14 and was oversubscribed, according to an update from executives on WMB’s second-quarter earnings call. The open season coincided with a reverse open season at Zone 5, signaling Transco’s priority to address the constraint. The project has a projected in-service date of Nov. 1, 2027.

Transco is also pursuing the Southside Reliability project, which would boost pipeline capacity by 423 MMcf/d to meet growing demand in North Carolina. Transco would upgrade meters, expand existing compressors and construct a new compressor station in Mecklenburg County, Virginia. The project has an in-service target in fourth-quarter 2024.

A market ripple builds to a splash

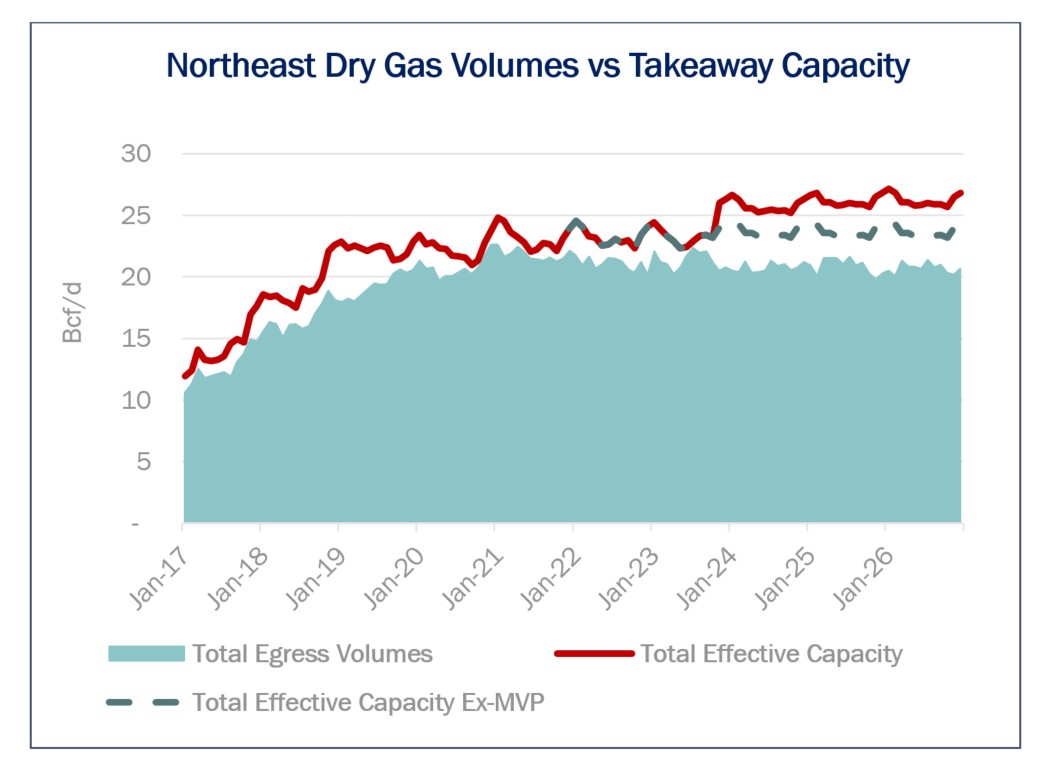

A lot has changed in the Northeast in the decade since MVP was first proposed. Gone are the heady days of growth as low prices and investor pressures leave most Marcellus and Utica producers content to hold gas production flat. Figure 1 shows projected flows and takeaway capacity in East Daley’s regional egress stack from the Northeast Supply & Demand Forecast. We anticipate spare near-term capacity for producers whether or not MVP is eventually built (see figure).

With spare capacity and the current constraints at Transco Zone 5, East Daley predicts the start of MVP would only marginally benefit Dominion South pricing. MVP’s main impact would be to cap upward price pressure at Transco Zone 5, particularly during winter or summer demand spikes. The Transco Zone 5 market is short gas during periods of high demand, and MVP would be able to bridge that seasonal gap, narrowing the spread between Dominion South and Transco Zone 5 prices.

MVP’s real value to the market would emerge later this decade, when a second wave of LNG projects are expected to start post-2026. EDA explored this market theme at the start of the year in our 2023 Dirty Little Secrets annual outlook. We are long-term bullish on natural gas due to a significant increase we anticipate in LNG exports. The Northeast region will need more pipeline capacity when LNG demand begins to ramp up. MVP and the reversal planned by Transco will be critical during this period to allow the Northeast industry to participate in future market expansions, provided additional infrastructure becomes available to fully utilize the new system.

Recommended Reading

TGS, SLB to Conduct Engagement Phase 5 in GoM

2024-02-05 - TGS and SLB’s seventh program within the joint venture involves the acquisition of 157 Outer Continental Shelf blocks.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

StimStixx, Hunting Titan Partner on Well Perforation, Acidizing

2024-02-07 - The strategic partnership between StimStixx Technologies and Hunting Titan will increase well treatments and reduce costs, the companies said.

Tech Trends: QYSEA’s Artificially Intelligent Underwater Additions

2024-02-13 - Using their AI underwater image filtering algorithm, the QYSEA AI Diver Tracking allows the FIFISH ROV to identify a diver's movements and conducts real-time automatic analysis.

Subsea Tieback Round-Up, 2026 and Beyond

2024-02-13 - The second in a two-part series, this report on subsea tiebacks looks at some of the projects around the world scheduled to come online in 2026 or later.