Williams (NYSE: WMB) announcement June 15 that it acquired 50% general partner interest in Oklahoma City-based Access Midstream Partners LP (NYSE: ACMP) and wants to merge too, could create a formidable midstream company.

Williams’ customer base would broaden with a platform to execute larger and more accretive growth opportunities. Access has a strong asset base and extensive intrastate pipeline infrastructure located strategically in the Barnett, Eagle Ford, Haynesville, Marcellus, Niobrara and Utica shales and it has access to major delivery points in the Midcontinent regions.

Access is able to move 3.8 billion cubic feet per day (Bcf/d) through more than 6,300 miles of natural gas gathering pipelines.

If consummated, the merged master limited partnerships (MLPs) would be called Williams Partners LP and would become one of the largest and fastest-growing MLPs with expected 2015 adjusted EBITDA of $5 billion.

Financially, Williams benefits from improved discounted cash flow growth. Strong distribution coverage should improve its credit rating to BBB, leading to a lower cost of capital and increased capital markets access, said Darren Horowitz, energy analyst for Raymond James Equity Research.

The deal makes sense as acquiring Access' improving results in the Eagle Ford and Utica means taking over a low-risk contract profile that is 100% fee-based with minimum volume commitments, acreage dedications, fee-redeterminations, cost of service protection and a robust, visible organic project backlog, Horowitz said.

“We believe Access is a great fit into Williams,” Horowitz said. “Not only is basin diversification enhanced, the complementary assets enhance vertical integration across the midstream supply chain (think "well-head to burner tip"), greater operational and financial synergies materialize economies of scale.”

The Acquisition

Access’ business growth is driven by expected production increases in its portfolio of more than 8.3 million acres under dedication in major shale and unconventional producing areas including the various plays it has a presence in.

Williams has already purchased its GP stake and 55.1 million limited partner units from ACMP, which was held by Global Infrastructure Partners II (GIP), for $5.995 billion in cash.

Access has a market capitalization of about $13.2 billion and provides oil and gas gathering services to Chesapeake Energy Corp. (NYSE: CHK), Anadarko Petroleum Corp. (NYSE: APC) and other major exploration companies, according to its 2013 annual report. Its shares are up about 16% this year, Bloomberg reported.

“We expect the acquisition to deliver immediate and future dividend growth for Williams’ shareholders and to further enhance our presence in attractive growth basins,” said Alan Armstrong, Williams’ CEO. “In addition, we expect the acquisition of Access Midstream Partners will fortify Williams’ stable, fee-based business model and support our industry-leading dividend growth strategy.”

Williams’ acquisition of the additional GP and LP interests in Access Midstream requires federal approval.

Williams plans to fund roughly half of the $5.995 billion acquisition with equity and the remainder with a combination of long-term debt, revolver borrowings and cash on hand.

The company expects to repay revolver borrowings with proceeds from the planned drop-down of its remaining NGL & Petchem Services assets and projects. In addition, Williams has entered into a backup financing commitment with respect to a $5.995 billion interim-liquidity facility with UBS Investment Bank, Barclays and Citigroup that would be available to fund the acquisition.

The Merger

GIP has sold its LP stake in Access over the past year through secondary public offerings.

“A complete takeout by Williams would seem to be beneficial for Access stock as it eliminates the continuous selling pressure,” Horowitz said.

Should a merger go through, it would include three key components of large scale, midstream positions:

Natural gas pipelines—Transco, Northwest and Gulfstream represent the nation’s premier interstate pipeline network. Transco is the nation’s largest and fastest-growing pipeline system.

Gathering and processing—Large-scale positions in growing natural-gas supply areas in major shale and unconventional producing areas, including the Marcellus, Utica, Piceance, Four Corners, Wyoming, Eagle Ford, Haynesville, Barnett, Midcontinent and Niobrara. The business would also include oil and natural gas gathering services in the deepwater Gulf of Mexico.

NGLs and petrochemical services—Unique downstream presence on the Gulf Coast and in western Canada provides differentiated long-term growth.

If the merger is completed, the partnership would likely be based in Tulsa.

Recommended Reading

Chesapeake, Awaiting FTC's OK, Plots Southwestern Integration

2024-04-01 - While the Federal Trade Commission reviews Chesapeake Energy's $7.4 billion deal for Southwestern Energy, the two companies are already aligning organizational design, work practices and processes and data infrastructure while waiting for federal approvals, COO Josh Viets told Hart Energy.

Exclusive: Liberty CEO Says World Needs to Get 'Energy Sober'

2024-04-02 - More money for the energy transition isn’t meaningfully moving how energy is being produced and fossile fuels will continue to dominate, Liberty Energy Chairman and CEO Christ Wright said.

Exclusive: Sabine CEO says 'Anything's Possible' on Haynesville M&A

2024-04-09 - Sabine Oil & Gas CEO Carl Isaac said it will be interesting to see what transpires with Chevron’s 72,000-net-acre Haynesville property that the company may sell.

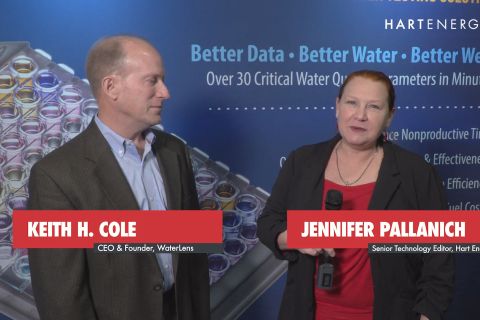

Exclusive: Calling on Automation to Help with Handling Produced Water

2024-03-10 - Water testing and real-time data can help automate decisions to handle produced water.