Medallion Midstream LLC launched a non-binding open season on May 24 for its capacity that is leased on EPIC Crude Pipeline LP’s crude oil pipeline system.

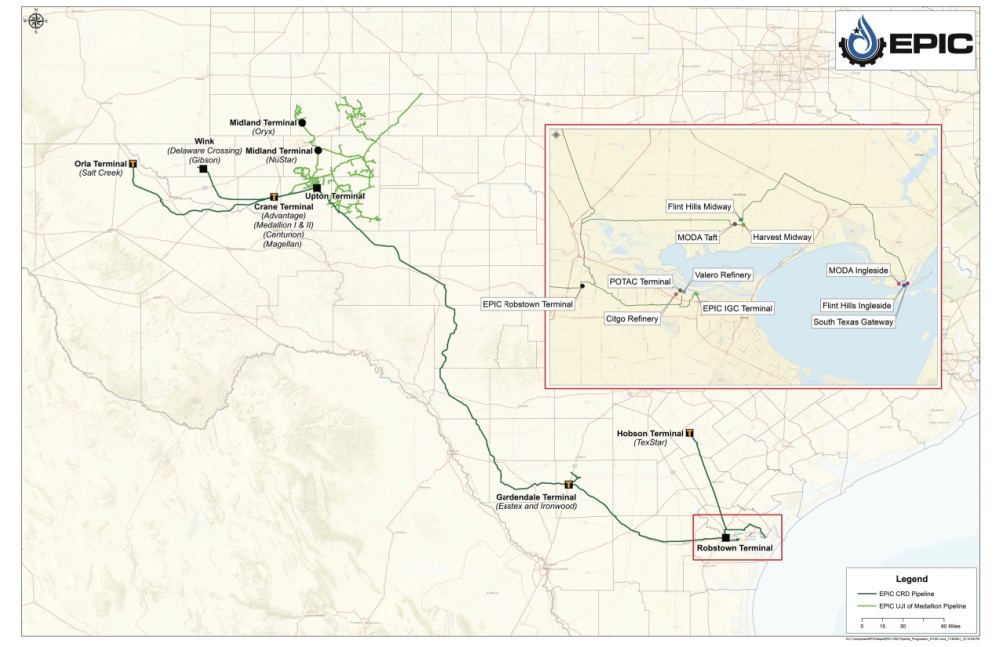

The EPIC Crude Oil Pipeline is a 700-mile, 30-inch crude oil pipeline that extends from Crane, Texas to the Port of Corpus Christi and services the Permian and Eagle Ford basins. The pipeline is currently operating at a capacity of 600,000 bbl/d and has a maximum capacity of 1 million bbl/d, according to its website.

Medallion Pipeline Co. LLC, which owns and operates a network of crude oil pipelines in the Midland Basin, leases 27,778 bbl/d of capacity from the “Group 1” origin points on EPIC Pipeline for delivery to the Corpus Christi and Ingleside destination points along the Texas Gulf Coast.

In 2019, Medallion executed a transportation services agreement with a third-party shipper to begin shipping on Medallion’s capacity that is leased on EPIC Pipeline. However, Medallion said in a May 24 release that the previous transportation services agreement had been terminated making the committed capacity on Medallion’s leased capacity on EPIC Pipeline available again.

Medallion is holding the current non-binding open season, which closes June 25, to gauge shipper interest in, and to potentially re-contract, the available leased capacity on EPIC Pipeline for the remaining term of the original 2019 transportation services agreement. The terms and conditions of the transportation services being offered are substantially similar to those applicable to the 2019 committed shipper, Medallion said in its release.

The Medallion pipeline system consists of eight pipeline segments covering approximately 1,100 miles of crude oil pipeline located in Crane, Glasscock, Howard, Irion, Martin, Midland, Mitchell, Reagan, Scurry and Upton counties, Texas, in the Midland Basin.

Recommended Reading

Dominion Energy Grows Virginia Solar Energy Portfolio

2024-04-02 - Dominion Energy will own or acquire four Virginia solar projects, which have a total capacity of 329 megawatts, the company says.

After Challenging Year, Which Way Will Offshore Wind Blow?

2024-04-03 - Following a year of negative headlines with some of the industry’s biggest players booking billion-dollar impairments and backing out of wind projects, this year appears to be going smoother.

Alberta to Ban Renewables Projects on Prime Agricultural Land

2024-02-28 - Alberta will ban renewable power projects on prime agricultural land and erect buffer zones to ensure wind turbines do not spoil scenic views.

Verdagy Awarded $39.6MM DOE Grant for Electrolyzer Production

2024-03-14 - Verdagy will use the Department of Energy grant to accelerate the manufacture of e-dynamic electrolyzers for green hydrogen solutions.

Energy Transition in Motion (Week of April 19, 2024)

2024-04-19 - Here is a look at some of this week’s renewable energy news, including the latest on global solar sector funding and M&A.