|

| Well productivity improvement process. . (Image courtesy of Landmark) |

Triple-digit crude oil prices and growing global demand provide powerful incentives for energy companies to focus attention on maximizing production from mature fields. Although production from these assets may be declining, they still have the potential to positively impact a company’s bottom line.

Industry advancements such as horizontal and multilateral drilling, improved perforation and stimulation methods, new fracturing techniques and fluids, cutting-edge completion technologies, different logging procedures, and enhanced recovery schemes such as CO2 flooding can extend the producing life of mature fields. Yet the complexity of some of these fields can still present formidable challenges. It takes the right data, the right tools and techniques, and the right team to create an efficient, cost-effective field development plan to optimize an aging asset.

The right assets

Most energy companies devote the bulk of their budgets and their more experienced personnel to glamorous and often highly publicized new discovery projects. However, these plays tend to be smaller than the industry’s previous finds — they are often located in remote and technically challenging environments, they require a significant infusion of capital, and they typically take four or five years from discovery to first oil, too long for their owners to take full advantage of the current high-price environment.

Constrained by an operator’s limited budgets and lean staffing, focus on new assets means mature fields are often neglected — operators choose to use “Band-Aid” approaches to resolve problems instead of reengineering the entire field to increase and accelerate production and to identify bypassed reserves. As a result, hydrocarbons — and potential profits — are left in the ground. Fields that could continue making money for some time become marginally economic or not economic at all.

Mature fields offer multiple advantages over these newer assets. First of all, they are relatively abundant, accounting for about 70% of the world’s current production. In fact, most of the 30 mammoth finds that are believed to contain half the planet’s crude oil reserves fall into the mature field category. And, like a well-worn pair of shoes, mature fields are proven and predictable. Exploration costs have been paid, permits have been obtained, and environmental tests

have been completed.

Another benefit to extending the life of aging fields is the opportunity to put off, as long as possible, incurring the considerable expense of meeting regulatory and environmental obligations associated with abandoning the asset.

On the other hand, mature fields offer their own set of challenges. As fields grow older, associated maintenance costs increase, and equipment wears out and then fails, leaving them to experience problems such as erosion and corrosion. Treatment costs, water-handling expenses, and power requirements rise because, for example, larger compression equipment costs more money. These fields must be managed wisely to draw as much oil and gas as possible out of the ground.

The right data

Intelligent management of aging fields begins with gathering the data required for sound decision-making. However, this information is frequently disorganized, inconsistent, or incomplete. Often, the one piece of information needed to resolve a major field development decision simply cannot be determined, e.g., initial reservoir pressure. Mature fields usually come with long histories and vast volumes of data that can be daunting to interpret, especially if much of the information exists on paper instead of in an electronic form.

The first step to a systematic approach to optimizing production is to review all of the available information, identify what is truly relevant, reconcile any inconsistencies, and organize it in a way that makes it easy to find and understand. While it requires an initial time commitment, this exercise reduces rework, improves overall project efficiency, and reveals information that can lead to increased production from the field.

The right tools and techniques

The traditional method of revitalizing a mature field takes a “silo” approach; it involves constructing models and running individual scenarios for each component of the field in isolation — reservoir, well, pipeline, and facilities — and then combining the results. This tactic is not only laborious and time-consuming, but it also often does not yield the optimal development plan and leaves risks unidentified and uncertainties unresolved.

One way to address inescapable uncertainties associated with any reservoir is to use the front-end loading (FEL) project planning methodology. FEL dictates exactly the deliberate, systematic approach to project planning that mature assets require. In recent years, Landmark’s Consulting & Services group has used FEL project planning as the basis for a holistic approach to mature field revitalization. Using FEL, asset managers can assess the impact of both surface and subsurface uncertainties in multiple development planning scenarios and make informed decisions about the best options to follow with much broader knowledge regarding the risks and rewards.

At the heart of this approach is Landmark’s Decision Management System (DMS), a technology that incorporates a suite of sophisticated analytical tools. DMS enables consultants to efficiently analyze hundreds of field development situations early in the life of a project. The end result is a ranked set of economically viable scenarios and sound, timely project planning decisions that are aligned with the company’s specific business objectives.

The right team

Even with the industry’s most advanced interpretation and analysis solutions, tools can only be as good as the people who use them. Another critical component of a systematic approach to mature field revitalization is the creation of consistent, repeatable best practices based on the experience of leading industry professionals.

Best practices can be formalized into a toolkit that captures and automates critical workflows to enable less-experienced engineers to execute field development plans effectively. The use of technologies such as Landmark’s AssetConnect integrated asset model enables the efficient creation of multidisciplinary workflows. In addition, the organization can maximize the use of one of its scarcest resources — experienced employees — by automating much of the nonvalue-adding work such as data reformatting.

Empowering experienced professionals with the latest technology solutions allows them to work more intelligently, efficiently, and to their fullest potential — a critical component of Landmark’s “From Insight to Execution” strategy for mature asset revitalization. Landmark’s Consulting & Services group offers insight into the problems that energy companies face and the most effective solutions for them. The company’s consultants then work with Halliburton’s Project Management organization to help customers execute solutions as efficiently as possible. By combining these capabilities, Landmark can create new opportunities and value for customers as part of an end-to-end solution.

The right data, the right tools to manipulate it, and the right team to analyze development scenarios can make a major difference in the profitability of a project. This powerful combination can result in a production increase of 2% to 10% from a field — at minimal capital expense. Some energy companies have leveraged a strategic revitalization approach to achieve even more impressive results.

One national oil company, for example, had predicted production of 20,000 b/d from a portfolio of about 60 wells in one of its most important onshore production centers. Through solid engineering work and the use of DMS integrated asset modeling, a multidisciplinary Landmark team delivered half that production from just the first 10 wells it optimized.

Another client in Southeast Asia wanted to boost production from three mature offshore fields. Based on its analyses, a Landmark asset team recommended that the company drill four in-fill wells, which would increase the fields’ oil reserves by 8 million bbl. The team also identified an extension structure that previously was unknown to the client and recommended drilling two in-fill gas wells, which contributed another 90 Bcf

of new gas reserves to the company’s portfolio.

In a third case, an oil industry major needed new ideas to reinvigorate a mature field in the Gulf of Mexico, but staff availability provided a significant obstacle to achieving this goal. Armed with a suite of decision-support tools, a consulting team from Landmark and Halliburton collaborated with the client’s production department and the leaders of its business and production units to take a comprehensive, “field-wide” view of the project. The results? Increased production from behind-pipe reserves, recommendations for optimizing gas-lift injection, and a portfolio of ranked well interventions to boost oil production further.

The average worldwide recovery factor for oil reservoirs is just 35% and roughly 70% for gas reservoirs. Generating just a 1% increase in these recovery numbers would provide a two-year additional supply for global consumption.

By leveraging the right data, tools, and professionals, an operator can close the knowledge gaps that are so often associated with aging fields.

Strategic project planning can take the guesswork out of these revitalization projects, reducing risk and uncertainty while providing opportunities to increase field reserves and production with minimal cost and effort – and with maximum returns.

Recommended Reading

Spate of New Contracts Boosts TechnipFMC's Subsea Profits

2024-04-30 - TechnipFMC's operational profits are growing as the company heightened its focus on “quality” subsea orders, which earned $2.4 billion for the first quarter.

TGS Starts Up Multiclient Wind, Metaocean North Sea Campaign

2024-05-07 - TGS is utilizing two laser imaging and ranging buoys to receive detailed wind measurements and metaocean data, with the goal of supporting decision-making in wind lease rounds in the German Bright.

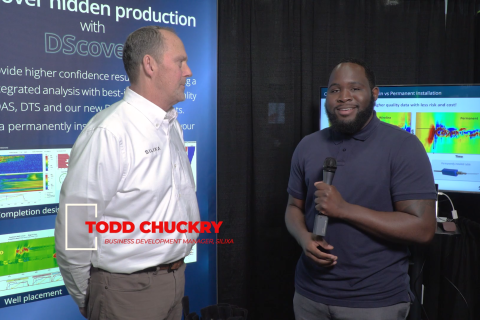

Exclusive: Silixa’s Distributed Fiber Optics Solutions for E&Ps

2024-03-19 - Todd Chuckry, business development manager for Silixa, highlights the company's DScover and Carina platforms to help oil and gas operators fully understand their fiber optics treatments from start to finish in this Hart Energy Exclusive.

CERAWeek: AI, Energy Industry Meet at Scary but Exciting Crossroads

2024-03-19 - From optimizing assets to enabling interoperability, digital technology works best through collaboration.

Cyber-informed Engineering Can Fortify OT Security

2024-03-12 - Ransomware is still a top threat in cybersecurity even as hacktivist attacks trend up, and the oil and gas sector must address both to maintain operational security.