The following information is provided by Eagle River Energy Advisors LLC. All inquiries on the following listings should be directed to Eagle River. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Eagle River Energy Advisors LLC has exclusively been retained by Ritter, Laber & Associates Inc. / Pilot Energy Group to divest certain nonoperated working interests and associated acreage in the Williston Basin.

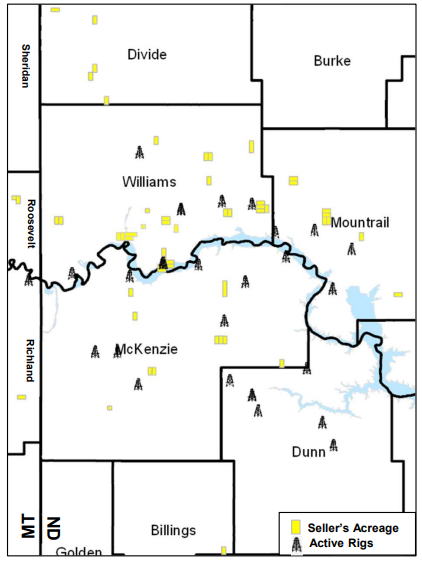

The assets provide the opportunity to acquire an oil-weighted production stream of roughly 200 boe/d of net production as invest a significant amount of capex in near-term wells in form of 41 DUCs and 32 permitted / confidential status wells, according to Eagle River. The firm added that the package is highly diversified by well count, well vintage, commodity and operator with locations spread across multiple counties in North Dakota and Montana.

Highlights:

- Significant Oil Weighted Production Base

- ~198 boe/d net production (April 2022 forecast)

- Oil weighted production (Oil 65% / Gas 19% / NGL 16%)

- $872,000 cash flow January (TTM Excluding Capex)

- Highly Diversified Assets

- Asset diversification across multiple counties in North Dakota

- Stable production created by wide-ranging well vintages

- Multiple experienced operators including ConocoPhillips, Continental Resources, Hess, Oasis Petroleum, Hunt Oil, Enerplus, Zavanna, Whiting Petroleum, EOG Resources and XTO Energy.

- 223 PDP and near-term wells spread across and 51 DSUs

- 667 net acres across asset package

- Significant Near Term Upside

- 41 DUCs, 30 Confidential wells and two Permitted wells

- Net Capex - $2.0 million; PV-20 - $5.0 million

- Majority of near-term upside value in LCU - 40 net acres

- 38 DUCs and 12 Confidential wells

- Net Capex - $1.5 million; PV-20 - $3.5 million

- Type Curve Key Metrics -

- Middle Bakken - EUR - 1,607 Mboe (64% liquids), IRR - >200%, ROI - 4.2

- Three Forks B1 - EUR - 1,200 Mboe (63% liquids), IRR - >150%, ROI - 3.4

- 41 DUCs, 30 Confidential wells and two Permitted wells

Bids for the acquisition opportunities with Ritter, Laber & Associates Inc. / Pilot Energy Group referenced are due April 15. The effective date of the transaction is April 1.

A virtual data room is available. For information contact Chris Martina, technical director at Eagle River, at 720-726-6092 or cmartina@eagleriverea.com.

Recommended Reading

CEO: Continental Adds Midland Basin Acreage, Explores Woodford, Barnett

2024-04-11 - Continental Resources is adding leases in Midland and Ector counties, Texas, as the private E&P hunts for drilling locations to explore. Continental is also testing deeper Barnett and Woodford intervals across its Permian footprint, CEO Doug Lawler said in an exclusive interview.

To Dawson: EOG, SM Energy, More Aim to Push Midland Heat Map North

2024-02-22 - SM Energy joined Birch Operations, EOG Resources and Callon Petroleum in applying the newest D&C intel to areas north of Midland and Martin counties.

Chevron Hunts Upside for Oil Recovery, D&C Savings with Permian Pilots

2024-02-06 - New techniques and technologies being piloted by Chevron in the Permian Basin are improving drilling and completed cycle times. Executives at the California-based major hope to eventually improve overall resource recovery from its shale portfolio.

Oceaneering Won $200MM in Manufactured Products Contracts in Q4 2023

2024-02-05 - The revenues from Oceaneering International’s manufactured products contracts range in value from less than $10 million to greater than $100 million.

E&P Highlights: Feb. 5, 2024

2024-02-05 - Here’s a roundup of the latest E&P headlines, including an update on Enauta’s Atlanta Phase 1 project.