The following information is provided by TenOaks Energy Advisors. All inquiries on the following listings should be directed to TenOaks Energy Advisors. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

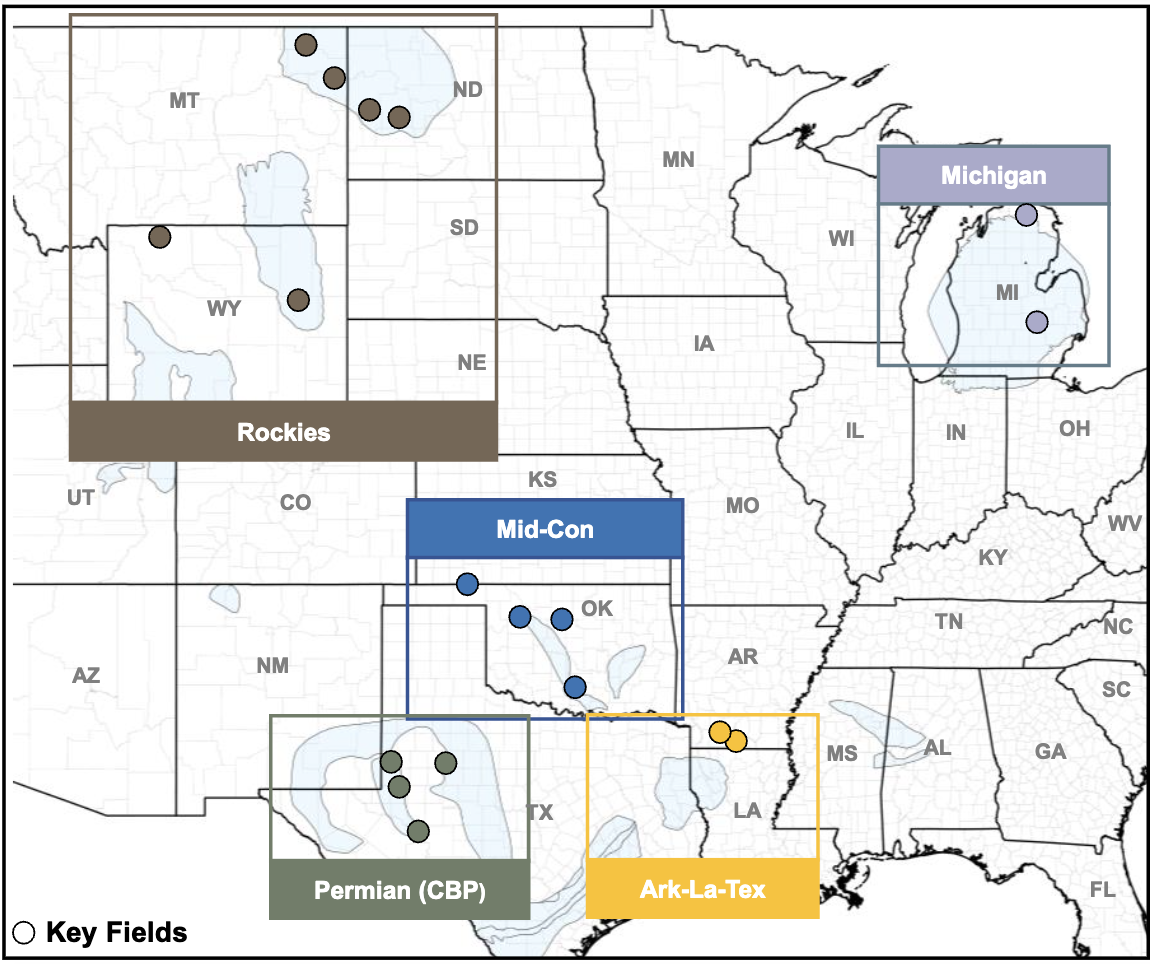

White Rock Oil & Gas LLC retained TenOaks Energy Advisors for the sale of a majority operated working interest portfolio located across five regions of the lower 48—the Permian Basin, Ark-La-Tex, Rockies, Mid-Continent and Michigan. Current net production of 2,263 Boe/d is supported by a shallow base decline of 6% and a strong weighting towards liquids (72%).

Key considerations:

- Large, scalable operated platform

- 32% Permian (CBP) | 30% Rockies | 27% Ark-La-Tex | 7% Mid-Con | 4% Michigan

- PDP PV10: $125 MM | NTM PDP cash flow: $26 MM | Net Production (PDP): 2,263 Boepd

- Commodity Mix: 72% liquids

- Long-lived production base / Strong, stable cash flow

- 6% PDP decline (predominantly vertical production)

- Sandbox of upside opportunities in each region

- Vertical & horizontal new drills, refracs/recompletions, waterflood optimizations/implementations, RTPs, and operational enhancements

- 100% HBP asset provides development timing flexibility

Bids are due at noon CST on Oct. 24, 2023. For additional information, please visit tenoaksenergyadvisors.com or email B.J. Brandenberger, partner, at bj.brandenberger@tenoaksadvisors.com.

Recommended Reading

APA’s Permian to Pick up Production Slack Amid Overseas Headaches

2024-02-26 - With various overseas headaches, Houston-based APA Corp. aims to boost its Permian Basin volumes and integrate its Callon Petroleum acquisition when it closes in the second quarter.

Everywhere All at Once: Woodside CEO Touts Current Global Portfolio

2024-03-05 - Meg O’Neill, the CEO of Australian energy giant Woodside Energy, is overseeing the “next wave” of growth projects around the globe, including developments in the Gulf of Mexico, offshore Senegal and further LNG expansion.

NAPE: In Basins Familiar to E&Ps, Lithium Rush Offers Little Gold

2024-02-07 - A quest for sources of lithium comes as the lucrative element is expected to play a part in global efforts to lower emissions, but in many areas the economics are challenging.

Utah’s Ute Tribe Demands FTC Allow XCL-Altamont Deal

2024-04-24 - More than 90% of the Utah Ute tribe’s income is from energy development on its 4.5-million-acre reservation and the tribe says XCL Resources’ bid to buy Altamont Energy shouldn’t be blocked.

Renewed US Sanctions to Complicate Venezuelan Oil Sales, Not Stop Them

2024-04-19 - Venezuela’s oil exports to world markets will not stop, despite reimposed sanctions by Washington, and will likely continue to flow with the help of Iran—as well as China and Russia.