The following information is provided by TenOaks Energy Advisors LLC. All inquiries on the following listings should be directed to TenOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

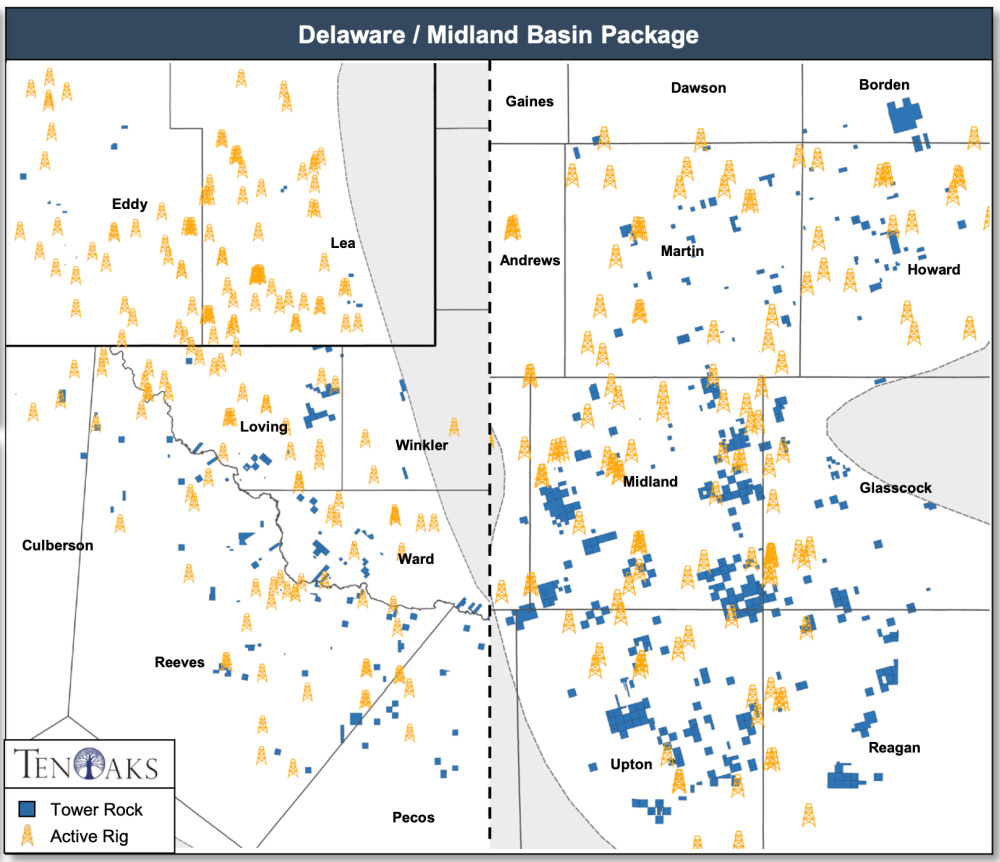

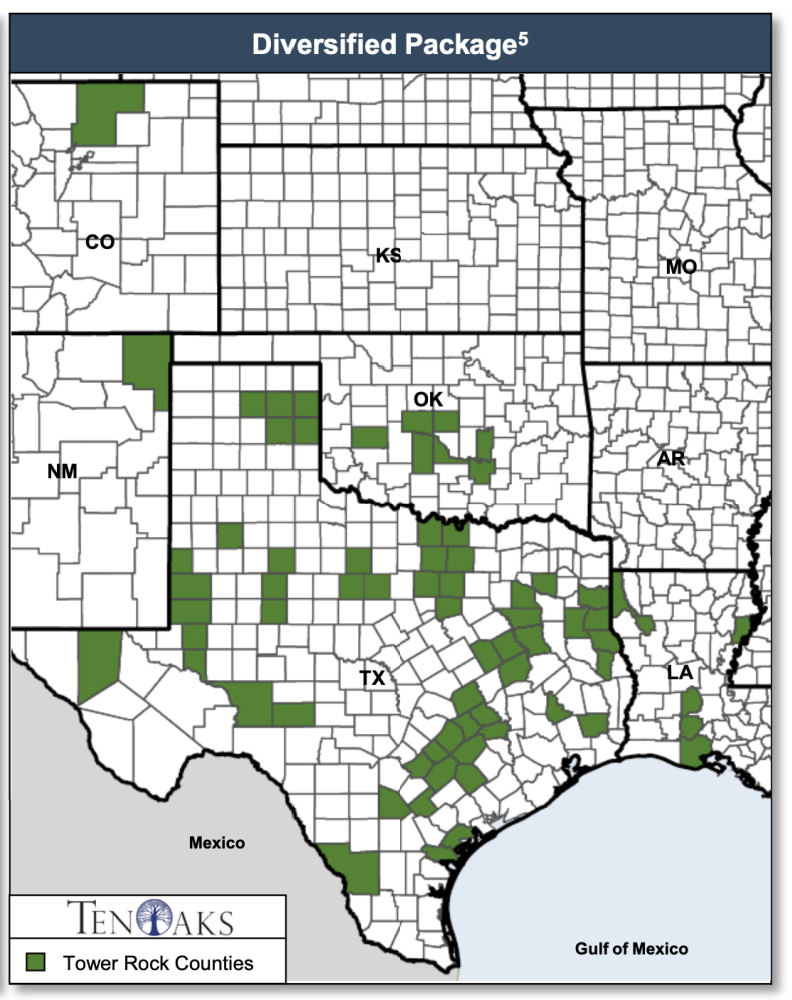

Tower Rock Oil & Gas is offering for sale certain mineral and royalty properties in separate packages: (1) Delaware / Midland Basin package (will entertain offers for one or both basins), (2) Diversified Multibasin package.

Tower Rock has retained TenOaks Energy Advisors as its exclusive adviser in connection with the transaction.

Key Considerations:

- Attractive mineral and royalty portfolio strategically positioned in areas with aggressive development

- Expansive footprint covering 9,704 net royalty acres (Delaware / Midland Basin: 2,355 NRA | Diversified Properties: 7,349 NRA)

- Track record of significant growth

- ~500 horizontal spuds on position in 2021 | On pace for more than 600 spuds in 2022 (>90% Delaware/Midland)

- Next 12-month Cash Flow: $10 million (80% Delaware/Midland)

- Asset poised for continued growth via ~750 DUCs/Permits (>90% Delaware/Midland)

- Decades of development inventory features 6,000+ quantified drilling locations targeting proven benches

Bids are due on Sept. 8. The transaction has an effective date of Oct. 1.

A virtual data room is available. For information visit tenoaksenergyadvisors.com or contact B.J. Brandenberger at TenOaks Energy Advisors at 214-663-6999 or BJ.Brandenberger@tenoaksadvisors.com.

Recommended Reading

Canadian Railway Companies Brace for Strike

2024-04-25 - A service disruption caused by a strike in May could delay freight deliveries of petrochemicals.

Talos Energy Expands Leadership Team After $1.29B QuarterNorth Deal

2024-04-25 - Talos Energy President and CEO Tim Duncan said the company has expanded its leadership team as the company integrates its QuarterNorth Energy acquisition.

Energy Transfer Ups Quarterly Cash Distribution

2024-04-25 - Energy Transfer will increase its dividend by about 3%.

Guyana’s Stabroek Boosts Production as Chevron Watches, Waits

2024-04-25 - Chevron Corp.’s planned $53 billion acquisition of Hess Corp. could potentially close in 2025, but in the meantime, the California-based energy giant is in a “read only” mode as an Exxon Mobil-led consortium boosts Guyana production.

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

2024-04-25 - Henry Hub blues: CNX Resources and other Appalachia producers are slashing production and deferring well completions as natural gas spot prices hover near record lows.