The following information is provided by PetroDivest Advisors. All inquiries on the following listings should be directed to PetroDivest Advisors. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

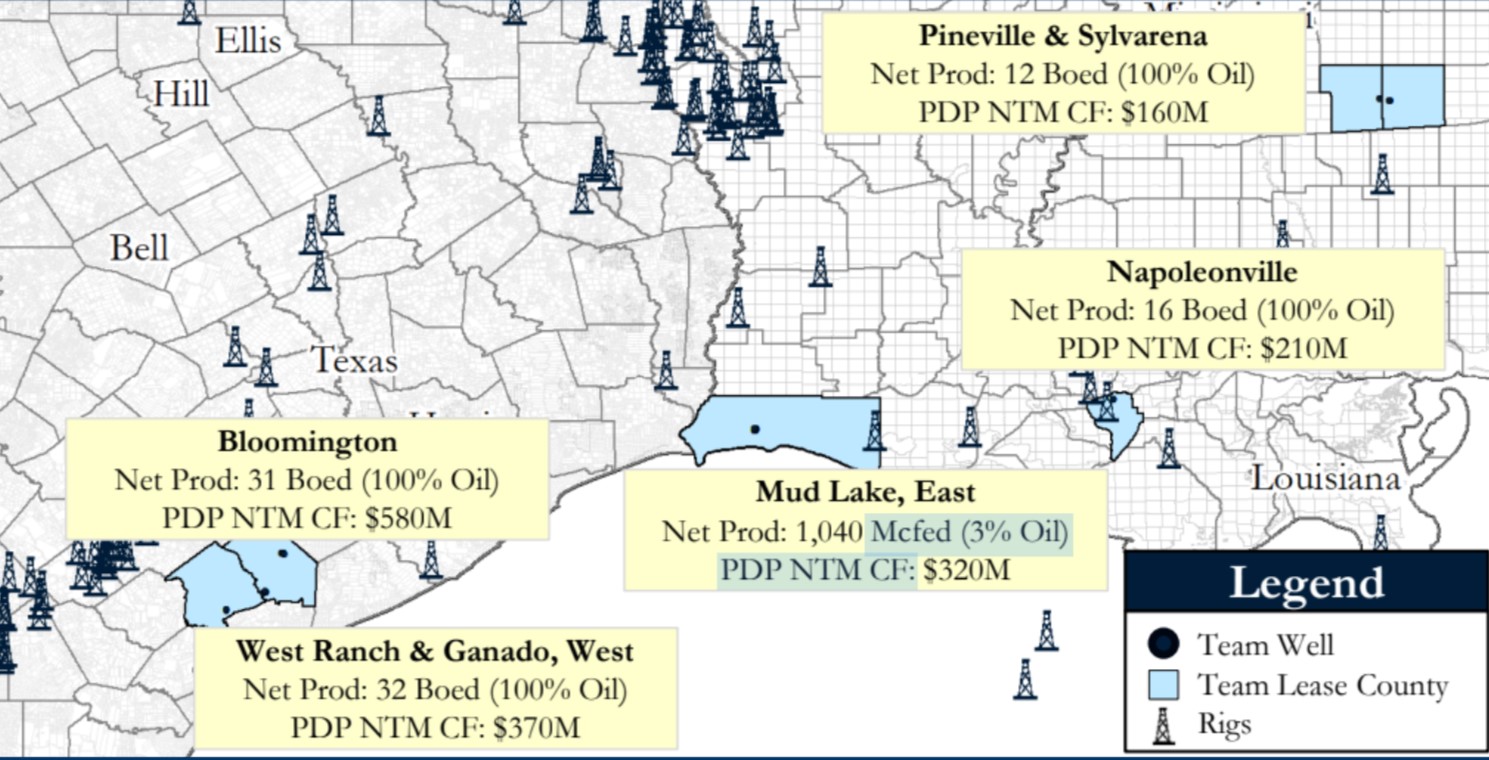

Team Operating LLC has retained PetroDivest Advisors for the sale of certain oil and gas leasehold and related assets spanning multiple counties in Texas, Louisiana and Mississippi. The package includes a well count of 16 vertical, three horizontal and five saltwater disposal.

Opportunity highlights:

- Oil Rich, Gas-Weighted Production | 1.6 MMcfed PDP Net Production| $1.6MM NTM Operated Cash Flow

- Diverse, net production stream comprised of ~95 Bopd (oil) and ~1.0 MMcfd (gas) (~35% oil)

- PDP PV10: $11MM

- PDP Net Reserves: 13 Bcfe (20% oil)

- Well Count: 16 vertical, 3 horizontal, and 5 SWD

- Diverse, net production stream comprised of ~95 Bopd (oil) and ~1.0 MMcfd (gas) (~35% oil)

-

- Sizeable base of low-decline, predictable cash flow underpins future development activities

- $1.6MM PDP net cash flow (NTM)

- 4.5% NTM production decline

- Sizeable base of low-decline, predictable cash flow underpins future development activities

- Regional Gulf Coast Assets | $37MM 3P PV10 | 100% HBP

- Regional operated Gulf Coast assets, 100% HBP across multiple fields

- Assets offer balanced exposure to both gas-rich and oil-rich fields

- Established operations, including 5 SWDs to support future asset development

- Attractive average royalty burden at ~78% NRI 8/8th enhancing operated asset economics

- Average 95% WI & 74% NRI

- Regional operated Gulf Coast assets, 100% HBP across multiple fields

- Low-Cost, High-Return Conventional Opportunities

- Multiple low-cost capital projects offer material value acceleration

- Return to production, up-hole recompletions, and new drills provide opportunities to enhance production in proven developments

- Multiple low-cost capital projects offer material value acceleration

-

- Future development opportunities 100% funded through current and developable cash flow

-

- Substantial net reserves (30.6 Bcfe) and 3P PV10 ($37MM)

Bids are due March 20. For complete due diligence, please visit petrodivest.com, or email Jerry Edrington, managing director, at jerry@petrodivest.com or Jonathan Bristal, director, at jonathan@detring.com.