The following information is provided by PetroDivest Advisors. All inquiries on the following listings should be directed to PetroDivest Advisors. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

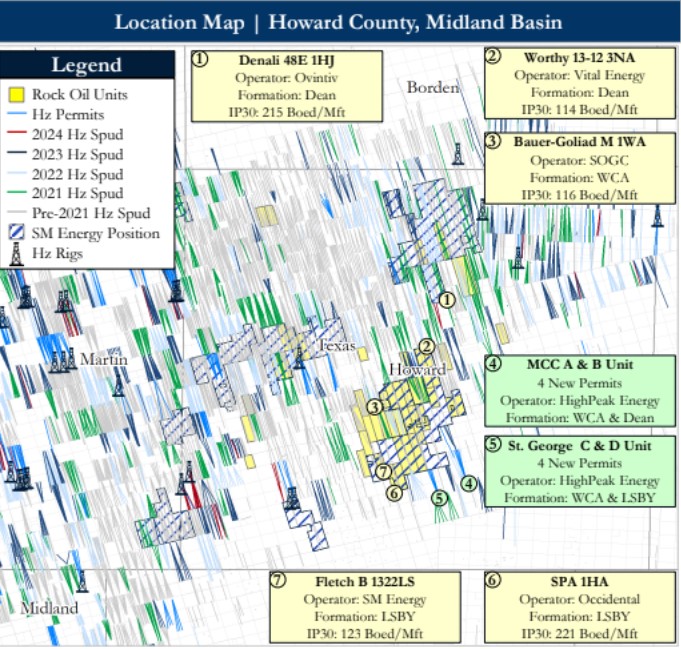

Rock Oil Holdings has retained PetroDivest Advisors for the sale of a mineral and royalty opportunity in Howard County, Midland Basin. The package includes 2,200 net royalty acres.

Opportunity highlights:

- $2.4MM Next-Twelve-Months Cash Flow | Primed For Pad Development & Growth

- 180 producing wells delivering stable base of existing cash flow

- PDP PV10: $7.9MM

- PDP NTM Cash Flow: $1.7MM

- Majority operated by SM Energy

- SM operates 70% of Rock Oil’s net production and 90% of its NRA

- Other operators include Vital, Sinclair (SOGC), Callon and Occidental

- 180 producing wells delivering stable base of existing cash flow

- ~2,200 Net Royalty Acres | Well-Positioned High-Interest Units

- High-interest units (up to ~7% RI)

- Highest interest acreage in prime drilling fairway well-positioned for imminent development

- SM Energy is focused on Howard County with the majority of its remaining North Midland Basin inventory (~50%+) under Rock Oil’s footprint

- Rock Oil positioned under SM’s key remaining scalable inventory

- SM Energy well performance in the county outperformed peers by 30%

- High-interest units (up to ~7% RI)

- 330 Undeveloped Locations | ~35% Horizontally Developed

- Imminent potential development set to substantially accelerate royalty value

- 3P PV10: $47MM ($100MM+ PV0)

- 3P Net Reserves: 2.2 MMBoe

- Proven primary horizontal targets across the Middle Spraberry, Jo Mill, Lower Spraberry Shale, and Wolfcamp A, B and D

- Position surrounded by recent permits and multi-bench pad development

- Estimated Operator avg. IRR of 70%

- Imminent potential development set to substantially accelerate royalty value

Bids are due April 10. For complete due diligence, please visit petrodivest.com, or email Jerry Edrington, managing director, at jerry@petrodivest.com.

Recommended Reading

M&A Spotlight Shifts from Permian to Bakken, Marcellus

2024-04-29 - Potential deals-in-waiting include the Bakken’s Grayson Mill Energy, EQT's remaining non-operated Marcellus portfolio and some Shell and BP assets in the Haynesville, Rystad said.

C-NLOPB Issues Call for Bids in Eastern Newfoundland

2024-04-29 - Winners of the Call for Bids No. NL24-CFB01 will be selected based on the highest total of money the bidder commits to spend on exploration of a parcel during the first six years of a nine-year license.

Tivoli Midstream Buys Southeast Texas Coast Infrastructure

2024-04-29 - Tivoli Midstream acquired the Chocolate Bayou from Ascend Performance Materials, including storage and land for development.

Phoenix Capital Group Acquires Uinta Basin Royalty Interests

2024-04-29 - Phoenix Capital Group’s acquisition of 1,500 net royalty acres in Duchesne County, Utah, brings the company's investment in the Uinta Basin to more than $60 million, the company said.

Ithaca Deal ‘Ticks All the Boxes,’ Eni’s CFO Says

2024-04-28 - Eni’s deal to acquire Ithaca Energy marks a “strategic move to significantly strengthen its presence” on the U.K. Continental Shelf and “ticks all of the boxes” for the Italian energy company.