The following information is provided by Detring Energy Advisors. All inquiries on the following listings should be directed to Detring Energy Advisors. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

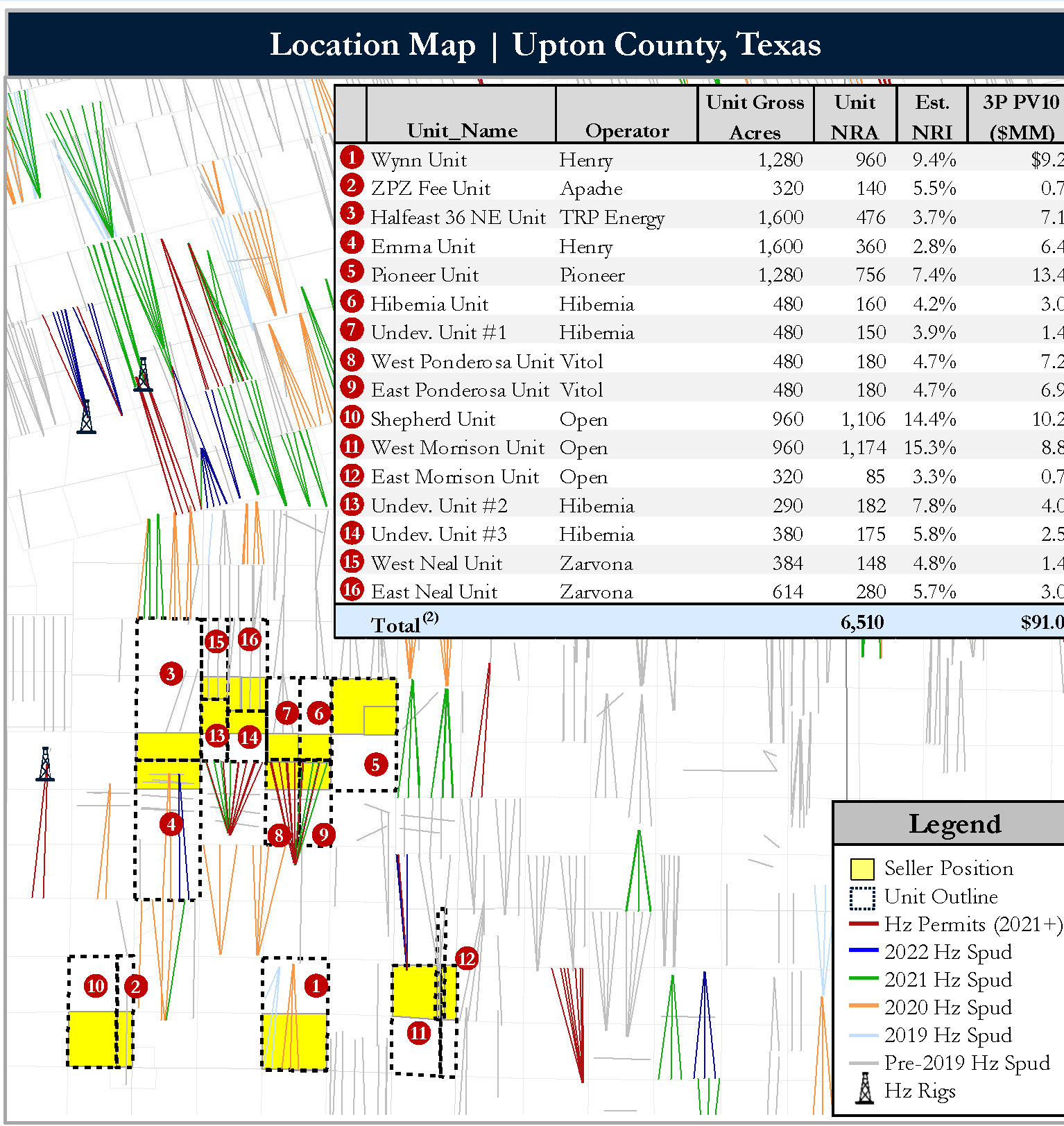

A private seller is offering a high-interest minerals opportunity in the Southern Midland Basin. This lot includes 6,510 Net Royalty Acres (100% minerals), ~7MM in NTM cash flow from 22 producing hz wells and 10 hz DUC's and permits, offering line-of-sight growth through mid-2024. The private seller has retained Detring Energy Advisors as its exclusive advisor relating to the transaction.

Asset Highlights:

- $6.8MM NTM Cash Flow; PDP + Line-of-Sight

- Active growth underwritten by high-interest DUCs (2) and permits (8)

- Average RI of ~5% across imminent near-term locations

- 27 producing wells (22 horizontal) provide a stable cash flow

- Net Prod: 290 Boed (71% liq.)

- PDP PV10: $14MM

- 6,510 Net Royalty Acres; 100% Minerals | 6.7% Avg. RI

- Dense NRA per section provides

material uplift with every new well or

pad developed across the position- 8 section gross footprint of 5,120

acres with high unit royalty interest

ranging from 2.8%-15.3%

- 8 section gross footprint of 5,120

- Key operators include Pioneer, Hibernia, Driftwood, & Henry

- Recent leasing to spur dev. activity

- Dense NRA per section provides

- 76 PUD Locations; Footprint Only 30% Developed

- Significant remaining locations and

anticipated lease bonus offer material

medium-term growth and longevity

over asset life- 3P PV10: $91MM ($241MM PV0)(1)

- 3P Net Reserves: 6.4 MMBoe

- Operators actively extending Wolfcamp A & B development across and beyond Seller’s position

- Three Wolfcamp targets (WCA,

WCB Upper, WCB Lower) offer

>100% avg. IRR

- Three Wolfcamp targets (WCA,

- Significant remaining locations and

Bids are due on June 7. For complete due diligence information, please visit detring.com or email Melinda Faust, managing director, at mel@detring.com.

Recommended Reading

CEO: Continental Adds Midland Basin Acreage, Explores Woodford, Barnett

2024-04-11 - Continental Resources is adding leases in Midland and Ector counties, Texas, as the private E&P hunts for drilling locations to explore. Continental is also testing deeper Barnett and Woodford intervals across its Permian footprint, CEO Doug Lawler said in an exclusive interview.

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.

Gibson, SOGDC to Develop Oil, Gas Facilities at Industrial Park in Malaysia

2024-02-14 - Sabah Oil & Gas Development Corp. says its collaboration with Gibson Shipbrokers will unlock energy availability for domestic and international markets.

TotalEnergies Acquires Eagle Ford Interest, Ups Texas NatGas Production

2024-04-08 - TotalEnergies’ 20% interest in the Eagle Ford’s Dorado Field will increase its natural gas production in Texas by 50 MMcf/d in 2024.

Chouest Acquires ROV Company ROVOP to Expand Subsea Capabilities

2024-05-02 - With the acquisition of ROVOP, Chouest will have a fleet of more than 100 ROVs.