The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

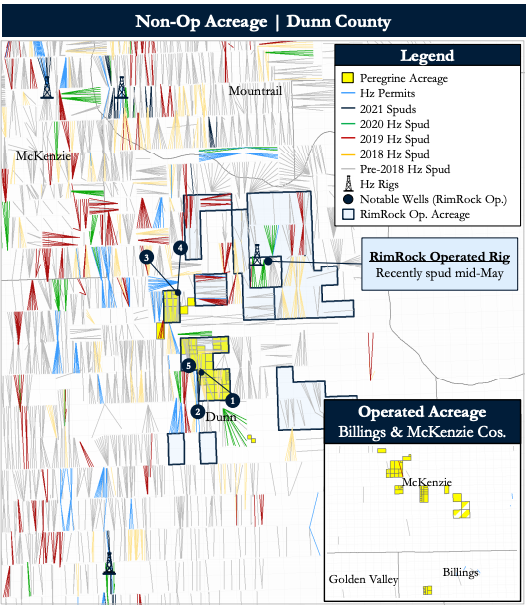

Peregrine Petroleum Partners Ltd. is offering for sale its oil and gas producing properties, leasehold and related assets located within the Williston Basin in North Dakota’s Dunn, McKenzie and Billings counties.

According to Detring Energy Advisors, retained by Peregrine as its exclusive adviser relating to the transaction, the assets offer an attractive opportunity to acquire (i) nonoperated leasehold underneath active development by a well-capitalized operator and (ii) a large operated footprint with substantial remaining inventory.

Highlights:

- Nonop Properties:

- 2,476 net acres in Dunn County (29% Working Interest / 23% Net Revenue Interest)

- Concentrated footprint underneath active development (RimRock Energy Partners LLC)

- Stellar on-lease and offsetting well results with strong type curve performance (~1,200-1,500 boe/d / 680,000-850,000 boe across the Bakken/Three Forks)

- Rimrock recently transitioned to a fully operated position (Exxon Mobil Corp. acreage swap) and picked up an offsetting rig (mid-May 2021)

- Located on Ft. Berthold Reservation with established infrastructure and regulatory processes in-place

- Operated Properties:

- 5,879 net acres in McKenzie/Billings Counties (93% Working Interest / 79% Net Revenue Interest)

- Developmental control with rights across multiple productive horizons

- Operated Saltwater Disposal system in-place

- Substantial Production Base – 1,600 boe/d / 90% Liquids (Nonop and Operated)

- Oil-weighted production with $16 million Next 12-month op. cash flow (PDP)

- $55 million PV-10 and 4.4 million boe net reserves from 62 horizontal wells (PDP)

- Average 36% Working Interest / 30% Net Revenue Interest

- 55 nonop and Seven operated horizontal wells

- Highly Economic Inventory

- 70-plus identified development locations across the Bakken and Three Forks

- Vastly improved well performance from optimized completions, longer laterals and pad development

- 18 million boe | $155 million PV-10 (3P)

Process Summary:

- Evaluation materials available via the Virtual Data Room on June 9

- Proposals due on July 14

For information visit detring.com or contact Melinda Faust at mel@detring.com or 512-296-4653.

Recommended Reading

Darbonne: The ESG Sword: BlackRock's Life, Death by ESG

2024-04-17 - BlackRock, the $10 trillion investment manager, is getting heat for too much ESG investing, while shareholders are complaining it’s doing too little.

Fire Closes Atlas Energy’s Kermit, Texas Mining Facility

2024-04-15 - Atlas Energy Solutions said no injuries were reported and the closing of the mine would not affect services to the company’s Permian Basin customers.

Coalition Launches Decarbonization Program in Major US Cities, Counties

2024-04-11 - A national coalition will start decarbonization efforts in nine U.S. cities and counties following a federal award of $20 billion “green bank” grants.

Exclusive: Scepter CEO: Methane Emissions Detection Saves on Cost

2024-04-08 - Methane emissions detection saves on cost and "can pay for itself," Scepter CEO Phillip Father says in this Hart Energy exclusive interview.