The following information is provided by Detring Energy Advisors. All inquiries on the following listings should be directed to Detring Energy Advisors. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Longreach Alternatives (LRA) has retained Detring Energy Advisors for the sale of its operated oil and gas assets in Andrews County in the northern Midland Basin. The package includes 1,200 boe/d of net production.

Opportunity Highlights:

- ~$17MM NTM PDP Cash Flow | ~1,200 Boed of Net Production | ~90% Liquids

- Oil weighted production stream generated from 6 modern horizontal and 143 vertical wells

- PDP Net Reserves: 3.3 MMBoe

- PDP PV10: $60MM

- Development program fully funded by operating cash flow

- Oil weighted production stream generated from 6 modern horizontal and 143 vertical wells

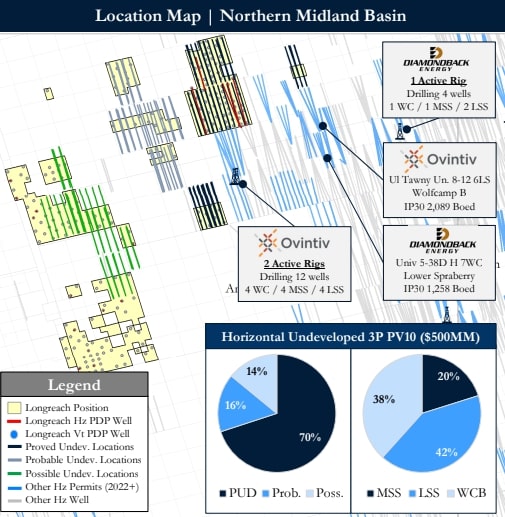

- ~16,000 Net Acre Position | Concentrated Footprint Ready for Development

- Large, contiguous operated position, 100% held-by-production

- Condensed position allows for centralized facilities and operations

- 1 active, operated SWD well handles majority of produced water

- Additional SWD candidates on acreage

- Large, contiguous operated position, 100% held-by-production

- ~180 Remaining Locations | Highly-Economic Reserves

- 84 Proven, 54 Probable, 40 Possible horizontal locations targeting multiple highly productive intervals

- Robust EURs of ~900 Mboe generate IRRs up to 100%+ (average IP30 of 850 Boed)

- 3P Net Reserves: ~80 MMBoe

- 3P PV10: ~$560MM

- De-risked prospects underpinned by recent on- and off-lease development

- Large, operated prospects with developmental control

- $850 per lateral foot of DC&F

- 84 Proven, 54 Probable, 40 Possible horizontal locations targeting multiple highly productive intervals

Bids are due Dec. 15. For complete due diligence, please visit detring.com or email Melinda Faust, managing director, at mel@detring.com .

Recommended Reading

Venture Global Gets FERC Nod to Process Gas for LNG

2024-04-23 - Venture Global’s massive export terminal will change natural gas flows across the Gulf of Mexico but its Plaquemines LNG export terminal may still be years away from delivering LNG to long-term customers.

Watson: Implications of LNG Pause

2024-03-07 - Critical questions remain for LNG on the heels of the Biden administration's pause on LNG export permits to non-Free Trade Agreement countries.

US Asks Venture Global LNG to Justify Filing of Confidential Documents

2024-03-13 - The FERC request comes days after Venture Global LNG customers had challenged the company's request for a one-year extension of its startup and urged the regulator to make Venture Global release the confidential commissioning documents.

Despite LNG Permitting Risks, Cheniere Expansions Continue

2024-02-28 - U.S.-based Cheniere Energy expects the U.S. market, which exported 86 million tonnes per annum (mtpa) of LNG in 2023, will be the first to surpass the 200 mtpa mark—even taking into account a recent pause on approvals related to new U.S. LNG projects.

Venture Global Seeks FERC Actions on LNG Projects with Sense of Urgency

2024-02-21 - Venture Global files requests with the Federal Energy Regulatory Commission for Calcasieu Pass 1 and 2 before a potential vacancy on the commission brings approvals to a standstill.