The following information is provided by TenOaks Energy Advisors LLC. All inquiries on the following listings should be directed to TenOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

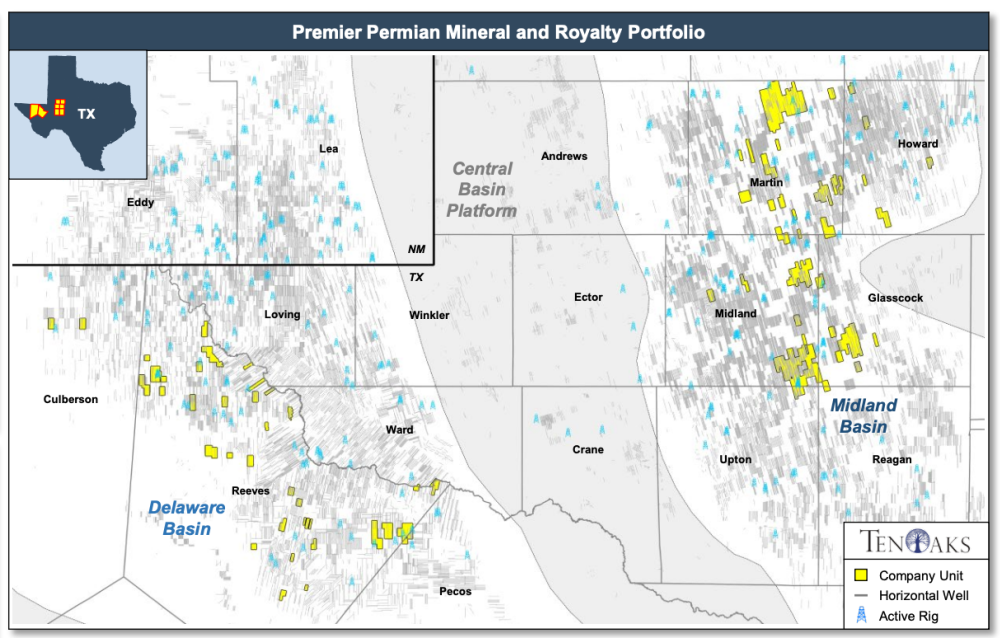

A private seller is offering for sale certain mineral and royalty properties located in the Delaware and Midland basins. The company retained TenOaks Energy Advisors as its exclusive adviser in connection with the transaction.

Key Considerations:

- Legacy mineral and royalty portfolio strategically positioned in rapidly developing areas of both the Delaware and Midland basins

- Expansive footprint covering 7,503 Net Royalty Acres (Delaware Basin: 2,806 Net Royalty Acres | Midland Basin: 4,697 Net Royalty Acres)

- Accelerated growth with 11 rigs on position

- 149 horizontal spuds on position in 2021 | On pace for ~200 spuds in 2022

- 13.5 new permits filed each month since Jan-21

- Next 12-month Cash Flow: $32 million

- Significant near-term cash flow growth expected from a vast inventory of DUCs (115) and active permits (141)

- >20 years of development inventory features >3,800 quantified drilling locations targeting proven benches with low breakeven economics

Bids are due at noon CST on July 28. The transaction effective date is July 1.

A virtual data room is available. For information visit tenoaksenergyadvisors.com or contact Forrest Salge at TenOaks Energy Advisors at 817-233-4096 or Forrest.Salge@tenoaksadvisors.com.

Recommended Reading

NOG Closes Utica Shale, Delaware Basin Acquisitions

2024-02-05 - Northern Oil and Gas’ Utica deal marks the entry of the non-op E&P in the shale play while it’s Delaware Basin acquisition extends its footprint in the Permian.

California Resources Corp., Aera Energy to Combine in $2.1B Merger

2024-02-07 - The announced combination between California Resources and Aera Energy comes one year after Exxon and Shell closed the sale of Aera to a German asset manager for $4 billion.

DXP Enterprises Buys Water Service Company Kappe Associates

2024-02-06 - DXP Enterprise’s purchase of Kappe, a water and wastewater company, adds scale to DXP’s national water management profile.

Pioneer Natural Resources Shareholders Approve $60B Exxon Merger

2024-02-07 - Pioneer Natural Resources shareholders voted at a special meeting to approve a merger with Exxon Mobil, although the deal remains under federal scrutiny.

Parker Wellbore, TDE Partner to ‘Revolutionize’ Well Drilling

2024-03-13 - Parker Wellbore and TDE are offering what they call the industry’s first downhole high power, high bandwidth data highway.