The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

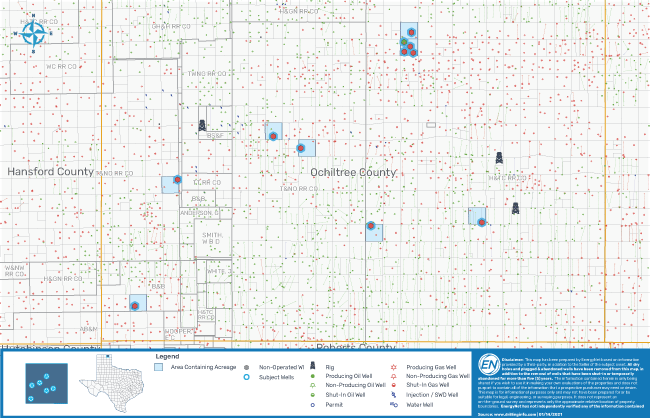

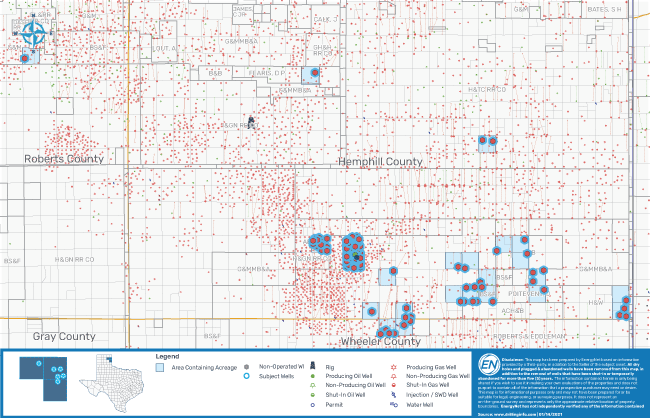

Kaiser-Francis Oil Co. retained EnergyNet for the sale of a 111 well package of nonoperated working interest and royalty interest through an auction closing Feb. 16. The assets are located across the Texas Panhandle in Hemphill, Ochiltree, Roberts and Wheeler counties, Texas.

Highlights:

- Nonoperated Working Interest in 110 Wells

- Average Working Interest of ~11.46% / Average Net Revenue Interest of ~10.15%

- 44 Producing Wells | 66 Non-Producing Wells

- 46 Wells Include a Royalty Interest

- Three Wells are After Payout Only

- Royalty Interest in the Non-Producing Teas 4304 Well:

- 2.35838% Royalty Interest

- Converts to Nonoperated Working Interest After Payout

- Six-month Average 8/8ths Production: 3,299 Mcf/d of Gas and 13 bbl/d of Oil

- Six-month Average Net Cash Flow: $8,917/Month

- ~1,875 Net Acres

Bids are due at 1:30 p.m. CST on Feb. 16. For complete due diligence information on either package visit energynet.com or email Ethan House, vice president of business development, at Ethan.House@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Recommended Reading

Battalion in Compliance with NYSE American after 2023 Meeting

2024-02-13 - Previously, Battalion Oil was not in compliance with the NYSE after failing to hold an annual meeting of stockholders during the fiscal year ending Dec. 31.

JMR Services, A-Plus P&A to Merge Companies

2024-03-05 - The combined organization will operate under JMR Services and aims to become the largest pure-play plug and abandonment company in the nation.

New Fortress Energy Sells Two Power Plants to Puerto Rico

2024-03-18 - New Fortress Energy sold two power plants to the Puerto Rico Electric Power Authority to provide cleaner and lower cost energy to the island.

Tellurian Executive Chairman ‘Encouraged’ by Progress

2024-03-18 - Tellurian announced new personnel assignments as the company continues to recover from a turbulent 2023.

Kissler: OPEC+ Likely to Buoy Crude Prices—At Least Somewhat

2024-03-18 - By keeping its voluntary production cuts, OPEC+ is sending a clear signal that oil prices need to be sustainable for both producers and consumers.