Jetstream Royalty Partners has retained PetroDivest Advisors for the sale of certain operated mineral and royalty interests located in the Permian Basin. The package includes 1,220 net royalty acres and net production of 215 boe/d.

Opportunity highlights:

- $9MM Cash Flow (NTM) | Transformative Development Activity

- Substantial operator activity results in rapid growth underwritten by recent DUCs (30) and permits (56)

- DUC & permit inventory provides >12 months of line-of-sight growth

- ~110 producing horizontal wells offer a stable foundation of production

- Net Production: ~215 Boed (85% liquids)

- PDP PV8: $12MM

- Substantial operator activity results in rapid growth underwritten by recent DUCs (30) and permits (56)

- 1,220 Net Royalty Acres | Broad, High-Activity Footprint

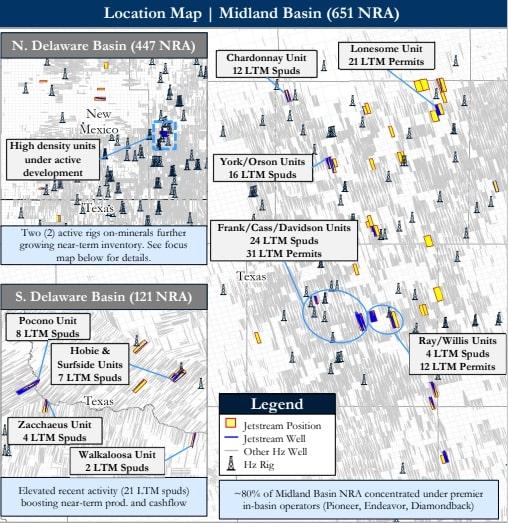

- Diversified position provides statistical coverage across the most active areas of the Permian Basin

- 53% Midland / 47% Delaware

- NRA concentrated under premier, highly active in-basin operators

- LTM average seven spuds/month on-minerals as operators continue rapid pad development across multiple zones

- 80% of Midland NRA concentrated under Pioneer, Endeavor, and Diamondback

- Two rigs on-minerals actively developing high-density units in Lea County (145 NRA) further growing near-term inventory

- Diversified position provides statistical coverage across the most active areas of the Permian Basin

Bids are due Nov.1. For complete due diligence, please visit PetroDivest.com or email Melinda Faust, managing director, at mel@detring.com

Recommended Reading

Well Logging Could Get a Makeover

2024-02-27 - Aramco’s KASHF robot, expected to deploy in 2025, will be able to operate in both vertical and horizontal segments of wellbores.

Shell Brings Deepwater Rydberg Subsea Tieback Onstream

2024-02-23 - The two-well Gulf of Mexico development will send 16,000 boe/d at peak rates to the Appomattox production semisubmersible.

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.

Remotely Controlled Well Completion Carried Out at SNEPCo’s Bonga Field

2024-02-27 - Optime Subsea, which supplied the operation’s remotely operated controls system, says its technology reduces equipment from transportation lists and reduces operation time.

Tech Trends: Halliburton’s Carbon Capturing Cement Solution

2024-02-20 - Halliburton’s new CorrosaLock cement solution provides chemical resistance to CO2 and minimizes the impact of cyclic loading on the cement barrier.