The following information is provided by Stephens Inc. All inquiries on the following listings should be directed to Stephens. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

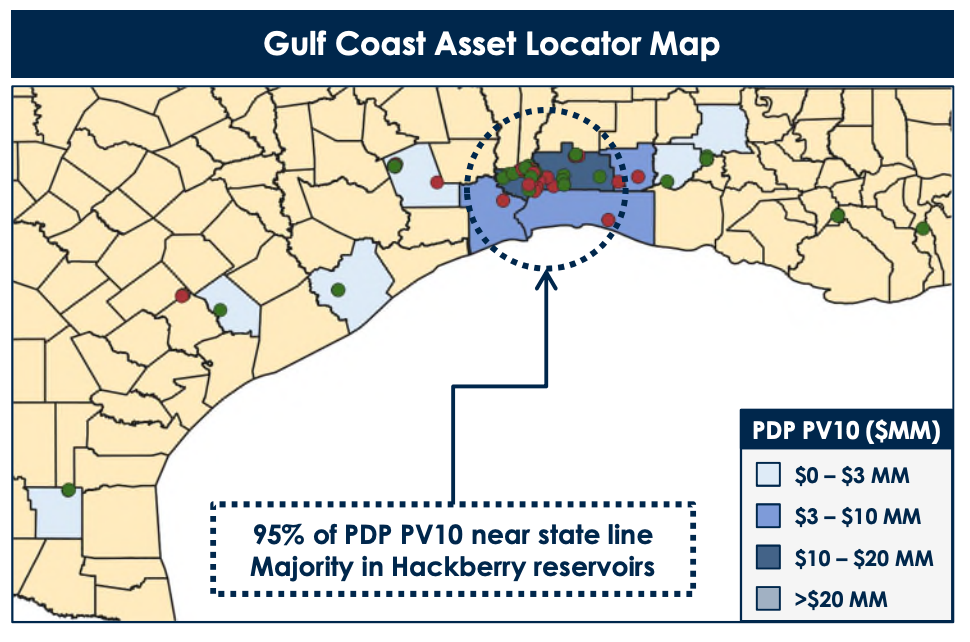

Ichor Energy LLC retained Stephens Inc. as its exclusive adviser to sell the company’s operated conventional oil assets in a single cash transaction. The primary acreage is located near the Texas-Louisiana border in the Hackberry reservoirs.

Highlights:

- Material Texas and Louisiana Hackberry Footprint with Operational Control

- Primary acreage located near the Texas-Louisiana border

- Vast majority operated on a PV-10 basis

- PV-10 Weighted Working Interest: ~93% | Net Revenue Interest: ~64% (~69% lease Net Revenue Interest)

- Note, Petrodome is the operator of record for operated well locations

- Reserves based upon an updated mid-year Netherland Sewell (NSAI) report; over 80% of PDP value from Hackberry producers

- Long-lived Production Provides Stable Cash Flow

- 2022E Net Production: ~1,350 boe/d

- Forecasts based on NSAI mid-year report, not including probable producing forecasts

- PDP PV-10: ~$80 million

- Next 12-month Average PDP Decline: ~10%

- Next 12-month PDP Cash Flow: ~$20 million

- PDP R/P: ~10 years

- 2022E Net Production: ~1,350 boe/d

- Significant Resources Potential From Asset Base

- Development potential includes return to production, artificial lift, behind pipe and new drill opportunities

- Future development is self-funding, with low drilling costs in conventional reservoirs accessible with vertical wells

- Nine PDNP opportunities quantified

- Nine PUD locations quantified

Bids are due Feb. 4. The transaction is structured as a sale of assets with an effective date of Jan. 1.

A virtual data room is available. For information visit stephens.com or contact Max Young, Stephens associate, at Max.Young@stephens.com.

Recommended Reading

Defeating the ‘Four Horsemen’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production—and keep the cash flowing.

Going with the Flow: Universities, Operators Team on Flow Assurance Research

2024-03-05 - From Icy Waterfloods to Gas Lift Slugs, operators and researchers at Texas Tech University and the Colorado School of Mines are finding ways to optimize flow assurance, reduce costs and improve wells.

Exclusive: Halliburton’s Frac Automation Roadmap

2024-03-06 - In this Hart Energy Exclusive, Halliburton’s William Ruhle describes the challenges and future of automating frac jobs.

Fracturing’s Geometry Test

2024-02-12 - During SPE’s Hydraulic Fracturing Technical Conference, industry experts looked for answers to their biggest test – fracture geometry.

AI Poised to Break Out of its Oilfield Niche

2024-04-11 - At the AI in Oil & Gas Conference in Houston, experts talked up the benefits artificial intelligence can provide to the downstream, midstream and upstream sectors, while assuring the audience humans will still run the show.