The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

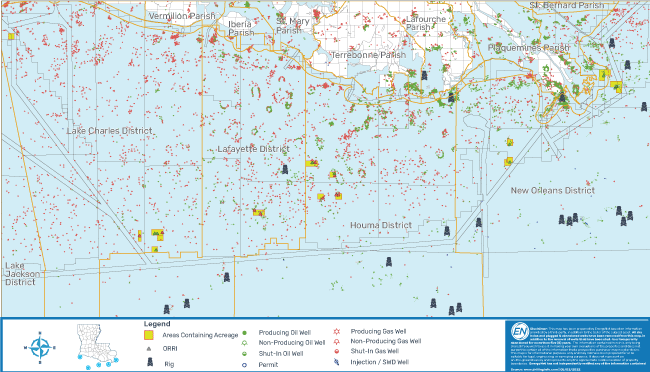

An undisclosed seller retained EnergyNet to sell a 266 well package of overriding royalty interest (ORRI) offshore Louisiana in the U.S. Gulf of Mexico.

Highlights:

- ORRI in 266 wells

- Sliding-scale ORRI between 2% - 10% based on LLS crude oil pricing

- Three-month average net cash flow: $539,681/month

- Net Proved Reserves(1): 896 Mboe (73% oil)

- 2022E Proved cash flow projection: $9.0 MM(1)

- Operators include Arena Offshore LP, Fieldwood Energy and Renaissance Offshore LLC

Sealed bids are due at 4 p.m. CST on May 27. For complete due diligence information visit energynet.com or email Cody Felton, vice president of business development, at Cody.Felton@energynet.com, or Reilly Bliton, director of engineering, at Reilly.Bliton@energynet.com.

Recommended Reading

Patterson-UTI Braces for Activity ‘Pause’ After E&P Consolidations

2024-02-19 - Patterson-UTI saw net income rebound from 2022 and CEO Andy Hendricks says the company is well positioned following a wave of E&P consolidations that may slow activity.

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

TechnipFMC Eyes $30B in Subsea Orders by 2025

2024-02-23 - TechnipFMC is capitalizing on an industry shift in spending to offshore projects from land projects.

NOV's AI, Edge Offerings Find Traction—Despite Crowded Field

2024-02-02 - NOV’s CEO Clay Williams is bullish on the company’s digital future, highlighting value-driven adoption of tech by customers.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.