The following information is provided by RedOaks Energy Advisors. All inquiries on the following listings should be directed to RedOaks Energy Advisors. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

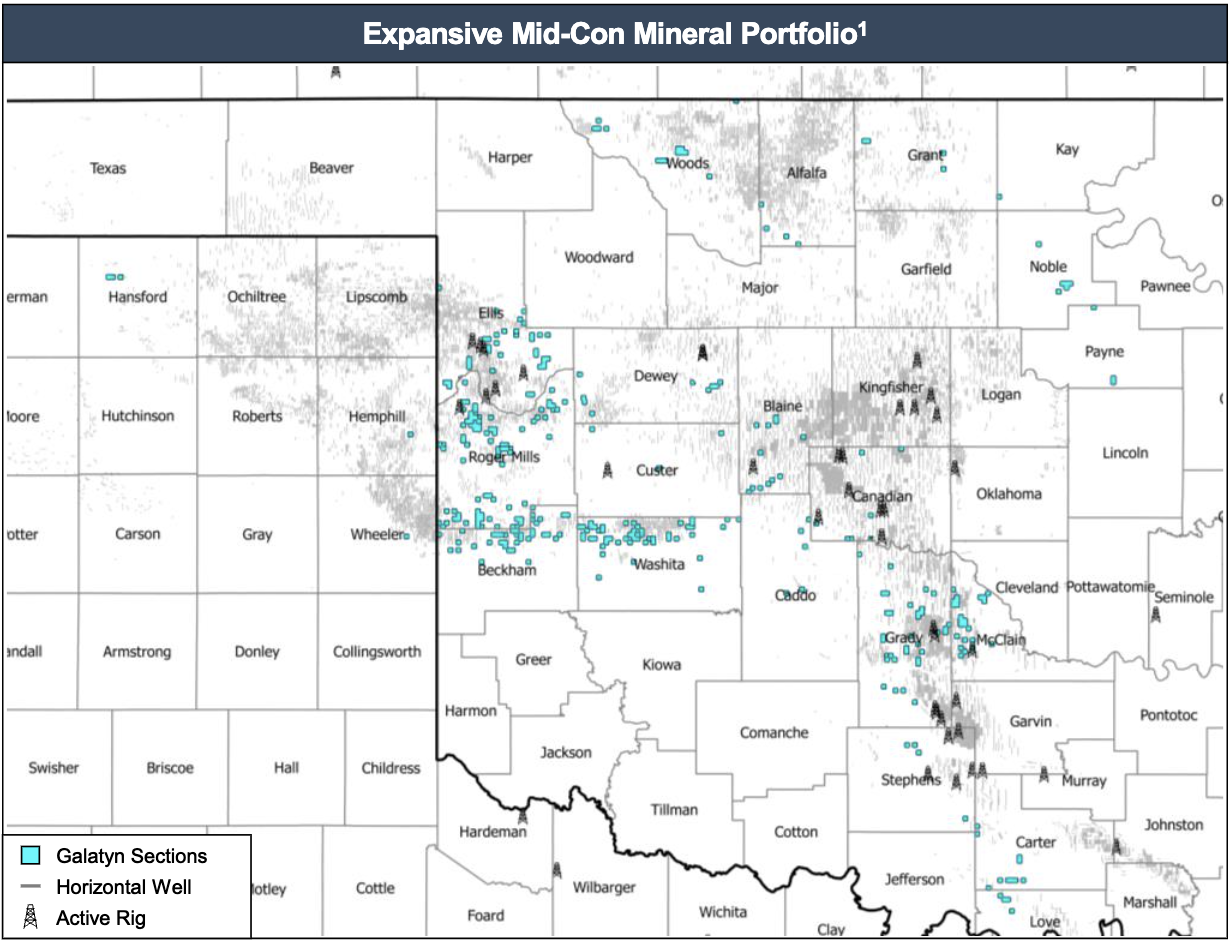

Galatyn Minerals LP retained RedOaks Energy Advisors for the sale of certain mineral and royalty properties located in Oklahoma, Louisiana and Texas. The mineral portfolio covers approximately 6,200 net mineral acres and 3,380 net royalty acres focused in the Mid-Continent region.

Key Considerations

- ~8,380 net royalty acres ("NRA") in the core of the Mid-Con

- NTM forecasted net cash flow: $3.4 MM

- Diversified production base spread across 340 producing horizontal wells

- PDP PV-10: $4.7 MM

- Consistent drilling activity on the position with significant line of sight to near-term development (13 - DUCs / Permits)

- DUC / Permit PV-10: $1.1 MM

- Primary operators: Continental, Ovintiv, EOG, Citizen, and Camino

- Upside inventory features 1,500+ quantified drilling locations targeting heavily delineated benches

Bids are due at noon CST on Oct. 5, 2023. For complete due diligence information, please visit redoaksenergyadvisors.com or email David Carter, partner, at david.carter@redoaksadvisors.com.

Recommended Reading

Imperial Oil Names Exxon’s Gomez-Smith as Upstream Senior VP

2024-04-30 - Cheryl Gomez-Smith, currently director of safety and risk at Exxon Mobil’s global operations and sustainability business, will join Imperial Oil in May.

1Q24 Dividends Declared in the Week of April 29

2024-05-03 - With earnings season in full swing, upstream and midstream companies are declaring quarterly dividends. Here is a selection of dividends announced in the past week.

SilverBow Rejects Kimmeridge’s Latest Offer, ‘Sets the Record Straight’

2024-03-28 - In a letter to SilverBow shareholders, the E&P said Kimmeridge’s offer “substantially undervalues SilverBow” and that Kimmeridge’s own South Texas gas asset values are “overstated.”

M4E Lithium Closes Funding for Brazilian Lithium Exploration

2024-03-15 - M4E’s financing package includes an equity investment, a royalty purchase and an option for a strategic offtake agreement.

Laredo Oil Subsidiary, Erehwon Enter Into Drilling Agreement with Texakoma

2024-03-14 - The agreement with Lustre Oil and Erehwon Oil & Gas would allow Texakoma to participate in the development of 7,375 net acres of mineral rights in Valley County, Montana.