The following information is provided by PetroDivest Advisors. All inquiries on the following listings should be directed to PetroDivest Advisors. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

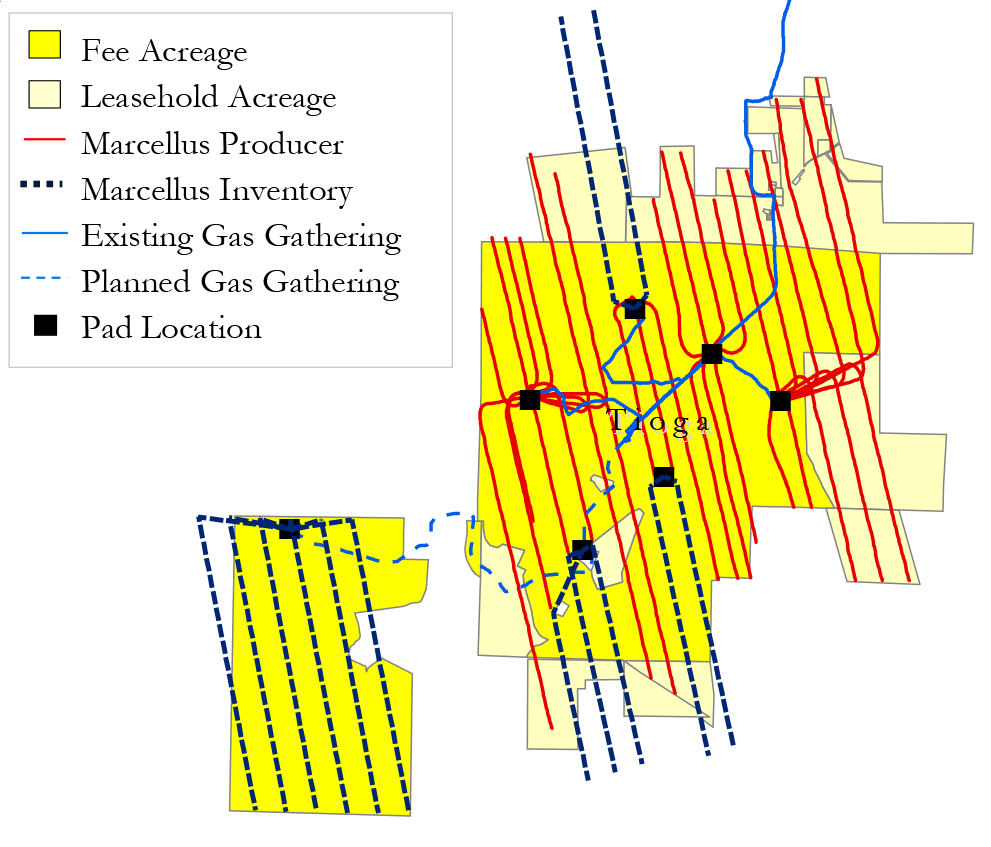

Diversified Energy Company is offering for sale its operated oil and gas fee and HBP leasehold in Tioga County, Pennsylvania. The assets include ~8,400 net acres, with ~340,000 net lateral feet of highly-economic inventory, and infrastructure that allows for immediate development. Diversified Energy Company has retained PetroDivest Advisors as its exclusive advisor relating to the transaction.

Asset Highlights:

- ~8,400 Net Acres (100% Fee & HBP Acreage)

- ~5,900 net acres of fee interests + 2,500 net acres HBP leasehold provide attractive natural gas optionality

- Undeveloped Marcellus inventory across ~2,500 net acres

- Utica rights across ~95% of the position

- 95% average 8/8ths NRI

- Fee ownership provides compelling returns in any pricing environment

- Scalable position with low-cost bolt-on and partnership opportunities to extend lateral lengths

- ~5,900 net acres of fee interests + 2,500 net acres HBP leasehold provide attractive natural gas optionality

- ~340,000 Net Lateral Feet of Highly-Economic Inventory

- 13 Marcellus locations with >10,000’ avg. lateral length 71% avg. WI

- 6 locations off of pre-approved pad on ~1,700 acre fee tract

- Robust type curves generate IRR’s >100% and EURs >2.5 Bcf/1,000’

- Marcellus Net Reserves: ~265 Bcf

- Marcellus PV10: ~$250MM

- Significant Utica upside

- 6 Utica locations on pre-approved pad alone add ~120 Bcf net reserves (>$100MM PV10)

- 13 Marcellus locations with >10,000’ avg. lateral length 71% avg. WI

- Infrastructure In-Place Allows for Immediate Development

- Gathering infrastructure and agreement in-place

- Delivery into TGP pipeline

- Low variable fees of $0.42/dth gathering and compression

- Ability to develop additional laterals from existing pads

- Single rig program fully develops position in under two years

- Favorable marketing area with takeaway capacity to premium markets

- Gathering infrastructure and agreement in-place

Bids are due on June 20. For complete due diligence information on this property, please visit http://www.petrodivest.com/ or contact Linda Fair.

Recommended Reading

Canadian Railway Companies Brace for Strike

2024-04-25 - A service disruption caused by a strike in May could delay freight deliveries of petrochemicals.

Talos Energy Expands Leadership Team After $1.29B QuarterNorth Deal

2024-04-25 - Talos Energy President and CEO Tim Duncan said the company has expanded its leadership team as the company integrates its QuarterNorth Energy acquisition.

Energy Transfer Ups Quarterly Cash Distribution

2024-04-25 - Energy Transfer will increase its dividend by about 3%.

Guyana’s Stabroek Boosts Production as Chevron Watches, Waits

2024-04-25 - Chevron Corp.’s planned $53 billion acquisition of Hess Corp. could potentially close in 2025, but in the meantime, the California-based energy giant is in a “read only” mode as an Exxon Mobil-led consortium boosts Guyana production.

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

2024-04-25 - Henry Hub blues: CNX Resources and other Appalachia producers are slashing production and deferring well completions as natural gas spot prices hover near record lows.