The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

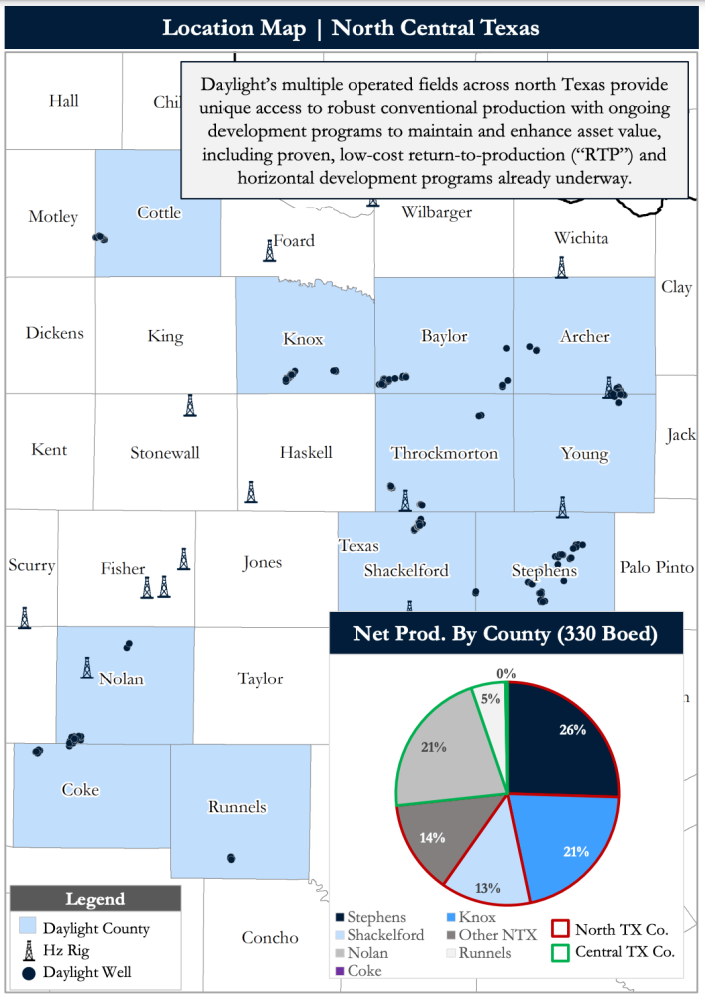

Daylight Petroleum LLC retained Detring Energy Advisors to market for sale certain of its oil and gas leasehold, producing properties and related assets located in various counties in northern Texas.

The assets offer an attractive opportunity, Detring said, to acquire a robust, stable production base with an oil-weighted product mix and long-term cash flow bolstered by attractive operating margins plus multiple opportunities for further field development through horizontal targeting of conventional reservoirs and continuation of an ongoing return-to-production program.

Asset Highlights:

- Oil-Weighted Production (330 net boe/d and $6.5 million next 12-month cash flow)

- Daylight’s multiple operated fields across north Texas offer unique access to robust conventional production

- Low decline (8%) oil-weighted production (92% oil) provides confidence in future performance

- PDP PV-10: $30 million

- PDP Net Reserves: 1.7 MMboe

- PDP R/P: 14 years

- High-margin cash flow resilient to any price environment

- $19/boe lifting costs

- 70% margin on next 12-month revenue

- Ongoing RTP and Horizontal Programs Drive Cash Flow Growth

- Proven, low-cost return-to-production (RTP) and horizontal development programs maintain and enhance asset value

- Daylight has consistently brought additional wells online since 2018 as part of an extensive RTP campaign

- 100+ additional candidates enable production uplift and maintenance

- Two highly economic horizontal PUDs targeting reef structures identified

- Additional horizontal potential remains across the position

- Line-of-sight to ~$20 million PV-10 through identified RTP and horizontal development candidates

- 14,900 Net Acres (PDP Average 87% Working Interest | 70% Net Revenue Interest)

- Diverse fields across north Texas contain multiple opportunities for further development & uplift

- Asset is 100% operated by Daylight Petroleum

- 159 producing wells with distributed value and low concentration risk

- Acreage position is 100% HBP

Process Summary:

- Evaluation materials available via the Virtual Data Room on May 11

- Bids are due on June 15

For information visit detring.com or contact Melinda Faust at mel@detring.com or 512-296-4653.

Recommended Reading

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

Well Logging Could Get a Makeover

2024-02-27 - Aramco’s KASHF robot, expected to deploy in 2025, will be able to operate in both vertical and horizontal segments of wellbores.

Shell Brings Deepwater Rydberg Subsea Tieback Onstream

2024-02-23 - The two-well Gulf of Mexico development will send 16,000 boe/d at peak rates to the Appomattox production semisubmersible.

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.

Remotely Controlled Well Completion Carried Out at SNEPCo’s Bonga Field

2024-02-27 - Optime Subsea, which supplied the operation’s remotely operated controls system, says its technology reduces equipment from transportation lists and reduces operation time.