The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Continental Resources Inc. retained EnergyNet for the sale of a 200-well package of conventional and unconventional assets in Oklahoma’s STACK play within the prolific Anadarko Basin through a sealed-bid offering.

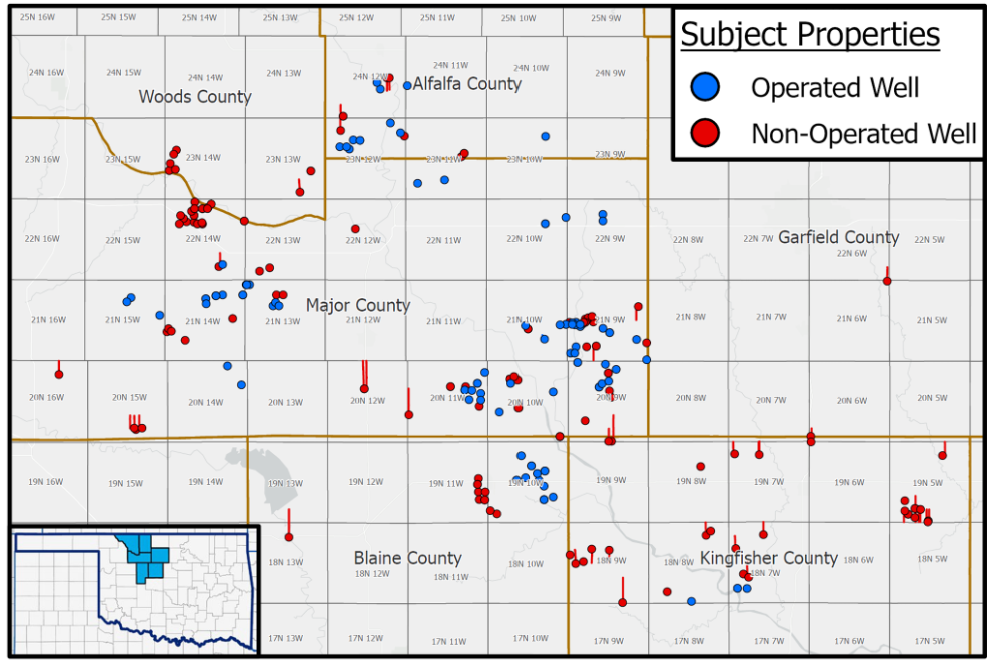

The North STACK opportunity, Lot# 98043, comprises operated and nonoperated working interests, royalty interest and overriding royalty interest (ORRI) with acreage located in Alfalfa, Blaine, Kingfisher, Garfield, Major and Woods counties in Oklahoma. EnergyNet said the asset includes multiple interest types along with a 2,500 sq ft field office. The divestiture also includes a saltwater disposal well that has an 8-mile gathering pipeline.

Highlights:

- Operations in 80 Wells:

- Average Working Interest ~94.63% and Net Revenue Interest ~79.17%

- Four wells are wellbore only

- Nonoperating working interest in 52 wells:

- Average Working Interest ~9.79% and ~7.98% Net Revenue Interest

- Select operators include Blake Production Co. Inc., Comanche Exploration Co., Sandridge Energy Inc. and XTO Energy Inc.

- Average Working Interest ~9.79% and ~7.98% Net Revenue Interest

- Royalty Interest/ORRI in 68 wells:

- Average ~0.61% Royalty Interest / Average ~3.99% ORRI

- Select operators include BCE-MACH III LLC, BRG Petroleum LLC, Redline Energy LLC and Staghorn Petroleum II LLC

- Average ~0.61% Royalty Interest / Average ~3.99% ORRI

- Five-month average (January 2022 –May 2022):

- Gross Production of 785 bbl/d of Oil and 9,521 Mcf/d of Gas

- Net Production of 88 bbl/d of Oil and 951 Mcf/d of Gas

- Net Operating Margin of $282,229/Month

- ~9,471 total net acres

- ~8,696 net operated acres

- Production primarily sourced from Arbuckle, Hunton and Mississippian

Bids are due at 4 p.m. CDT on Oct. 27. The effective date of sale is Oct. 1. A virtual data room will be available starting Sept. 21.

For complete due diligence information visit energynet.com or email Ethan House, managing director, at Ethan.House@energynet.com, or Denna Arias, executive director of acquisitions and divestments, at Denna.Arias@energynet.com.

Recommended Reading

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

2024-04-25 - Henry Hub blues: CNX Resources and other Appalachia producers are slashing production and deferring well completions as natural gas spot prices hover near record lows.

TPH: Lower 48 to Shed Rigs Through 3Q Before Gas Plays Rebound

2024-03-13 - TPH&Co. analysis shows the Permian Basin will lose rigs near term, but as activity in gassy plays ticks up later this year, the Permian may be headed towards muted activity into 2025.

US Gas Rig Count Falls to Lowest Since January 2022

2024-03-22 - The combined oil and gas rig count, an early indicator of future output, fell by five to 624 in the week to March 22.

US Drillers Cut Oil, Gas Rigs for Fourth Week in a Row-Baker Hughes

2024-04-12 - The oil and gas rig count, an early indicator of future output, fell by three to 617 in the week to April 12, the lowest since November.

Proven Volumes at Aramco’s Jafurah Field Jump on New Booking Approach

2024-02-27 - Aramco’s addition of 15 Tcf of gas and 2 Bbbl of condensate brings Jafurah’s proven reserves up to 229 Tcf of gas and 75 Bbbl of condensate.