The following information is provided by RedOaks Energy Advisors. All inquiries on the following listings should be directed to RedOaks Energy Advisors. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

A confidential seller retained RedOaks Energy Advisors for the sale of certain mineral and royalty interests in Louisiana. The package includes a 2024 projected net cash flow of $2.8 million.

Opportunity highlights:

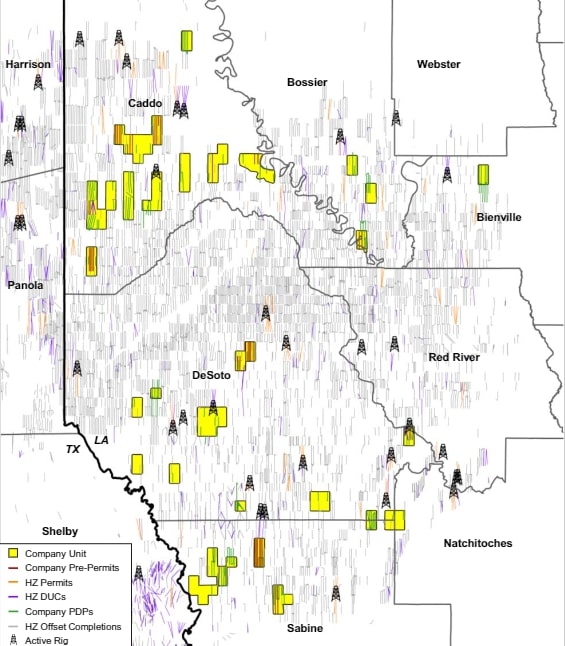

• 2,320 net royalty acres located across core areas of the Haynesville Shale

○ Total PV-10: ~$50 MM

• Significant line-of-sight development with years of de-risked inventory remaining

○ 9 DUCs | 38 permits / pre-permits | >300 remaining upside locations

• Leading Haynesville operators driving development: Southwestern, Chesapeake, Aethon

Bids are due Feb. 20 at noon CST. For complete due diligence, please visit redoaksenergyadvisors.com or email David Carter, partner, at david.carter@redoaksadvisors.com or Will McDonald, vice president, at will.mcdonald@redoaksadvisors.com.

Recommended Reading

US Oil, Gas Rig Count Falls to Lowest Since January 2022

2024-05-03 - The oil and gas rig count, an early indicator of future output, fell by eight to 605 in the week to May 3, in the biggest weekly decline since September 2023.

Pemex Reports Lower 2Q Production and Net Income

2024-05-03 - Mexico’s Pemex reported both lower oil and gas production and a 91% drop in net income in first-quarter 2024, but the company also reduced its total debt to $101.5 billion, executives said during an earnings webcast with analysts.

Chouest Acquires ROV Company ROVOP to Expand Subsea Capabilities

2024-05-02 - With the acquisition of ROVOP, Chouest will have a fleet of more than 100 ROVs.

SLB, OneSubsea, Subsea 7 Sign Collaboration Deal with Equinor

2024-05-02 - Work is expected to begin immediately on Equinor’s Wisting and Bay Du Nord projects.

SilverBow Makes Horseshoe Lateral in Austin Chalk

2024-05-01 - SilverBow Resources’ 8,900-foot lateral was drilled in Live Oak County at the intersection of South Texas’ oil and condensate phases. It's a first in the Chalk.