The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Cavallo Mineral Partners LLC retained Detring Energy Advisors to market for sale its minerals and royalty interests across the prolific Appalachian Basin.

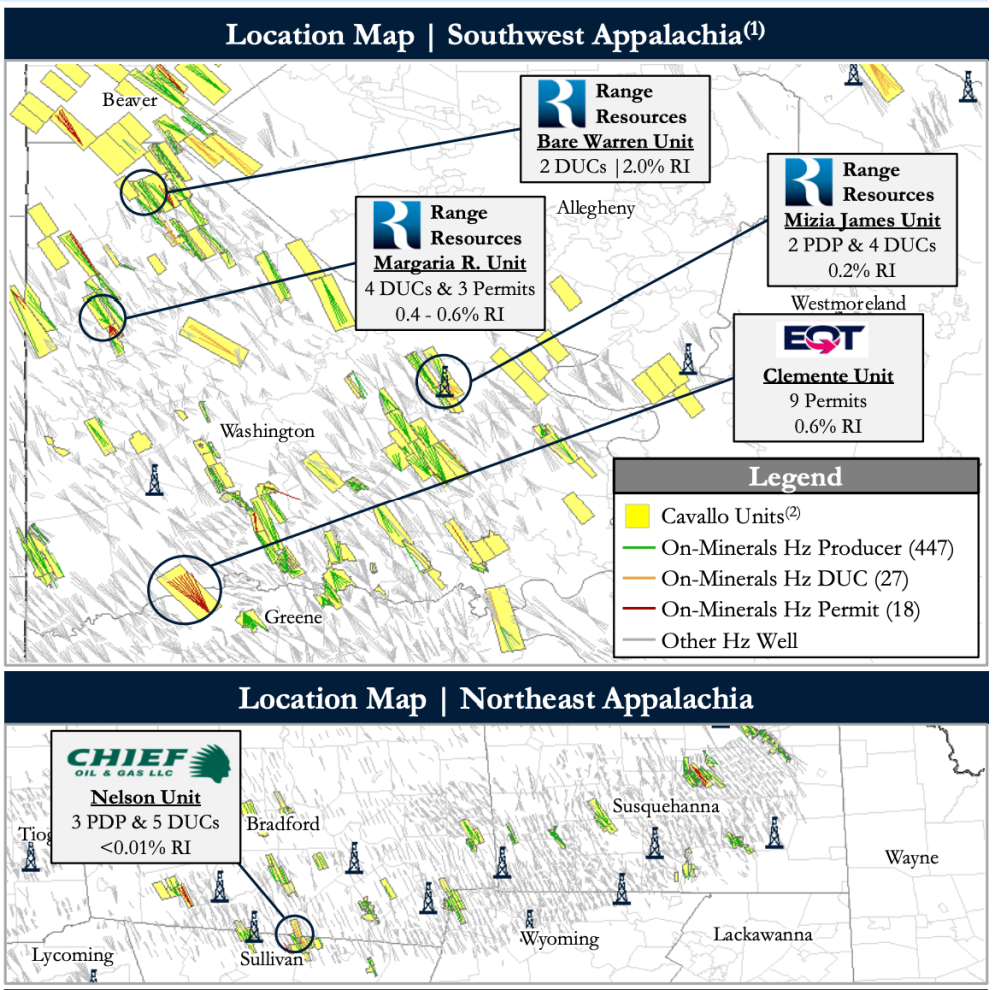

The assets offer an attractive opportunity, Detring said, to acquire roughly 9,500 net royalty acres (96% minerals) consolidated in both the southwest and northeast cores of the play under premier, well-capitalized operators with about 450 horizontal PDP wells and 50 near-term development wells generating $18 million in next 12-month cash flow. Additionally, Detring said the package includes about 400 highly-economic Lower Marcellus and Utica development locations in addition to substantial untapped reserves in the Upper Marcellus and Upper Devonian, which are in early-stage development across the position.

Asset Highlights:

- $18 Million Cash Flow (next 12-month) | ~9 MMcfe/d Net Production (~25% Liquids)

- $37 million PDP PV10 from ~450 horizontal producers

- 27 DUCs and 18 permitted locations provide line-of-sight to continued near-term development

- PDP+DUC+Permit PV-10 and net reserves of $50 million and 28 Bcfe, respectively

- ~9,500 Net Royalty Acres

- 78% Southwest Appalachia (Southwestern Pennsylvania, West Virginia, and Eastern Ohio) and 22% Northeastern Pennsylvania

- Diversified exposure to premier, well-capitalized Appalachia operators including Range Resources, EQT, Coterra Energy, Chesapeake Energy and Southwestern Energy

- World-Class Inventory of ~400 Undeveloped Lower Marcellus and Utica/Point Pleasant Locations

- Compelling well performance and economics ensure continued development with EUR’s as high as ~5 Bcfe/Mft

- Average operator IRR >100% for all zones (~4-8 month payout)

- Total 3P PV-10 and net reserves of $143MM and 104 Bcfe, respectively ($337 million PV0)

Process Summary:

- Evaluation materials are available via the Virtual Data Room on June 6

- Bids are due on July 13

For information visit detring.com or contact Matt Loewenstein at matt@detring.com or 713-595-1003.

Recommended Reading

ONEOK CEO: ‘Huge Competitive Advantage’ to Upping Permian NGL Capacity

2024-03-27 - ONEOK is getting deeper into refined products and adding new crude pipelines through an $18.8 billion acquisition of Magellan Midstream. But the Tulsa company aims to capitalize on NGL output growth with expansion projects in the Permian and Rockies.

Dallas Fed Energy Survey: Permian Basin Breakeven Costs Moving Up

2024-03-28 - Breakeven costs in America’s hottest oil play continue to rise, but crude producers are still making money, according to the first-quarter Dallas Fed Energy Survey. The situation is more dire for natural gas producers.

EIA: E&P Dealmaking Activity Soars to $234 Billion in ‘23

2024-03-19 - Oil and gas E&Ps spent a collective $234 billion on corporate M&A and asset acquisitions in 2023, the most in more than a decade, the U.S. Energy Information Administration reported.

Ohio Oil, Appalachia Gas Plays Ripe for Consolidation

2024-04-09 - With buyers “starved” for top-tier natural gas assets, Appalachia could become a dealmaking hotspot in the coming years. Operators, analysts and investors are also closely watching what comes out of the ground in the Ohio Utica oil fairway.

From Tokyo Gas to Chesapeake: The Slow-burning Fuse that Lit Haynesville M&A

2024-03-01 - TG Natural Resources rides the LNG wave with Rockcliff deal amid shale consolidation boom.