The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

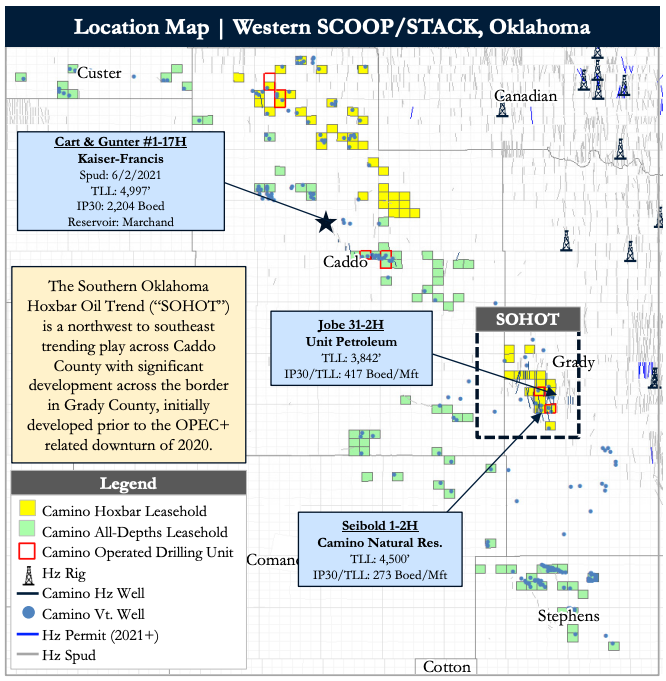

Camino Natural Resources retained Detring Energy Advisors to market for sale certain of its oil and gas leasehold, producing properties and related assets located in the western SCOOP/STACK of the Anadarko Basin in Oklahoma.

The assets offer an attractive opportunity, according to Detring, to acquire a robust, stable production base with a balanced product mix and long-term cash flow bolstered by attractive operating margins. Additionally, the offering includes a substantial, diversified operated and nonoperated working interest position primed for development through a large inventory of Hoxbar locations identified across proven pay zones in Caddo and Grady counties.

Highlights:

- Diversified Production Base of 6.3 MMcfe/d Generates $9MM in Net Cash Flow (next 12-month PDP)

- Blended hydrocarbon stream comprised of 3.7 MMcf/d (gas), 180 bbl/d (oil), and 230 bbl/d (NGL) (~50% operated/~40% liquids)

- PDP PV-10: $37.5 million

- PDP Net Reserves: 4.5 million boe

- PDP Well Count: 227 (42 horizontal wells)

- Decline Rate: 9% (next 12-month PDP)

- Sizeable base of predictable, high-margin cash flow

- Realized pricing of $6.30/Mcfe generates netback of $4.20/Mcfe

- Blended hydrocarbon stream comprised of 3.7 MMcf/d (gas), 180 bbl/d (oil), and 230 bbl/d (NGL) (~50% operated/~40% liquids)

- ~17,000 Net Acres (51% Operated & 49% Nonoperated)

- Large, diversified, operated and nonoperated footprint >99% HBP across multiple formations

- Meaningful exposure to the well-delineated SOHOT trend area with access to proven locations

- ~2,250 net acres (97% HBP)

- Hydrocarbon flexibility with exposure to liquids-rich Marchand and gas-rich Medrano horizontal targets

- Large Inventory of Low-Risk Horizontal Hoxbar Locations

- The Hoxbar Group is a Pennsylvanian-Missourian series of stacked oil and gas-bearing sandstones and siltstones

- Camino's acreage encompasses an area with ~3,000 ft of gross section, 550 ft+ net sand and seven stacked horizontal targets

- Camino has successfully drilled wells in the Medrano and Marchand (upper, middle and lower)

- 89 high-returning development locations across the Marchand and Medrano formations of the Hoxbar

- 12 operated and 77 nonoperated

- Robust performance generates >100% IRR and <12 month payback

- Substantial 3P PV-10 of $80 million and net reserves of 14 million boe

- Operated development locations provide >3x production uplift above current PDP

Process Summary:

- Evaluation materials available via the Virtual Data Room on Feb. 9

- Bids are due March 9

For information visit detring.com or contact Melinda Faust at mel@detring.com or 512-296-4653.

Recommended Reading

Well Done Foundation Wins California Orphan Well Project

2024-02-12 - Nonprofit Well Done Foundation will plug orphan wells in Santa Barbara County, California, starting in Orcutt and Santa Maria.

NAPE: Turning Orphan Wells From a Hot Mess Into a Hot Opportunity

2024-02-09 - Certain orphaned wells across the U.S. could be plugged to earn carbon credits.

Vår Energi Hits Oil with Ringhorne North

2024-04-17 - Vår Energi’s North Sea discovery de-risks drilling prospects in the area and could be tied back to Balder area infrastructure.

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.

E&P Highlights: March 4, 2024

2024-03-04 - Here’s a roundup of the latest E&P headlines, including a reserves update and new contract awards.