The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

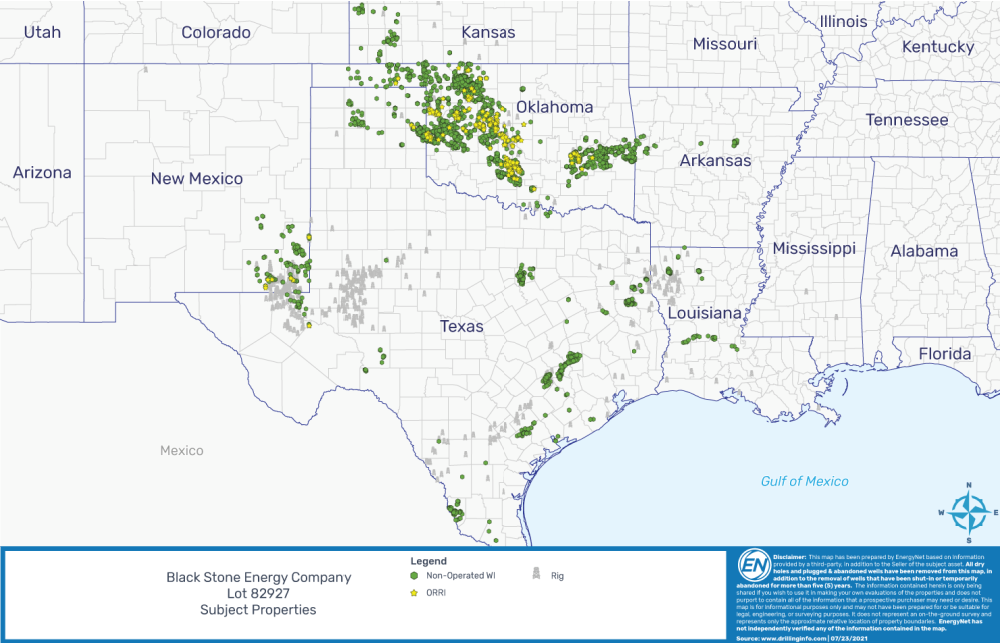

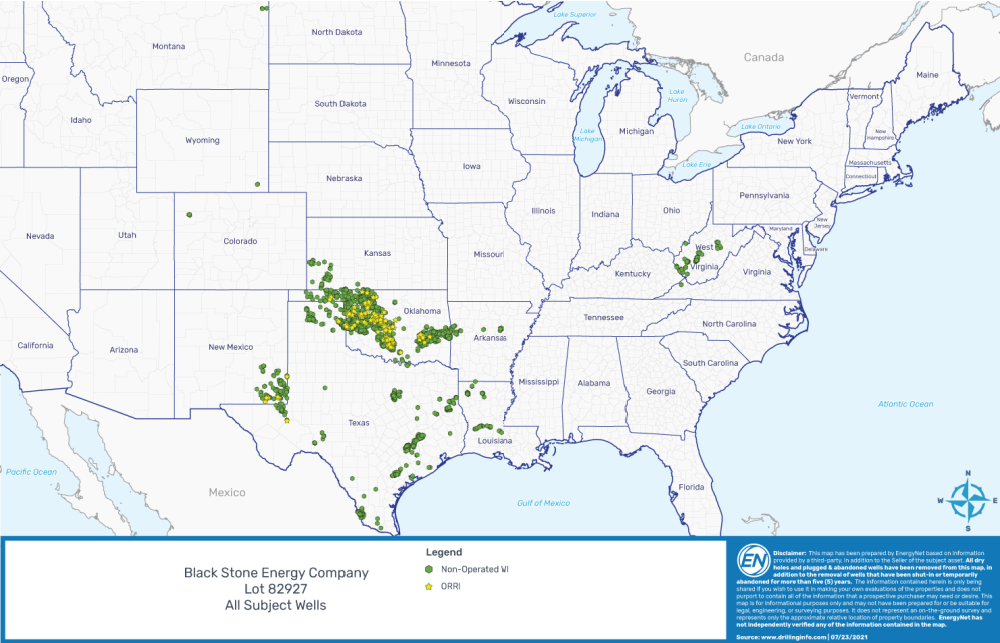

Black Stone Energy Co. LLC retained EnergyNet for the sale of interests in over 6,500 wells across the U.S. through a sealed-bid offering closing Aug. 25.

The offering comprises nonoperated working interest and overriding royalty interest (ORRI) in 6,563 wells located in various counties and states including Arkansas, Colorado, Kansas, Louisiana, Montana, New Mexico, Oklahoma, Texas, Virginia, West Virginia and Wyoming.

Highlights:

- Nonoperated Working Interest in 6,219 Wells:

- Average Working Interest 2.2461999% / Average Net Revenue Interest 1.8011984%

- An Additional ORRI in 121 Wells

- 4,409 Producing Wells | 1,810 Non-Producing Wells

- Select Operators include BP America Production Co., Chesapeake Operating Inc., TEP Barnett USA LLC and XTO Energy Inc.

- ORRI in 344 Wells:

- Average ORRI 0.1033482%

- 325 Producing Wells | 19 Non-Producing Wells

- Select Operators include Cimarex Energy Co., Gulfport Midcon LLC, Marathon Oil Co. and Newfield Exploration Mid-Continent Inc.

- Six-month Average 8/8ths Production: 685,556 Mcf/d of Gas and 17,982 bbl/d of Oil

- Five-month Average Net Cash Flow: $277,480/Month

Bids are due by 4 p.m. CST on Aug. 25. For complete due diligence information on any of the packages visit energynet.com or email Cody Felton, vice president of business development, at Cody.Felton@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Recommended Reading

Deep Well Services, CNX Launch JV AutoSep Technologies

2024-04-25 - AutoSep Technologies, a joint venture between Deep Well Services and CNX Resources, will provide automated conventional flowback operations to the oil and gas industry.

EQT Sees Clear Path to $5B in Potential Divestments

2024-04-24 - EQT Corp. executives said that an April deal with Equinor has been a catalyst for talks with potential buyers as the company looks to shed debt for its Equitrans Midstream acquisition.

Matador Hoards Dry Powder for Potential M&A, Adds Delaware Acreage

2024-04-24 - Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities.

TotalEnergies, Vanguard Renewables Form RNG JV in US

2024-04-24 - Total Energies and Vanguard Renewable’s equally owned joint venture initially aims to advance 10 RNG projects into construction during the next 12 months.

Sitio Royalties Dives Deeper in D-J with $150MM Acquisition

2024-02-29 - Sitio Royalties is deepening its roots in the D-J Basin with a $150 million acquisition—citing regulatory certainty over future development activity in Colorado.