The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

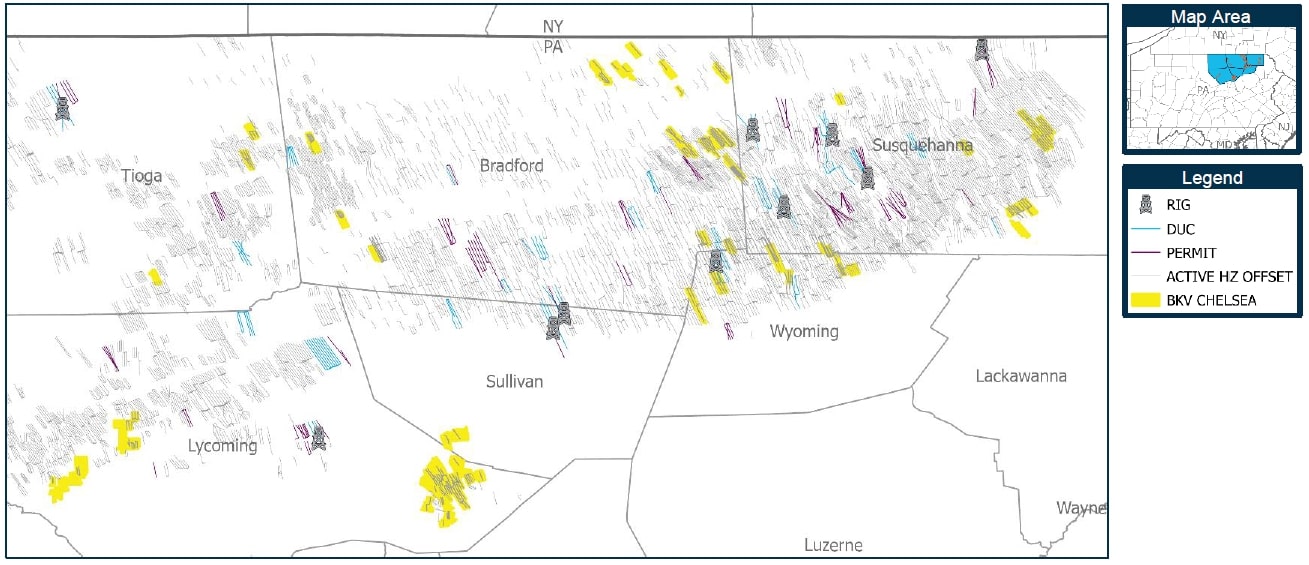

BKV Chelsea has retained EnergyNet for the sale of a 214 non-operated well package in Bradford, Lycoming, Sullivan, Susquehanna, Tioga and Wyoming counties, Pennsylvania. The lot# 115742 package includes 209 active wells with current net production of 7.5 MMcfe/d.

Opportunity highlights:

- Premium Non-Operated Appalachian Basin Portfolio

-

- Attractive opportunity to acquire non-operated working interests with leading operators in the NE Pennsylvania dry gas Marcellus play;

- $26.3MM PDP PV-10;

- PDP NTM CF estimated at $2.9 MM;

- 209 active wells with current net production 7.5 MMcfe/d;

- Approximately 26,000 gross acres / 6,700 net acres; 100% HBP; and

- Average well ownership 7.1% WI / 5.8% NRI; 18% average royalty burden (8/8ths).

- Predictable Production and Durable Cash Flows

-

- Stable cash flow from diversified portfolio featuring 200+ wells with six operators over five counties;

- Asset value distributed throughout portfolio with 75 wells accounting for top 80% of estimated PV-10;

- Wells have been producing for more than 10 years on average with established and predictable production profile and shallow base decline less than 10%; and

- Minimal near-term abandonment exposure with only $300k of estimated P&A spend through 2030.

- Meaningful Upside Exposure

-

- 111 identified new drill opportunities with estimated $37.1MM PV-10 in addition to refrac targets on early generation wells;

- Natural gas forward strip pricing shows consensus for significant increases in coming years driven by LNG startups and export premium; and

- 100% HBP acreage position offers ownership in future developments unlocked in higher gas price environment.

Bids are due April 23 at 4 p.m. CDT. For complete due diligence, please visit indigo.energynet.com or email Ethan House, managing director, at Ethan.House@energynet.com, or Jessica Scott, buyer, at Jessica.Scott@energynet.com.

Recommended Reading

Kinder Morgan Exec: Don’t Count Out Midstream in M&A Frenzy

2024-04-02 - Kinder Morgan’s Allen Fore said 2024 should be an ‘interesting’ year in M&A during a discussion at DUG GAS+ Conference and Expo.

Baker Hughes Tapped for NatGas, Hydrogen Technology

2024-04-03 - Baker Hughes will provide three of its NovaLT 12 gas turbine driven compressor trains for a new gas compressor station in Sulmona, Italy.

FERC Approves ONEOK Pipeline Segment Connecting Permian to Mexico

2024-02-16 - ONEOK’s Saguaro Connector Pipeline will transport U.S. gas to Mexico Pacific’s Saguaro LNG project.

Tallgrass Energy Announces Latest Open Season for Pony Express Pipeline

2024-03-12 - Prospective shippers can review details of the open season, which began March 11, after signing a confidentiality agreement with Tallgrass.

Energy Transfer Asks FERC to Weigh in on Williams Gas Project

2024-04-08 - Energy Transfer's filing continues the dispute over Williams’ development of the Louisiana Energy Gateway.