The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

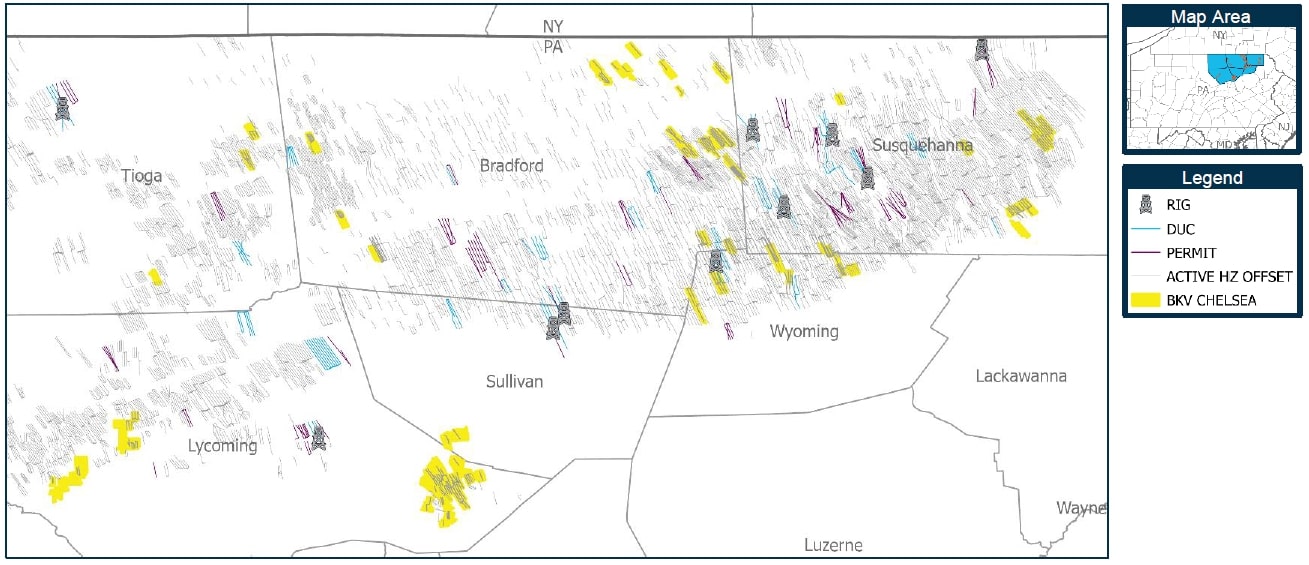

BKV Chelsea has retained EnergyNet for the sale of a 214 non-operated well package in Bradford, Lycoming, Sullivan, Susquehanna, Tioga and Wyoming counties, Pennsylvania. The lot# 115742 package includes 209 active wells with current net production of 7.5 MMcfe/d.

Opportunity highlights:

- Premium Non-Operated Appalachian Basin Portfolio

-

- Attractive opportunity to acquire non-operated working interests with leading operators in the NE Pennsylvania dry gas Marcellus play;

- $26.3MM PDP PV-10;

- PDP NTM CF estimated at $2.9 MM;

- 209 active wells with current net production 7.5 MMcfe/d;

- Approximately 26,000 gross acres / 6,700 net acres; 100% HBP; and

- Average well ownership 7.1% WI / 5.8% NRI; 18% average royalty burden (8/8ths).

- Predictable Production and Durable Cash Flows

-

- Stable cash flow from diversified portfolio featuring 200+ wells with six operators over five counties;

- Asset value distributed throughout portfolio with 75 wells accounting for top 80% of estimated PV-10;

- Wells have been producing for more than 10 years on average with established and predictable production profile and shallow base decline less than 10%; and

- Minimal near-term abandonment exposure with only $300k of estimated P&A spend through 2030.

- Meaningful Upside Exposure

-

- 111 identified new drill opportunities with estimated $37.1MM PV-10 in addition to refrac targets on early generation wells;

- Natural gas forward strip pricing shows consensus for significant increases in coming years driven by LNG startups and export premium; and

- 100% HBP acreage position offers ownership in future developments unlocked in higher gas price environment.

Bids are due April 23 at 4 p.m. CDT. For complete due diligence, please visit indigo.energynet.com or email Ethan House, managing director, at Ethan.House@energynet.com, or Jessica Scott, buyer, at Jessica.Scott@energynet.com.

Recommended Reading

Repsol Plans to Double Oil Production in Venezuela

2024-05-01 - Spain’s Repsol plans to double its oil production in Venezuela and continue with its diluent swap agreements with the OPEC country as approved by the U.S. government.

US Gulf Coast Heavy Crude Oil Prices Firm as Supplies Tighten

2024-04-10 - Pushing up heavy crude prices are falling oil exports from Mexico, the potential for resumption of sanctions on Venezuelan crude, the imminent startup of a Canadian pipeline and continued output cuts by OPEC+.

Wirth: Chevron Won’t Put ‘New Capital into Venezuela’

2024-05-01 - California-based Chevron Corp. doesn’t plan on allocating more capex into its operations in Venezuela even though it still has U.S. approval to operate there, despite Washington sanctions.

CERAWeek: Sens. Manchin, Sullivan Say LNG Pause Needs to be Paused

2024-03-20 - U.S. Sens. Joe Manchin and Daniel Sullivan argued against the recent LNG pause announced by U.S. President Joe Biden, saying it creates doubts among allies and creates an opening for competitors as well as U.S. rival Russia.

What's Affecting Oil Prices This Week? (April 22, 2024)

2024-04-22 - Stratas Advisors predict that despite geopolitical tensions, the oil supply will not be disrupted, even with the U.S. House of Representatives inserting sanctions on Iran’s oil exports.