The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

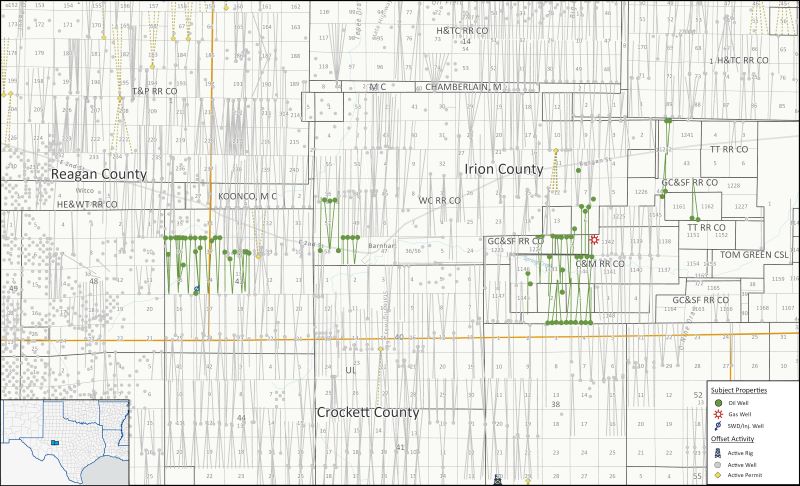

Bendel Ventures LP has retained EnergyNet for the sale of a 73 well package in Iron and Reagan counties, Texas. The lot# 96679 package includes a six-month average net income of $21,132 per month.

Opportunity highlights:

- Non-Operated Working Interest in 73 Wells:

- 3.74% Avg. WI / 2.84% Avg. NRI

- Includes 1 SWD Well

- 6-Month Average 8/8ths Production: 14,881 MCFPD and 205 BOPD

- 6-Month Average Net Income: $21,132/Month

- Operator: Earthstone Operating, LLC

- Subject to Lein to be released at closing.

Bids are due March 6 at 1:50 p.m. CST. For complete due diligence, please visit energynet.com, or email Cody Felton, managing director, at Cody.Felton@energynet.com.

Recommended Reading

Exxon’s Guyana Gas Project a “Win-Win,” Set for Hook-up by Year-end ‘24

2024-04-26 - Exxon Mobil Corp. CEO Darren Woods said the company’s gas-to-power project in Guyana as a “win-win proposition particularly for the people of Guyana” when completed and hooked-up by year-end 2024.

Segrist: The LNG Pause and a Big, Dumb Question

2024-04-25 - In trying to understand the White House’s decision to pause LNG export permits and wondering if it’s just a red herring, one big, dumb question must be asked.

Texas LNG Export Plant Signs Additional Offtake Deal With EQT

2024-04-23 - Glenfarne Group LLC's proposed Texas LNG export plant in Brownsville has signed an additional tolling agreement with EQT Corp. to provide natural gas liquefaction services of an additional 1.5 mtpa over 20 years.

US Refiners to Face Tighter Heavy Spreads this Summer TPH

2024-04-22 - Tudor, Pickering, Holt and Co. (TPH) expects fairly tight heavy crude discounts in the U.S. this summer and beyond owing to lower imports of Canadian, Mexican and Venezuelan crudes.

What's Affecting Oil Prices This Week? (April 22, 2024)

2024-04-22 - Stratas Advisors predict that despite geopolitical tensions, the oil supply will not be disrupted, even with the U.S. House of Representatives inserting sanctions on Iran’s oil exports.