The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Armor Energy LLC retained EnergyNet for the sale of a Mississippian Play opportunity in Oklahoma through a sealed-bid offering closing July 28.

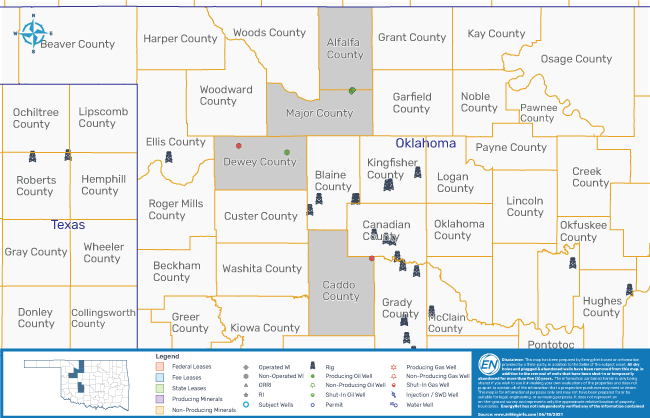

The offering includes operations and nonoperated working interest in a six-well package plus HBP leasehold in Oklahoma’s Alfalfa, Caddo, Dewey and Major counties.

Highlights:

- Operated Working Interest in 3 Producing Wells:

- 100.00% to 95.00% Working Interest / 78.430788% to 75.703126% Net Revenue Interest (Before Payout)

- Nonoperated Working Interest in Three Producing Wells:

- 4.1016% to 2.171469% Working Interest / 3.28125% to 1.737174% Net Revenue Interest

- Operators include Cimarex Energy Co., Sand Creek Resources LLC and Tapstone Energy LLC

- Nine-month Average Net Income: $28,115/Month

- Six-month Average 8/8ths Production: 40 bbl/d of Oil and 1,449 Mcf/d of Gas

- 1,330.7136 Net HBP Leasehold Acres

- Operator Bond Required

- Further subject to Oklahoma State Sales Tax

Bids are due at 4 p.m. CST on July 28. For complete due diligence information on any of the packages visit energynet.com or email Ethan House, vice president of business development, at Ethan.House@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Recommended Reading

US Drillers Cut Most Oil Rigs in a Week Since November

2024-04-26 - The number of oil rigs fell by five to 506 this week, while gas rigs fell by one to 105, their lowest since December 2021.

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

2024-04-25 - Henry Hub blues: CNX Resources and other Appalachia producers are slashing production and deferring well completions as natural gas spot prices hover near record lows.

Chevron’s Tengiz Oil Field Operations Start Up in Kazakhstan

2024-04-25 - The final phase of Chevron’s project will produce about 260,000 bbl/d.

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.