The following information is provided by PetroDivest Advisors. All inquiries on the following listings should be directed to PetroDivest. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

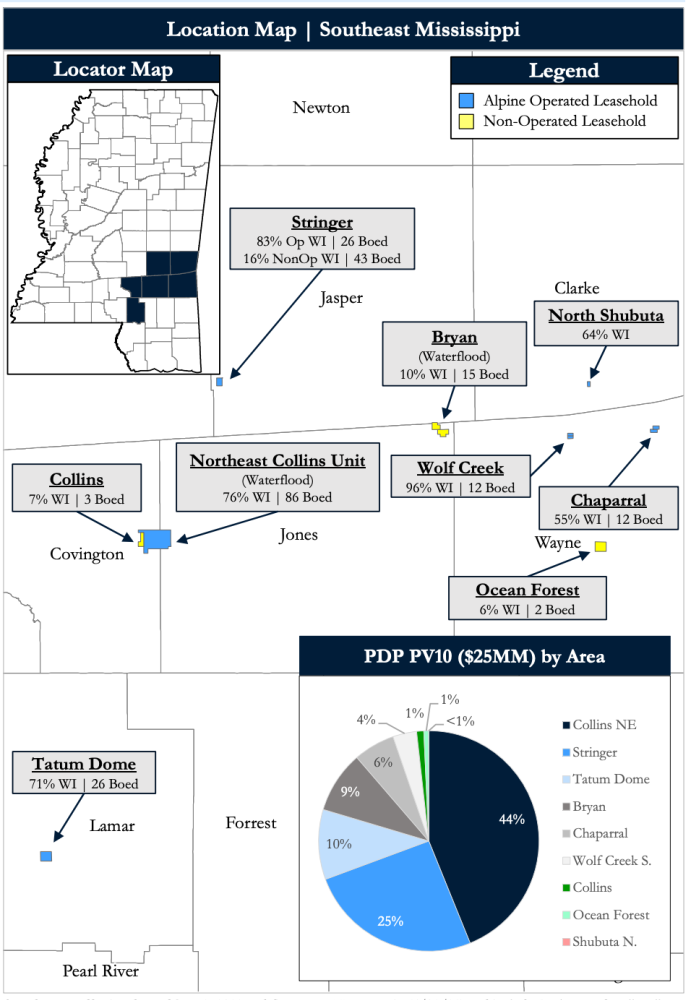

Alpine Gas Investors LP has retained PetroDivest Advisors to market for sale its oil and gas leasehold, producing properties and related assets throughout various counties in Southeast Mississippi.

The assets offer an attractive opportunity, PetroDivest said, to acquire an oil-weighted production base generating roughly 225 boe/d (93% oil) from 31 active wells on an established, low decline with about 3,500 net acres 100% HBP including two active waterfloods and substantial upside opportunities through return-to-production workovers, 12 behind pipe recompletions and four undeveloped new drill locations to unlock additional production, reserves and cash flow.

Asset Highlights:

- Low Decline (~7% next 12-month) Oil-Weighted Production | 225 boe/d | 93% Oil

- Premium LLS oil pricing over WTI

- ~$5 million Next 12-month PDP operating cash flow

- Average Operated Working Interest and Net Revenue Interest: 73% and 56% respectively

- Average Nonop Working Interest and Net Revenue Interest: 12% and 10% respectively

- Long-life, conventional PDP asset base from 31 active wells

- PDP PV-10: $24.5 million

- PDP Net Res.: 2.2 MMboe (95% liquids)

- 76% of PDP PV10 operated by Alpine

- ~3,500 Net Acres | 100% Held by Production

- Fully HBP leasehold with multiple targeted pay intervals

- Target intervals include the Cotton Valley, Rodessa, Hosston, Tuscaloosa, Paluxy, Smackover and Sligo

- Two active waterfloods

- Operated NECU Unit, one new well TIL in May 2022

- Nonoperated Bryan Unit

- Fully HBP leasehold with multiple targeted pay intervals

- Highly Economic Behind Pipe and Undeveloped Inventory

- 12 behind pipe recompletions

- Well delineated uphole potential provides long-term optionality

- Four operated PUD locations

- Low-risk undeveloped locations across the Tatum Dome and Reef

- Significant upside value through a combination of workovers, recompletions and PUD inventory

- 3P PV-10: $43 million

- 3P Net Res.: 4.6 MMboe (85% liquids)

- 12 behind pipe recompletions

Process Summary:

- Evaluation materials are available via the Virtual Data Room on June 13

- Proposals are due on July 27

For information visit petrodivest.com or contact Jerry Edrington, director of PetroDivest, at jerry@petrodivest.com or 713-595-1017.

Recommended Reading

Brett: Oil M&A Outlook is Strong, Even With Bifurcation in Valuations

2024-04-18 - Valuations across major basins are experiencing a very divergent bifurcation as value rushes back toward high-quality undeveloped properties.

Ohio Oil, Appalachia Gas Plays Ripe for Consolidation

2024-04-09 - With buyers “starved” for top-tier natural gas assets, Appalachia could become a dealmaking hotspot in the coming years. Operators, analysts and investors are also closely watching what comes out of the ground in the Ohio Utica oil fairway.

Occidental to Divest Some Permian Assets after Closing CrownRock Deal

2024-02-21 - Occidental CEO Vicki Hollub said plans to divest non-core Permian assets would come after closing the pending acquisition of CrownRock — but reports have since emerged that the company is considering selling its share of Western Midstream Partners, valued at about $20 billion, according to Reuters.

Dallas Fed Energy Survey: Permian Basin Breakeven Costs Moving Up

2024-03-28 - Breakeven costs in America’s hottest oil play continue to rise, but crude producers are still making money, according to the first-quarter Dallas Fed Energy Survey. The situation is more dire for natural gas producers.

Continental Resources Makes $1B in M&A Moves—But Where?

2024-02-26 - Continental Resources added acreage in Oklahoma’s Anadarko Basin, but precisely where else it bought and sold is a little more complicated.