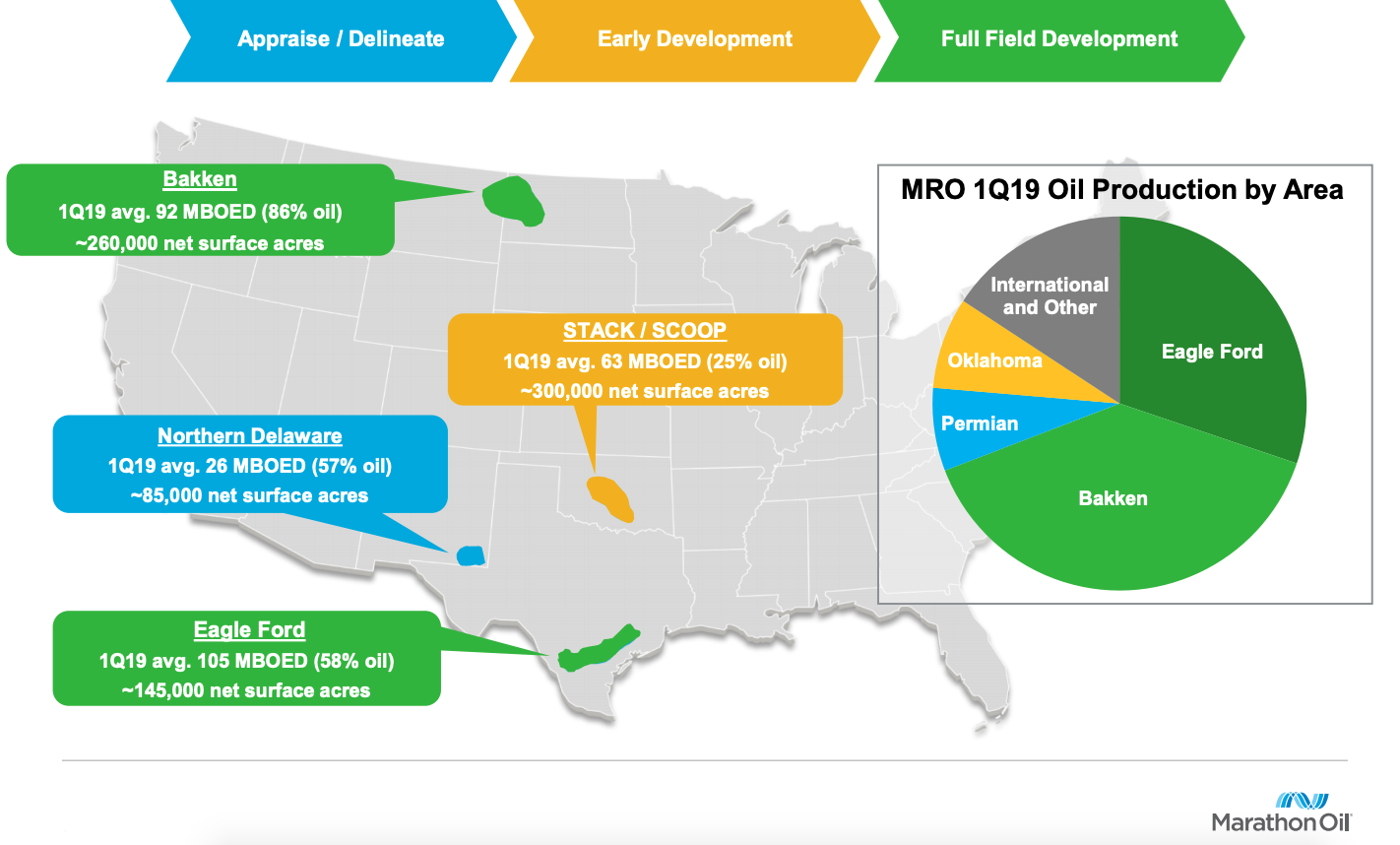

Over 95% of Marathon Oil’s development capex for 2019 is allocated to operations in U.S. shale including in the Bakken, Permian Basin, Oklahoma’s Stack and Scoop and the Eagle Ford. (Source: Hart Energy/Shutterstock.com)

Marathon Oil Corp. continues to narrow its focus on U.S. shale with the completion of its Kurdistan divestiture on May 31.

The transaction, which represented a complete country exit for the Houston-based company, included Marathon’s 15% participating interest in the Atrush Block in Kurdistan. Production from the assets averaged 2,400 net barrels of oil equivalent per day (boe/d), 100% oil, during the first quarter.

Appears In: Oil And Gas Investor July 2018 Cover Story - “E&P Processing Power”

Both the buyer of the assets and the terms of the transaction were not disclosed. Marathon had previously announced the sale during its second-quarter results last year. The company originally had expected to close the transaction by year-end 2018.

Marathon’s Kurdistan divestiture marks the 10th country exit for the company since 2013, including its most recent agreement with RockRose Energy Plc to sell its U.K. North Sea assets for $350 million.

RELATED: Marathon Oil Narrows Focus On US Shale With $450 Million Libya Exit

Following the closing of the U.K. North Sea sale, expected in the second half of the year, Marathon only remaining asset in its international portfolio will be in Equatorial Guinea.

For 2019, over 95% of Marathon’s development capex is allocated to operations in U.S. shale, including its positions in the Bakken, Permian Basin, Oklahoma’s Stack and Scoop and the Eagle Ford Shale.

(Source: Marathon Oil Corp. May 2019 Investor Presentation)

Production from Marathon’s U.S. shale assets in first-quarter 2019 averaged 286,000 net boe/d. International production averaged 92,000 boe/d (net) during the quarter.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Enbridge Advances Expansion of Permian’s Gray Oak Pipeline

2024-02-13 - In its fourth-quarter earnings call, Enbridge also said the Mainline pipeline system tolling agreement is awaiting regulatory approval from a Canadian regulatory agency.

Canadian Natural Resources Boosting Production in Oil Sands

2024-03-04 - Canadian Natural Resources will increase its quarterly dividend following record production volumes in the quarter.

Bobby Tudor on Capital Access and Oil, Gas Participation in the Energy Transition

2024-04-05 - Bobby Tudor, the founder and CEO of Artemis Energy Partners, says while public companies are generating cash, private equity firms in the upstream business are facing more difficulties raising new funds, in this Hart Energy Exclusive interview.

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

Kimmeridge Fast Forwards on SilverBow with Takeover Bid

2024-03-13 - Investment firm Kimmeridge Energy Management, which first asked for additional SilverBow Resources board seats, has followed up with a buyout offer. A deal would make a nearly 1 Bcfe/d Eagle Ford pureplay.