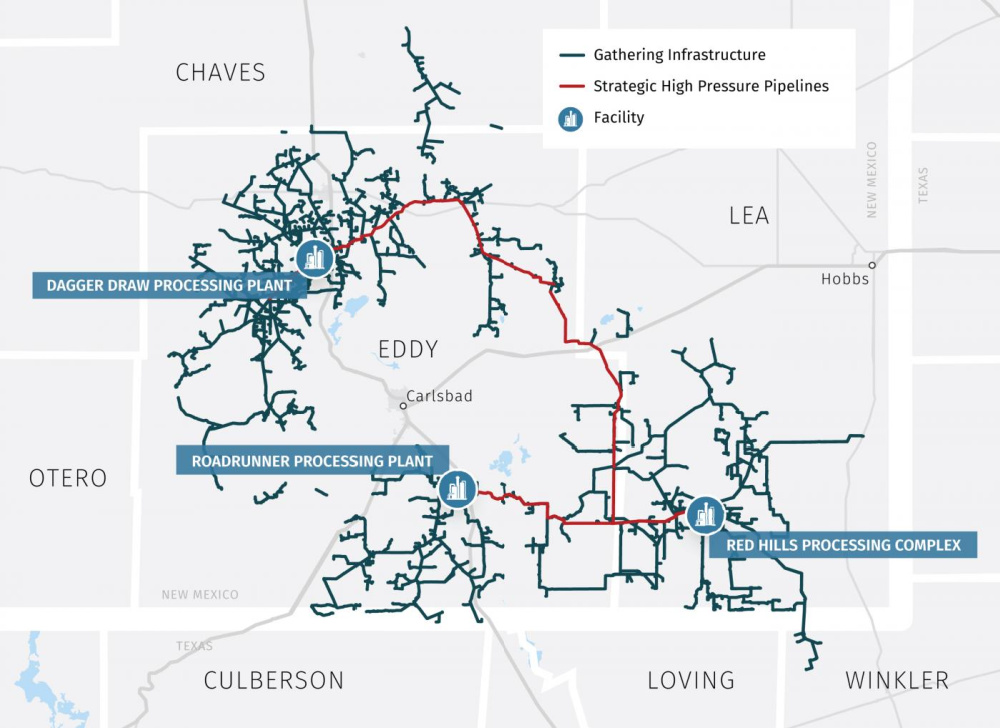

Lucid currently operates the largest private gas gathering and processing system in the northern Delaware Basin. (Source: Lucid Energy Group)

Lucid Energy Group laid out plans on Jan. 11 to develop the largest carbon capture and storage (CCS) project in the Permian Basin.

“Since our entry to the Delaware Basin five years ago, Lucid has targeted investments in large-scale gas treating assets, which empower our customers to develop highly economic drilling locations with associated off-spec gas,” Lucid CEO Mike Latchem commented in a company release.

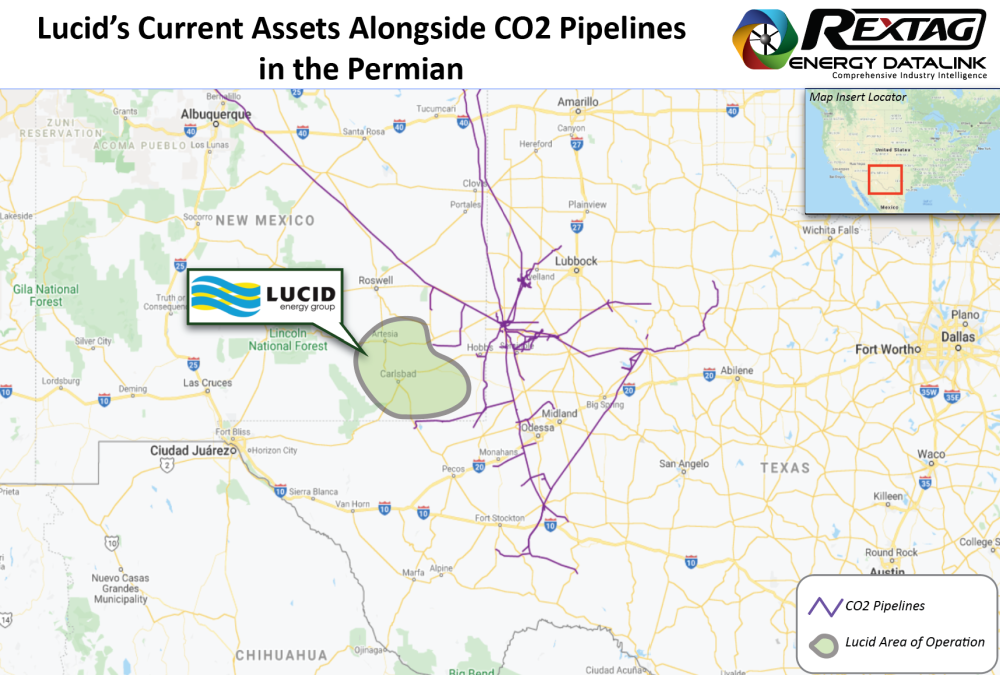

Based in Dallas, Lucid Energy Group is the largest privately held natural gas processor in the Permian Basin. The company’s gathering and processing system is centered in the northern Delaware Basin, strategically located in the two most active counties in the Lower 48—New Mexico’s Eddy and Lea counties.

Lucid’s strategy has proven beneficial for all stakeholders, according to Latchem who said Lucid currently removes more CO₂ from Permian Basin shale production than any other midstream operator.

“In turn, Lucid is the perfect candidate to develop the largest CCS project in the Permian Basin by simply modifying and expanding our existing operations,” he added.

On Jan. 11, Lucid said it received EPA approval for the company’s previously submitted monitoring, reporting and verification (MRV) plan for the sequestering of CO₂ from its Red Hills gas processing complex. Located in Lea County, Lucid’s Red Hills facility is the largest gas processing complex in the Permian Basin, according to the company website.

The MRV plan documents Lucid’s means of safely ensuring permanent CCS of CO₂ removed from the natural gas stream during the processing and treating of natural gas from its customers, which it said totals more than 50 producers in New Mexico and West Texas.

The company added that the plan is scalable and provides growth capacity. It is expected to also provide section 45Q tax credits for the sequestration and permanent storage of CO₂ in Lucid’s existing and permitted disposal wells.

Lucid is supported by growth capital commitments from Riverstone Holdings LLC and Goldman Sachs Asset Management. The company’s assets consist of more than 2,000 miles of pipeline in operation, approximately 150,000 of operating hp compression and 1.2 Bcf of natural gas processing capacity in operation or under construction, the Lucid website said.

Recommended Reading

Solaris to Acquire Mobile Energy Rentals, Rename to Solaris Energy Infrastructure

2024-07-10 - Following the closing of its deal to acquire Mobile Energy Rentals, Solaris Oilfield Infrastructure will also be rebranding to Solaris Energy Infrastructure to more closely represent its expanded solutions offerings.

Detechtion Acquires Software Solutions Company EZ Ops

2024-07-17 - The acquisition of EZ Ops plans to enhance Detechtion’s presence in field service management and complements its Fieldlink product, which serves producers and service companies in inspection and maintenance.

LLOG Exploration Acquires 41 Deepwater Gulf of Mexico Blocks

2024-07-17 - LLOG acquisition makes it the sole interest holder and operator in the 41 Gulf of Mexico blocks.

US Silica Investors OK Apollo’s $1.85B Take-private Deal

2024-07-16 - U.S. Silica stockholders approved a $1.85 billion all-cash deal with Apollo Global Management, a transaction that will take publicly traded proppant services provider private.

EQT Closes $5.45B Acquisition of Equitrans Midstream

2024-07-22 - In addition to integrating Equistrans’ midstream assets, EQT will focus on reducing the infrastructure company’s debt of between $7.6 billion and $8 billion. Including equity and debt, the deal is valued at roughly $13 billion.