(Source: Hart Energy, Shutterstock)

The market for LNG has, like the product itself, become liquid.

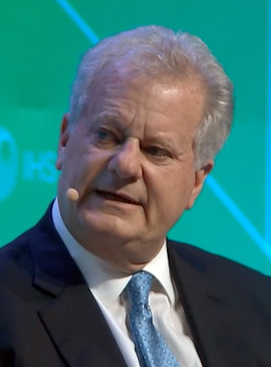

“On any given day now, there are 15 cargoes for sale, there are 400 cargoes full of LNG on the water,” said Charif Souki, chairman of Tellurian Inc. (NASDAQ: TELL), recently at CERAWeek by IHS Markit. “Any customer around the world that needs to get molecules can by simply paying a price for it.”

Long-term contracts, while a comfort to investors back when Souki-led Cheniere Energy Inc. (NYSE American: LNG) and others launched projects to convert massive LNG regasification import terminals on the Gulf Coast into liquefaction export terminals, will lose their dominance in the next five years as the product is increasingly recognized for what it is—a commodity.

This trend will accompany what McKinsey projects is a 20% increase in global natural gas demand between now and 2035. Gas is the only fossil fuel that will expand its share of total energy demand in that time period.

Replacing those contracts will be a system of commodity markets akin to crude oil, with prices fluctuating based on the supply and demand of a given day. During his time at Cheniere, Souki and his team introduced Henry Hub pricing for LNG. Within five years, Souki said, the Platts Japan Korea Marker (JKM) LNG Price Assessment will be the benchmark, with other prices calculated for individual cargoes in tankers on the water.

“There is a profound change going on globally,” said Robert Pender, co-CEO, co-chairman and founder of Venture Global LNG Inc., during a different panel discussion at the conference. “Every major [international oil company] and [national oil company] in the world buys gas today…. They are developing trading desks. To the extent that … North American gas is going to be 20% to 30% of the global energy mix, every single one of those trading offices needs, as a matter of portfolio diversification, to have a piece of Henry Hub in their portfolio.”

But there is another change developing in the contracts themselves, Pender said.

“As a function of that liquid market, we really don’t need destination clauses,” he said. “We can remove that from our contracts. Our customers can pick up and take it anywhere in the world. And they don’t need to consume it.”

Michael Smith, chairman, CEO and founder of Freeport LNG, agreed.

“We are going to break the back of the industry with destination restrictions,” he said.

At What Price?

So contracts are loosening up and a market-orient approach to pricing is taking hold. Assuming that economic growth will continue in China, which McKinsey expects to account for more demand growth than the next 10 demand-growth countries combined, the key differential among competitors in this global commodity market is price.

That provides a major advantage for U.S. LNG producers because the natural gas resource is relatively cheap.

“If you are getting into a commodity business, you don’t exactly know what the business model is going to end up being,” Souki said. “We always search for it. But you know if you are in the top quartile for cost, you will do very well on a long-term basis.”

Cheniere’s cost for its first five trains at Sabine Pass was in the neighborhood of $18 billion. The Souki-led project eschewed bidding, instead partnering with Baker Hughes, a GE company (NYSE: BHGE) and Bechtel Corp. from the start and working with those companies to reduce costs. The result of strategies like this, he said, is that only two LNG projects have come online on time and on budget—Cheniere’s Sabine Pass and Russian company PAO Novatek’s Yamal LNG—neither of which used a bidding process.

“Everything else has been horribly over budget and horribly behind schedule,” said Souki. “For us, it has been critical to be involved with GE and Bechtel from the beginning and work with them to constantly reduce our costs.”

Lorenzo Simonelli, chairman and CEO of Baker Hughes, said he viewed these partnerships as part of the necessary evolution of the LNG sector.

“[Partners are] going to become more the players in LNG and at the end, the best projects will win,” he said. “What we really like to do is take out inefficiencies and you can only do that with transparency and knowing what your role is.

“I think that’s what we need to do better as an industry because LNG is going to compete across other fuels as well,” he continued. “It is the ranked energy transition fuel. We miss an opportunity if we don’t make it competitive.”

Recommended Reading

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

President: Financial Debt for Mexico's Pemex Totaled $106.8B End of 2023

2024-02-21 - President Andres Manuel Lopez Obrador revealed the debt data in a chart from a presentation on Pemex at a government press conference.

From Restructuring to Reinvention, Weatherford Upbeat on Upcycle

2024-02-11 - Weatherford CEO Girish Saligram charts course for growth as the company looks to enter the third year of what appears to be a long upcycle.

TechnipFMC Eyes $30B in Subsea Orders by 2025

2024-02-23 - TechnipFMC is capitalizing on an industry shift in spending to offshore projects from land projects.

NOV's AI, Edge Offerings Find Traction—Despite Crowded Field

2024-02-02 - NOV’s CEO Clay Williams is bullish on the company’s digital future, highlighting value-driven adoption of tech by customers.