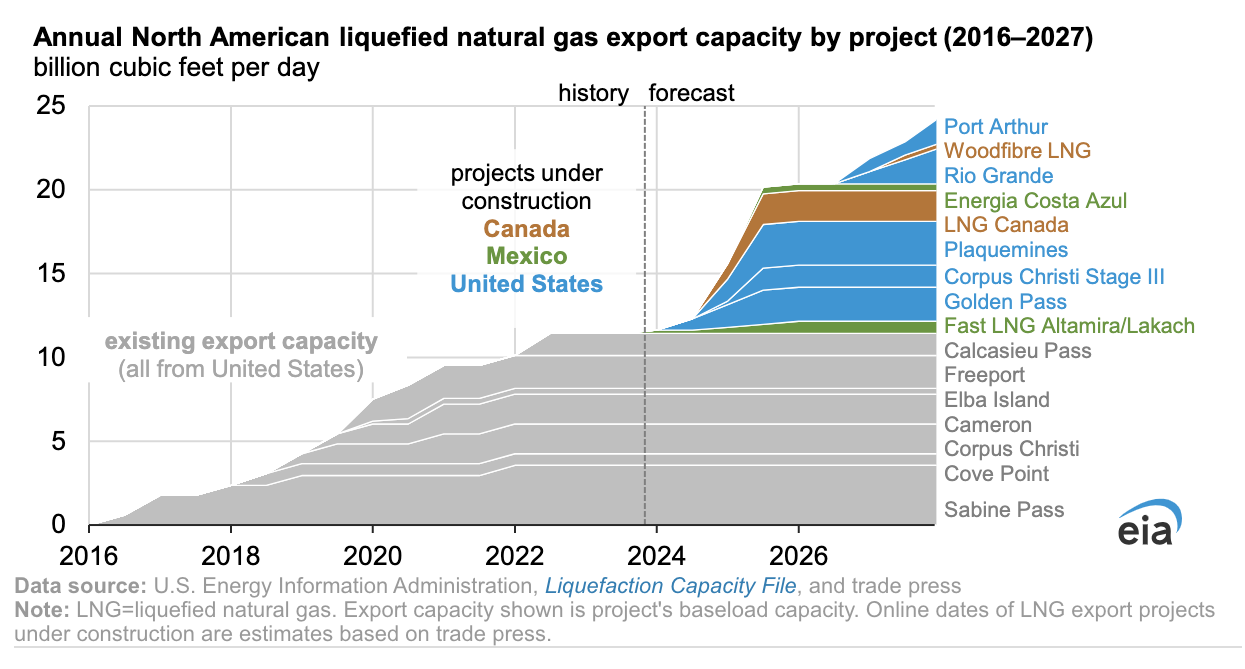

North American LNG export capacity is expected to grow by 113% from 11.4 Bcf/d to 24.3 Bcf/d by the end of 2027, according to the U.S. Energy Information Administration. (Source: Shutterstock.com)

North American LNG export capacity is expected to grow by 113%, reaching 24.3 Bcf/d by the end of 2027, according to the U.S. Energy Information Administration (EIA).

The rise will come as the U.S. adds to its existing capacity and its trading partners Mexico and Canada place their first LNG export facilities in operation, the EIA said in a Nov. 13 report.

In total, the EIA expects North American LNG export capacity to rise by 12.9 Bcf/d by year-end 2027 from a total of 10 new projects across the three countries. As a result, the U.S. will add 9.7 Bcf/d, Canada, 2.1 Bcf/d and Mexico, 1.1 Bcf/d. Currently, the LNG export capacity from the three countries is 11.4 Bcf/d—all attributable to the U.S.

Developments by country

In the U.S., five projects under construction would add 9.7 Bcf/d. They are Golden Pass, Plaquemines, Corpus Christi Stage III, Rio Grande and Port Arthur. Golden Pass and Plaquemines are expected to come online in 2024, according to the EIA, citing project developers.

In Canada, a pair of projects under construction in British Columbia will source gas from western Canada and will add 2.1 Bcf/d. LNG Canada will have a capacity of 1.8 Bcf/d and is slated to start up in 2025. Woodfibre LNG will have a capacity of 0.3 Bcf/d and is projected to begin operations in 2027. Additionally, 18 LNG export projects with a combined capacity of 29 Bcf/d have been authorized by the Canada Energy Regulator (CER).

In Mexico, three projects under construction would add 1.1 Bcf/d and include Fast LNG Altamira offshore and onshore and Fast LNG Lakach; both are located on Mexico's East Coast. Energia Costa Azul is on Mexico's West Coast.

Fast LNG Altamira will consist of three units with 0.18 Bcf/d capacity each or a combined 0.54 Bcf/d. The project will source U.S. gas delivered through the Sur de Texas-Tuxpan Pipeline. Offshore exports are expected to start in December 2023, while onshore exports would begin in 2025.

Fast LNG Lakach will consist of one unit with 0.18 Bcf/d capacity, located offshore Veracruz near the Lakach gas field. First exports are expected in 2026.

Energia Costa Azul LNG, located in Baja California on Mexico’s West Coast, will have an initial capacity of 0.4 Bcf/d (Phase 1) while a later facility (Phase 2) will have a capacity of 1.6 Bcf/d. The project will source U.S. gas.

Other projects on Mexico’s West Coast—with a combined export capacity of more than 2.7 Bcf/d—include Saguaro Energia LNG, Salina Cruz floating LNG and Vista Pacifico LNG. All the projects aim to source U.S. gas for processing and export from Mexico as LNG with cargoes destined for Asian markets. No final investment decision has been taken on any of the projects, the EIA said.

Recommended Reading

EOG Resources Wildcatting Veteran Billy Helms to Retire

2024-04-02 - Joining an EOG Resources predecessor in 1981, Helms is among the pre-1986-oil-bust generation who later found success in shale.

Battalion in Compliance with NYSE American after 2023 Meeting

2024-02-13 - Previously, Battalion Oil was not in compliance with the NYSE after failing to hold an annual meeting of stockholders during the fiscal year ending Dec. 31.

JMR Services, A-Plus P&A to Merge Companies

2024-03-05 - The combined organization will operate under JMR Services and aims to become the largest pure-play plug and abandonment company in the nation.

New Fortress Energy Sells Two Power Plants to Puerto Rico

2024-03-18 - New Fortress Energy sold two power plants to the Puerto Rico Electric Power Authority to provide cleaner and lower cost energy to the island.

Tellurian Executive Chairman ‘Encouraged’ by Progress

2024-03-18 - Tellurian announced new personnel assignments as the company continues to recover from a turbulent 2023.