The company paid its highest price yet to increase its position in Lea County, N.M., but still spent less per acre than average 2017 Permian transactions.

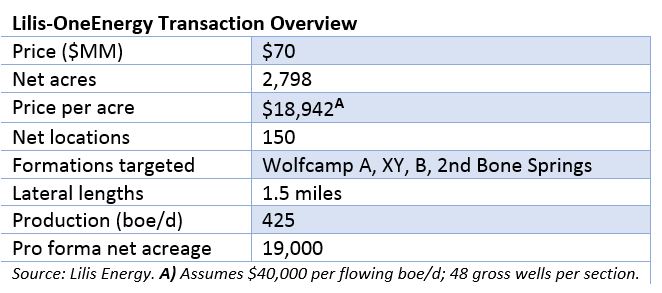

Lilis Energy Inc. (NYSE: LLEX) signed its most expensive deal yet in the Delaware Basin with an agreement to buy leasehold at about $18,940 per acre—a price still below neighboring transactions.

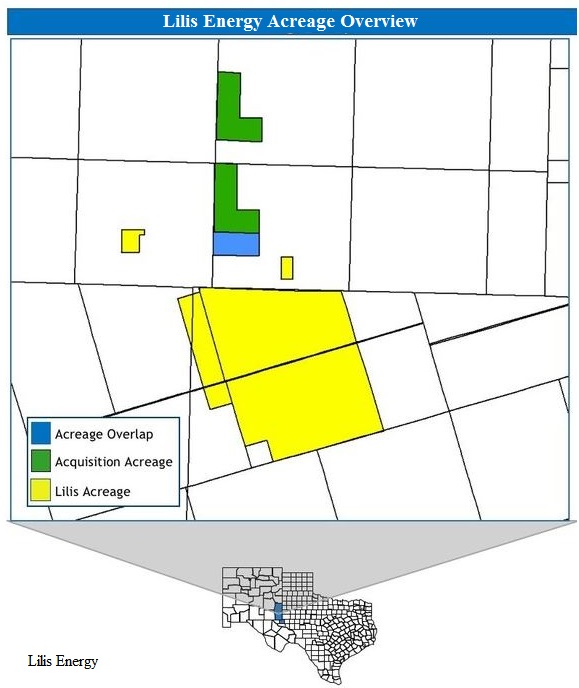

Lilis plans to purchase 2,798 net acres in Lea County, N.M., from OneEnergy Partners Operating LLC for $70 million in cash and stock. The acreage is 84% operated and overlaps or is contiguous with Lilis’ 16,200-net acre position.

The deal may also augur in a number of private company deals, including others involving OneEnergy, Seaport Global Securities analysts said in a Jan. 29 report.

The OneEnergy deal adds more than 150 net locations to Lilis’ inventory with potential targets in the Wolfcamp A, XY and B and the 2nd Bone Spring. The mostly contiguous acreage blocks allow for 7,920-ft laterals and adds about 72 gross locations, Lilis said. The acquisition includes average net production of 425 barrels of oil equivalent per day (boe/d).

The deal also puts Lilis in full control of two of its operated wells, the Wildhog BWX State Com 1H and the Prize Hog State Com 1H. After closing, it will have a 100% working interest in both wells.

In 2018, Lilis will run a two-rig program targeting 14 net wells with an exit rate of 7,500 boe/d, Seaport analysts said in a Jan. 31 report. Lilis set its 2018 drilling and completions capex at $100 million.

“At first glance, we’re big fans of the acquisition—the acreage overlaps Lilis’ existing acreage in southern Lea County, which is proving to be a zip code amongst the best in Permian, and at [less than] $20,000 per acre, we think the deal is both economically prudent and screens attractively versus recent Delaware deals done in the same neighborhood,” Seaport’s report said.

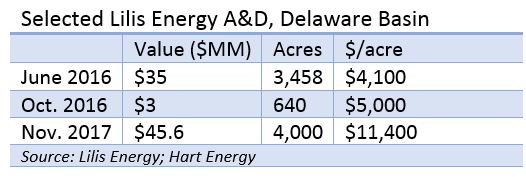

Lilis’ leasehold acquisitions have typically fallen far below market prices, which averaged roughly $23,000 per acre in 2017.

Since Lilis entered the Delaware Basin it has expanded acreage by 340% to 15,400 net acres late last year from about 3,500 net acres in June 2016.

Lilis’ most expensive deal during that period closed in November as it added 3,200 net acres in Winkler County, Texas, for $35.8 million—about $11,400 per undeveloped acre. In December, Oasis Petroleum Inc. (NYSE: OAS) agreed to buy 20,300 net Delaware Basin acres from Forge Energy LLC for about $38,200 per acre. The acreage purchased by Lilis and Oasis are in close proximity.

A Jan. 29 Seaport said a Delaware Basin executive expecting four or five to be “consummated within the next six weeks” and noted that OneEnergy’s Lea acreage was expected to be sold in two transactions.

Lilis intends to raise $100 million in a private share offering of new convertible preferred stock to Varde Partners Inc. About $40 million of the net proceeds will be used for the transaction. OneEnergy will get the balance of the purchase price $30 million of newly issued Lilis stock.

Ronald Ormand, Lilis’ executive chairman, said the company has reached a new milestone with a pro formal position nearing 20,000 net acres and production closing in on 5,000 boe/d.

“The transaction will allow us to enhance our overall position in the Northern Delaware Basin,” he said in a news release. “The acquired acreage represents a consolidated position with offset operators that have and continue to materially de-risk this position. As we look forward into 2018, we intend to focus on delineation of our acreage position. We intend to do this through development of our eastern acreage and drilling of additional benches.”

Lilis expects the acquisition to close in March with an effective date of Oct. 1, 2017.

SunTrust Robinson Humphrey acted as Lilis’ exclusive financial adviser for the transaction, and Thompson & Knight LLP and Bracewell LLP acted as counsel for Lilis.

Bracewell LLP also served as counsel to Lilis in connection with its preferred stock transaction. Kirkland & Ellis LLP acted as counsel to Varde.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

Keeping it Simple: Antero Stays on Profitable Course in 1Q

2024-04-26 - Bucking trend, Antero Resources posted a slight increase in natural gas production as other companies curtailed production.

Oil and Gas Chain Reaction: E&P M&A Begets OFS Consolidation

2024-04-26 - Record-breaking E&P consolidation is rippling into oilfield services, with much more M&A on the way.

Exxon Mobil, Chevron See Profits Fall in 1Q Earnings

2024-04-26 - Chevron and Exxon Mobil are feeling the pinch of weak energy prices, particularly natural gas, and fuels margins that have cooled in the last year.

Marathon Oil Declares 1Q Dividend

2024-04-26 - Marathon Oil’s first quarter 2024 dividend is payable on June 10.

Talos Energy Expands Leadership Team After $1.29B QuarterNorth Deal

2024-04-25 - Talos Energy President and CEO Tim Duncan said the company has expanded its leadership team as the company integrates its QuarterNorth Energy acquisition.