|

| Gas flares from the Songa Saturn drillship during a drillstem test of Mahogany-2, the appraisal well for Ghana’s Jubilee Field. Three successful wells have been drilled in Jubilee, and Odum-1, a wildcat on a separate structure, also encountered oil. |

I?t was 51 years ago that Kwame Nkrumah led Ghana to independence. For centuries, the former Gold Coast had poured a wealth of metals and men into the hands of Portuguese, Dutch, Scandinavian and finally British colonial powers. Last year, as Ghana marked its Golden Jubilee, it had an extra reason to celebrate: A small Dallas-based private exploration company had struck black gold in the nation’s heretofore unproductive offshore.

Kosmos Energy discovered a billion-barrel field, and it found this field in a petroleum province that was considered a backwater. Today, thanks to the lucrative find, Ghana is besieged with interest from international explorers. At latest report, an impressive total of 41 companies had applied for blocks in Ghana.

When Kosmos came calling three years previously, it was a far different scene.

International ambition

Business school professors always preach focus to their young students. That precept was certainly one Kosmos adhered to with ferocity. In 2003, the company was formed with the single-minded strategy of achieving success through exploration drilling and accelerated development of international oil and gas projects. More remarkable: It would engage in this high-risk part of the upstream business with private-equity capital.

| Brian Maxted, chief operation officer, Kosmos Energy, says the company is set up to find big oil fields, and West Africa is its prime focus. |  |

“We are an exploration company, and we’re set up to find big oil fields,” says Brian Maxted, chief operating officer and a Kosmos founding partner. “The Jubilee discovery is the successful execution of our business plan.”

Kosmos is an absolute explorer. The plays that it deliberately chooses to chase are subtle combination traps, as it contends that most structural prospects have already been located and tested, and those that remain are generally not first rank. Furthermore, the founders of Kosmos accepted that success in subtle traps could only be achieved if they were willing to lavish the non-standard ideas with time, money and attention.

“We focused specifically on Upper Cretaceous stratigraphic and structural traps in emerging basins,” says Maxted. Kosmos divided the basins of the world into four categories: frontier, emerging, growing and mature. It liked emerging areas, where drilling has established the presence of working source and reservoir rocks, but where commercial-size traps have never been found and an economic discovery never made.

“Emerging basins offer the right risk-reward balance. They are moderate- to high-risk, and if exploration is successful, there is significant potential to exploit.”

The company zeroed in on West Africa as its choice working area. “We believed in West Africa’s potential, and we had a very good understanding of its geology and petroleum systems,” he says. “We think most of the undiscovered oil in West Africa is in subtle, hard-to-find accumulations.”

The small cast at Kosmos came with deep experience in West Africa. Members of the company had successfully prospected offshore Equatorial Guinea for Triton Energy Corp., which was sold to Hess Corp. in 2000, and they retained excellent relationships in the region. Triton had an incredible exploration track record: It was responsible for huge finds in Colombia and Asia as well as offshore West Africa.

The highly skilled group had worked together for years, and all of its senior-level people were intimately involved in prospect generation. Because its management and technical staff were the same, the company could bypass the low-risk, simple, seismic-attribute-supported traps so favored in big firms.

Kosmos could go after the exotic.

Gathering prospects

Fortunately, the solid track record of the Kosmos principals allowed the new firm to attract muscular financial support from Warburg Pincus and Blackstone Capital Partners. The two heavyweight private-equity firms and senior management committed an aggregate $300 million to the venture.

After Kosmos coalesced into a company in 2003, it spent most of 2004 and 2005 building a portfolio of West African opportunities. It took acreage in emerging plays in Ghana, Benin and Cameroon. And, in a bow to convention, it mixed in a lower-risk opportunity in Nigeria and a frontier play in Morocco.

Ghana was the first project Kosmos picked up, and it fit its model nicely. The block was large—435,000 acres—and carried a long contract period and favorable commercial terms. “Ghana was very much in the mold of what we wanted,” says Greg Dunlevy, chief financial officer and a Kosmos co-founder. “That’s why we liked it so much and, perversely, why no one else liked it.”

Indeed, because the company attempts to unlock plays, basins and petroleum systems that it believes are underexplored, under-evaluated or generally misunderstood, its targets are typically unpopular with the rest of the industry. Kosmos usually finds itself working in areas that don’t interest other explorers. In 2004, it was the only company to enter Ghana, although several firms were in the process of leaving the country.

Kosmos liked West Africa’s transform margin, which runs from just west of Nigeria through Benin, Togo, Ghana, Côte d’Ivoire, Liberia and up to Senegal. Industry had adequately explored the transform margin during the past several decades. When Kosmos began its research, some 100 wells had been drilled in fewer than 200 meters of water, and most were unsuccessful. The lack of commercial finds had soured most explorers on the province.

The start-up company had a different perspective, however. It saw that 90% of the drilled wells had encountered shows of oil and gas, indicating the presence of a working hydrocarbon system.

The lack of commercial oil was due to two factors: a dearth of quality reservoirs and small sizes of the structural traps. Shoreward of the 200-meter water depth, most reservoirs were Lower Cretaceous or older, and rock characteristics were poor. Additionally, the transform margin was not capable of hosting large structures explorers want to see.

Still, the small fields were filled to their spill points. That meant the hydrocarbon system was very effective, but the trapping potential was limited. No source rock was preserved in the section in water depths of fewer than 200 meters, so that meant source rocks lay farther offshore. Kosmos moved into the deep waters to look for a major stratigraphic trap in younger, high-quality reservoirs in the Upper Cretaceous zones.

Only a handful of wells had been drilled across the entire province in deep water, but those tests almost exclusively recorded encouraging hydrocarbon shows. Drilled on structural ideas, the discoveries were subcommercial. The exception was Baobab, Canadian Natural Resources’ 200-million-barrel find in 1,480 meters of water offshore Côte d’Ivoire. Baobab was a wonderful find, but it occupied the largest structure that existed along the entire transform margin.

Kosmos was seeking something completely different.

“We went along the margin looking for the right recipe for success: areas with big sand deposits, mature source rock and sufficient structuring to create stratigraphic trapping and migration focus.”

Time to drill

Kosmos picked up a 100% interest in its West Cape Three Points Block in 2004. A neighboring block, 273,000-acre Deepwater Tano, was held by another company. After Kosmos shot seismic and matured its prospect idea, it brought Houston-based Anadarko Petroleum Corp. in as a 50% partner.

The explorers applied for the Deepwater Tano Block after it was turned back to the government; at the same time, Irish firm Tullow Oil Plc asked for the block. That company had a shallow-water play it was chasing in from Côte d’Ivoire, where it already had interests.

Ghana eventually awarded the block to Tullow. Kosmos and Anadarko soon made a deal with the new owner, and the trio cross-assigned interests between the two blocks. Kosmos ended up with 30.875% of West Cape Three Points and 18% of Deepwater Tano.

Anadarko had access to a deepwater rig, so it operated the first test, Mahogany-1, in 2007. It was drilled in 1,320 meters of water to a total depth of 4,200 meters. It encountered a gross hydrocarbon column of 270 meters, including 95 meters of net stacked pay.

Kosmos and partners had discovered an Upper Cretaceous turbidite stratigraphic trap, a brand new play in the Tano Basin. The discovery lay right between the two licenses, and extended onto each.

The second well was Hyedua-1, on Deepwater Tano. Tullow Oil drilled that test 5.3 kilometers from Mahogany-1 and encountered 108 meters of stacked reservoir sands and 41 meters of net pay. It was drilled in water depths of 1,530 meters and reached 4,002 meters total depth. The Hyedua was in communication with Mahogany-1, and confirmed 361 meters of hydrocarbon column in the new accumulation.

In honor of its 50 years of independence, Ghana’s government renamed the stupendous find Jubilee Field.

The most recent test was Mahogany-2. That appraisal, on West Cape Three Points, cut 193 meters of gross and 50 meters of net pay, again in turbidite sands. This well was in 1,080 meters of water, and reached total depth of 3,443 meters. A drillstem test over a 17-meter lower interval flowed at the rate of 5,200 barrels of oil and 5.5 million cubic feet of gas per day, and another test over an upper 23-meter interval flowed 4,448 barrels of oil and 5.1 million cubic feet of gas. It extended the known hydrocarbon column to 600 meters.

Based on well results to date, Kosmos’ partners have estimated that Jubilee contains between 500 million and 1.8 billion barrels of recoverable oil.

At present, Mahogany-2 is being completed and a development plan is being put together. The group expects the project will be sanctioned this year; first oil is planned in 2010. The scheme calls for subsea wells tied back into a floating production, storage and offloading (FPSO) vessel, and onshore power generation from the associated gas. Four rigs are under contract now, and development drilling and seismic acquisition will quickly begin.

“We’re going to be very busy,” says Maxted. “We will also explore and appraise the rest of the exploration portfolio along the trend in the two blocks.”

Going forward

Kosmos and partners made a separate discovery on West Cape Three Points. In early 2008, they drilled Odum-1 in 955 meters of water. The 3,386-meter well encountered a gross oil column of 60 meters, with 22 meters of net pay. It’s about 13 kilometers east of Jubilee.

“Odum is not as big as Jubilee, but it has confirmed our exploration concept and demonstrated the potential in the trend,” says Maxted. “We have opened up a new petroleum system, and we have multiple prospects with aggregate potential of several billion barrels of oil.”

In five years since inception, Kosmos has tested three of its five assets. Of five wells drilled to date, it’s had three commercial discoveries and another well that was a technical success. Compared with the industry average of 20% success in West Africa, Kosmos is currently at 60%. And, its average find is much larger than the typical 50-million-barrel field discovery.

Coming up, in 2009 and 2010, Kosmos plans to drill its Cameroon acreage. It holds interests in Kombe-N’sepe Block in the Douala Basin, and Ndian River Block in Rio del Rey Basin. At the same time, Kosmos is maturing its Moroccan Boujdour Block for drilling.

It has plenty of money to move ahead: This June, Blackstone Capital and Warburg Pincus committed an additional $500 million in equity funding to Kosmos. “We raised a substantial amount of equity, and we have strong endorsement support from the private-equity community,” says Dunlevy. “We are well funded and well financed to accelerate our activities, and we’ll do that expeditiously.”

The adventure continues.

“The great thing about Kosmos is that the technical group is part of the management, so we sell things to ourselves,” says Maxted. “It can be quite dangerous.”

Or cause for jubilation.

Recommended Reading

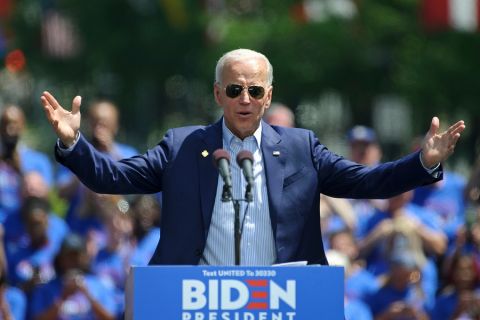

Pitts: Producers Ponder Ramifications of Biden’s LNG Strategy

2024-03-13 - While existing offtake agreements have been spared by the Biden administration's LNG permitting pause, the ramifications fall on supplying the Asian market post-2030, many analysts argue.

Hirs: LNG Plan is a Global Fail

2024-03-13 - Only by expanding U.S. LNG output can we provide the certainty that customers require to build new gas power plants, says Ed Hirs.

CERAWeek: Energy Secretary Defends LNG Pause Amid Industry Outcry

2024-03-18 - U.S. Energy Secretary Jennifer Granholm said she expects the review of LNG exports to be in the “rearview mirror” by next year.

Watson: Implications of LNG Pause

2024-03-07 - Critical questions remain for LNG on the heels of the Biden administration's pause on LNG export permits to non-Free Trade Agreement countries.

Belcher: Our Leaders Should Embrace, Not Vilify, Certified Natural Gas

2024-03-18 - Recognition gained through gas certification verified by third-party auditors has led natural gas producers and midstream companies to voluntarily comply and often exceed compliance with regulatory requirements, including the EPA methane rule.