Kinetik Holdings will buy Durango Permian infrastructure for $765 million, excluding contingency payments, and sell its interests in the Gulf Coast Express pipeline to AcrLight Capital Partners for $540 million. (Source: Shutterstock.com, Kinetik)

Kinetik Holdings announced a series of transactions on May 9, led by a cash-and-stock deal to acquire Durango Permian infrastructure for an aggregate $765 million. In a related move, Kinetik will divest its 16% equity interest in the Gulf Coast Express (GCX) pipeline to ArcLight Capital Partners for $540 million cash.

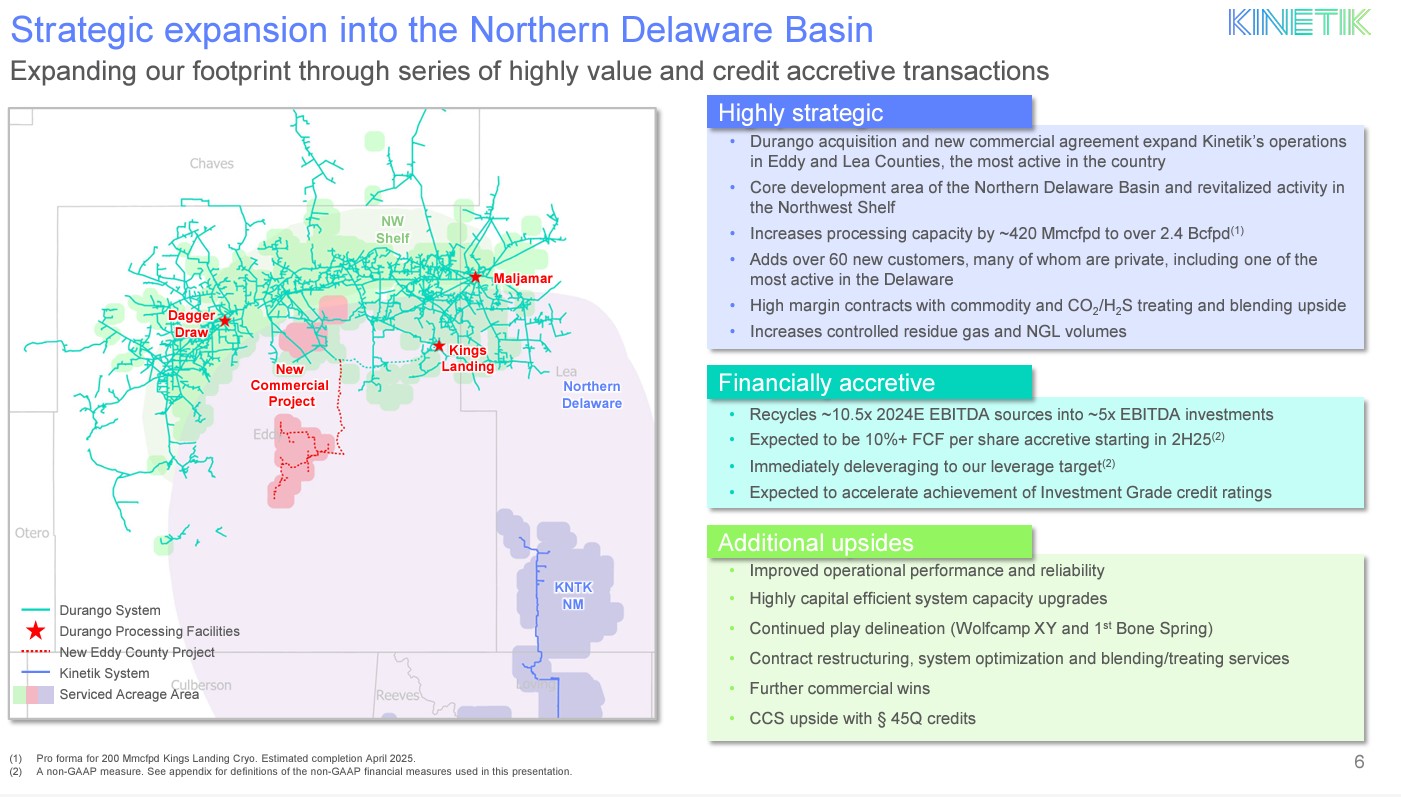

The Durango acquisition—along with a new, long-term gathering and processing contract, represents approximately $1 billion of new investment for the company, said Jamie Welch, Kinetik’s president and CEO.

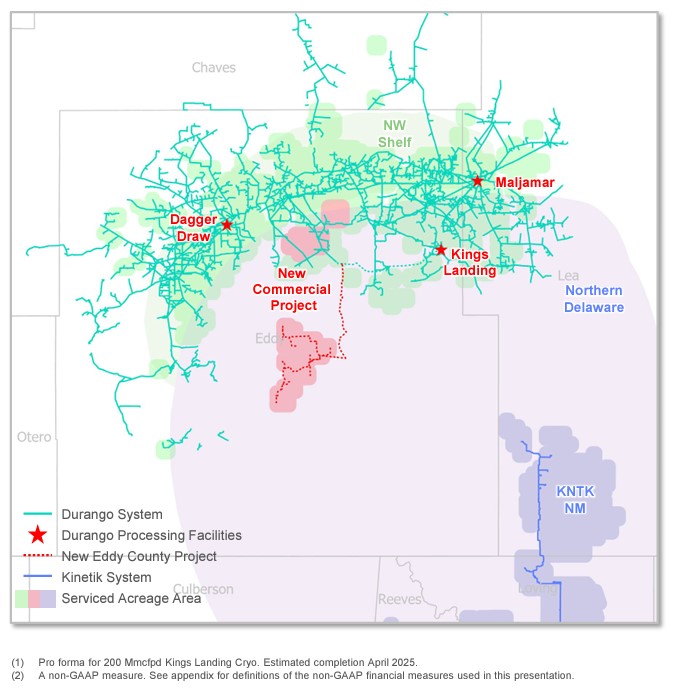

“Following the Durango acquisition and the expected completion of Kings Landing, Kinetik will own and operate over 2.4 billion cubic feet per day of processing capacity, entirely in the Delaware Basin, and approximately 4,600 miles of pipelines across eight counties,” Welch said.

The Durango deal will expand the company’s presence as a pure-play midstream provider in the northern Delaware Basin. Kinetik will pay $315 million in cash and 11.5 million shares of Class C common stock, some of it deferred until July 2025, to seller Morgan Stanley Energy Partners.

Durango’s assets in Eddy, Lea and Chaves counties, New Mexico, include approximately 2,400 miles of gas gathering pipelines and approximately 220 MMcf/d of processing capacity. The Durango assets also bring aboard more than 60 new customers, many private operators, Kinetik said.

Kinetik’s Durango transaction includes a $75 million contingent payment tied to the capital cost for the Kings Landing complex, which is currently under construction. Kings Landing is a new 200 MMcf/d greenfield processing complex in Eddy County, which is expected to be completed in April 2025. The complex will increase Durango’s processing capacity to 420 MMcf/d.

To offset the purchase price, Kinetik is selling its interests in GCX, the company said in a May 9 press release. The purchase price is comprised of $510 million in upfront cash and an additional $30 million deferred cash payment due upon a final investment decision (FID) on a capacity expansion project.

Additionally, Kinetik announced a 15-year agreement to provide gathering and processing services in Eddy County for approximately $200 million. Kinetik will construct low- and high-pressure gathering infrastructure, which is expected to be approximately $200 million of aggregate capital through 2026.

Kinetik anticipates an approximately 5x run-rate EBITDA investment multiple. The contract begins at the end of 2024, starting with gathering services. It extends to processing services starting in the second quarter of 2025.

“Following on from our tremendous success with our recent Lea County, New Mexico system expansion, we are delighted to now announce this series of strategic transactions that further our expansion into New Mexico and significantly increase our footprint across the Northern Delaware Basin,” Welch said.

“Proceeds from the GCX sale and the aggregate issuance of $450 million of Kinetik Class C shares, in two installments, will be reinvested into projects at a mid-single digit EBITDA multiple,” Welch said. “These actions efficiently and accretively recycle cash proceeds from a non-operated asset into highly strategic, operated assets.”

The transactions are expected to be over 10% accretive to free cash flow per share starting in the second half of 2025, with the level of accretion increasing thereafter, which coincides with an expected acceleration of capital returns to shareholders.

The Durango acquisition and new Eddy County agreement also offer full control of plant products, including more than 350 MMcf/d of residue gas and more than 60,000 bbl/d of natural gas liquids. The volumes will provide “significant additional upside value via system optimization, modifications to existing commercial contracts and integration with our pipeline transportation segment,” Welch said.

Recommended Reading

Texas Earthquake Could Further Restrict Oil Companies' Saltwater Disposal Options

2024-04-12 - The quake was the largest yet in the Stanton Seismic Response Area in the Permian Basin, where regulators were already monitoring seismic activity linked to disposal of saltwater, a natural byproduct of oil and gas production.

Pemex GoM Oil Platform Blaze Leaves One Dead, 13 Injured

2024-04-08 - A Coter contract worker died from a fire that broke out at Pemex’s Akal-B platform this weekend that also left several others in serious condition, the company said.

Diamondback May Go Nuclear to Power Permian Basin Ops

2024-04-08 - Oklo Inc., a California fission power plant developer, on April 8 said it signed a letter of intent to collaborate with Diamondback Energy on implementation of nuclear energy for drilling operations in the Permian Basin.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.