High demand has prompted Kinder Morgan and Williams to as FERC for increased natural gas shipments to the western U.S. (Source: Shutterstock.com)

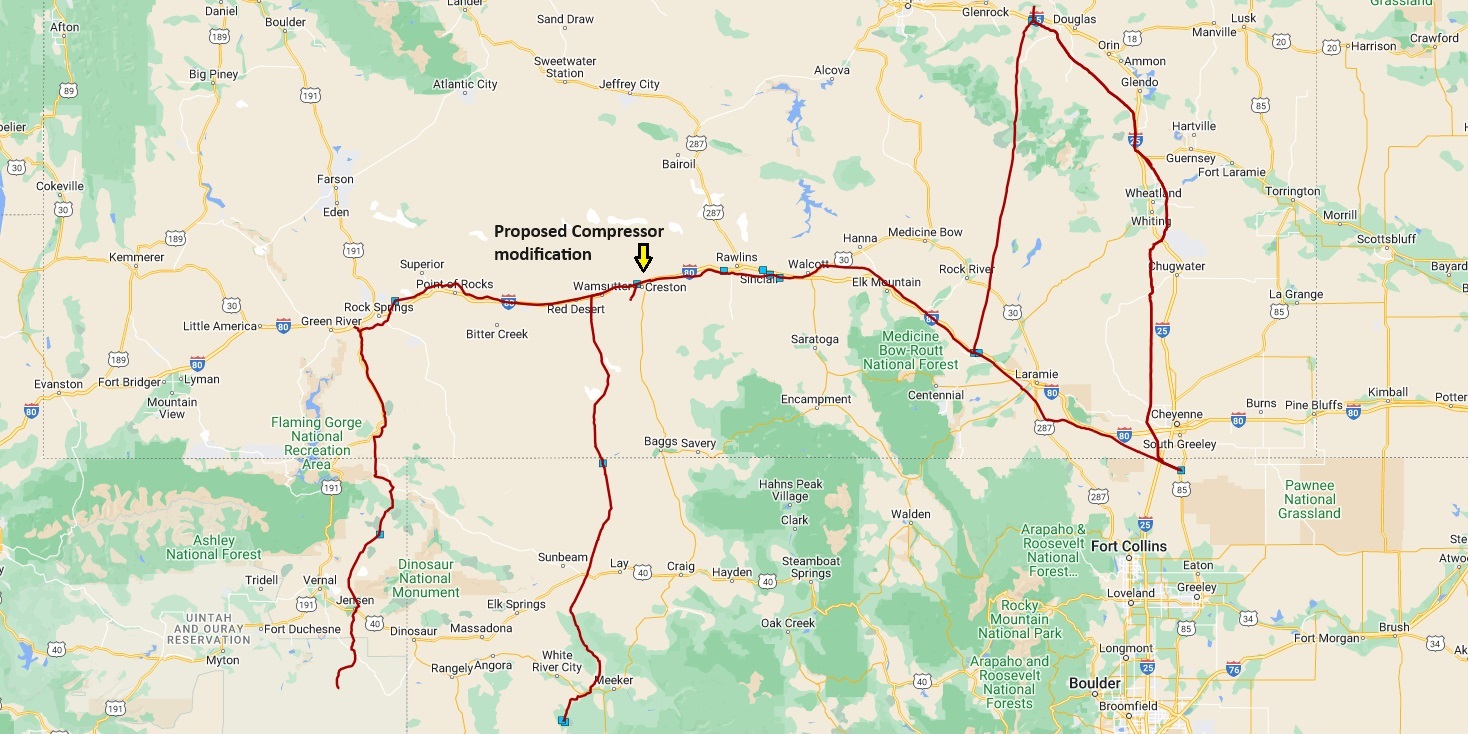

Wyoming Interstate (WIC) has asked for a 180 MMcf/d capacity expansion to take more natural gas from Eastern Colorado across the Continental Divide to a junction near a compression station in Wamsutter, Wyoming.

WIC, owned by Kinder Morgan, proposed to start construction on the capacity expansion in June 2024 and start service in May 2025, according to a November filing with the Federal Energy Regulatory Commission.

WIC’s project would alter the configuration of the Wamsutter compression station, which connects to the Piceance lateral network to the west. The company held an open season on the proposal in June of 2023 and Citadel Energy Marketing was awarded all 180 MMcf/d of capacity.

The move signals that some midstream companies are seeking ways to deliver more natural gas to a western U.S. market that will face supply shortages well into the late 2020s, according to East Daley Analytics (EDA).

The expansion proposal follows an earlier project announcement from Williams Cos. for an expansion capacity of the MountainWest Overthrust Pipeline, located primarily in Southern Wyoming. The project would add 325 MMcf/d of capacity. Williams plans to begin service on the project in December 2026.

“Western Rockies production has fallen about 2 Bcf/d since 2018,” said Justin Carlson, EDA senior energy expert. “So that is 2 Bcf/d out of the Western Rockies that can no longer serve California, Nevada, Oregon, those markets that need it.”

The West Coast has faced a shortfall of natural gas supply since then, leading to a widespread divergence of prices depending on which side of the Rocky Mountains the buyer happens to be on, according to East Daley.

The decline in production previously led to record-setting price increases in the West last winter. In August 2022, an explosion and breakdown on Kinder Morgan’s El Paso Line 2000 led to a 640 MMcf/d decrease in supply from the Permian Basin to Southern California.

The pipeline capacity over the Eastern Rockies was unable to make up for the shortfall, and after cold weather set in, prices at the Southern California regional gas hub hit $57.07/ MMbtu on Dec. 21, 2022, at a time when the national Henry Hub price was $6.13/MMbtu, according to U.S. Energy Information Administration (EIA) records.

The regional hubs that serve the West Coast continually have higher spot prices than those serving the rest of the country. On Dec. 19, the EIA showed that the price of gas at the Southern California hub was $3.04/MMbtu and $3.97/MMbtu at the Northern California hub. No other regional hub was above $2.90.

Carlson said California can expect shortages until the latter half of the 2020s. Until 2027, high demand and tight supplies will combine to create a volatile market. Last month, KMI sent a record monthly daily 2.4 Bcf/d of natural gas westward out of the Permian on the El Paso natural gas system. East Daley speculated the amount of gas, up 10% from the previous four-month average, was sent to keep prices down at the Southern California hub.

Carlson said he does not expect the West Coast supply problems to be permanent. Post 2027, increased production west of the Rockies, pipeline capacity increases and declining demand in California should stabilize the market.

Recommended Reading

Exxon Mobil Green-lights $12.7B Whiptail Project Offshore Guyana

2024-04-12 - Exxon Mobil’s sixth development in the Stabroek Block will add 250,000 bbl/d capacity when it starts production in 2027.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

Exxon Ups Mammoth Offshore Guyana Production by Another 100,000 bbl/d

2024-04-15 - Exxon Mobil, which took a final investment decision on its Whiptail development on April 12, now estimates its six offshore Guyana projects will average gross production of 1.3 MMbbl/d by 2027.

E&P Highlights: Feb. 16, 2024

2024-02-19 - From the mobile offshore production unit arriving at the Nong Yao Field offshore Thailand to approval for the Castorone vessel to resume operations, below is a compilation of the latest headlines in the E&P space.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.