(Source: Elnur/Shutterstock.com)

The digital revolution has fundamentally reshaped the energy industry. At its onset, the slow-to-adapt industry feared a potential disruption and a hefty financial undertaking. Those fears are subsiding as more organizations realize the importance of adopting and investing in a digital future, maturing from a hesitant culture to the forefront of emergent technology including the Internet of Things (IoT), artificial intelligence (AI) and software as a service (SaaS).

“Companies and organizations that don’t actively budget for and proactively invest in digital above and beyond their normal course of business are the ones that are falling behind the furthest,” said Kentaro Kawamori, venture partner at Rice Investment Group and former chief digital officer at Chesapeake Energy Corp., in an exclusive interview with Hart Energy. “Transformation by definition requires an active intent to improve and change the posture from the current state to a future state, and without investing that is very hard, if not impossible.”

A digital guide

Energy companies face a unique set of challenges as part of the digital journey. Aside from fluctuating prices, the culture surrounding data ownership, along with scaling those digital programs, strains the progress of the transformation, according to industry experts.

“We have a culture that’s built around intellectual property ownership and that’s a sound approach when it relates to products, but to execute on an effective road map for digital you need to think about how you enable and collaborate with others,” Moray Laing, Halliburton’s director of digital solutions for the company’s Drilling & Evaluation division, told Hart Energy. “Data in oil and gas contain a wealth of inherit value to the owner of the asset, which they rightfully want to protect. So we have to find ways to effectively open up access to the data without risking the value that’s stored within it, and that’s been an ongoing challenge.”

Kawamori noted that the industry has established a collaborative environment through joint ventures for things like capital investments and operating agreements, but it stops at the mention of data and technology.

“When it comes to sharing data and technology everyone still thinks that they have this secret sauce that is sitting untapped in their datasets, so there is a risk with giving away what is proprietary to them,” he said. “There is still a long ways to go with collaborating from a technology perspective, but when you bring multiple parties, perspectives and the diversity of thought to the table, then certainly those initiatives will be more successful. We’re not there yet, but I do see it getting progressively better.”

Marie-Hélène Ben Samoun, managing director and partner of topic lead for digital transformation in oil and gas for North America at Boston Consulting Group, pointed out in an interview with Hart Energy that many of the use cases applied across a corporation fail to have impact at scale.

“It’s important to highlight positive results from a particular field, equipment or platform, but what you want to see is people change the way they are working by leveraging the digital technologies to do so,” she said. “Every time you do a use case, it’s not enough to have the technology working or an algorithm, because it only gives you 10% of the success, and your data and digital platform is another 20%. [But] 70% of the impact depends on your change management.”

The fix, Samoun advised, is to define a process that is critical to improve on within the organization’s business strategy (e.g., profit and loss). Then take the process end to end to identify all the use cases along the way because “you’ll have a chance at the end to rethink your process, digitize it and have a more focused change management effort. Then you will have the incentive to make it work all across,” she said.

According to Samoun, a common mistake that companies make is scoping out existing technology and seeing how it can apply to the oil and gas world instead of pinpointing where it can assist in achieving the company’s goals.

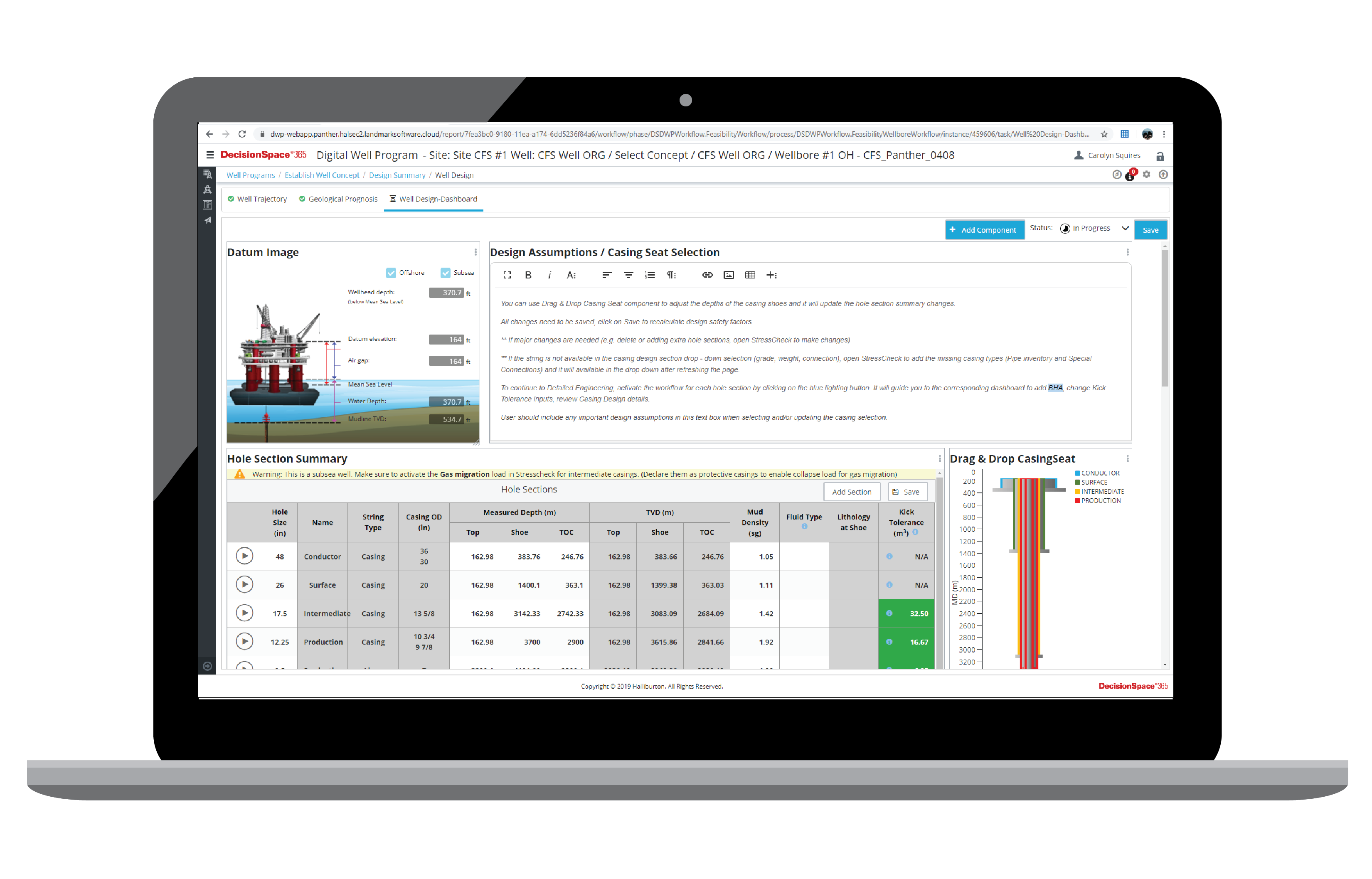

Halliburton is building on an open architecture to solve business problems through co-innovation. The development included the addition of DecisionSpace 365—numerous integrated cloud-native applications that leverage advances in digital technology to help operators reduce exploration risks, improve reservoir characterization and boost drilling efficiency—just last year.

“Digital technology is fundamentally about interconnectedness and having an agile velocity of development,” Laing said. “For Halliburton, digital enables our ability to collaborate and engineer solutions to maximize our customer’s asset value, and it really infuses every aspect of our business.”

‘Meaningful’ investments

Oil crises increase the appetite of investment as companies seek a competitive edge. There is no longer an option to not embrace digital technologies or technologies that are essential for effective and efficient operations.

Kawamori said a portion of a company’s budget dedicated to the development of technology should be “meaningful enough” for the company to be able to take advantage of new technologies and systems “while giving people the tools and capabilities they need to be more productive over the short term and long term.”

“I think those companies that have not embraced technology, and as a result lowered their operating costs and their cost per barrel extracted, are probably the ones that have taken that position [against investing in technology]. If those companies and people don’t believe that technology can help them operate cheaper and more efficiently, then those are the companies that won’t be around much longer,” he added.

RELATED:

2020 Automation & Data Technology Showcase

A major area of investment in the oil and gas space, Kawamori said, combines disciplines like data management, utilization, architecture, transformation and other unexplored applications of data.

“The energy industry still runs incredibly inefficiently, and using data to make informed decisions of how to operate more efficiently has been and continues to be the biggest opportunity in this space,” he said. “If you look at the history of the most successful technology companies and use cases, almost all of them were bred out of situations with a lack or restrictive amount of resources. When you combine the creativity of people under pressure and limited resource, and you put technology on top of that, you’re absolutely going to get innovative solutions out of that every single time.”

Digital technologies like Big Data, blockchain and AI have long promised to transform the digital landscape in the industry, and companies are now beginning to understand the magnitude of the opportunity, according to Laing.

“We are reaching a level of maturity in the industry where we really understand now how to get value from these tools and how to build on that value by operationalizing it at scale,” he said.

Forward thinking

Though cloud-computing services stagger behind in the conversation, early adopters are cashing in on the agility of applications like IoT and SaaS.

Last year Halliburton implemented Well Construction 4.0, lead by Laing, which adapts the concepts of Industry 4.0 (IoT, cloud computing and Big Data) to obtain digital twin technology. According to Halliburton, the software minimizes cycle times and drilling costs while maximizing reservoir contact, drilling performance, rig use and equipment utilization.

Laing said the digital approach provides a seamless integration between operators, drilling contractors and oilfield service companies.

“An industry that traditionally didn’t integrate beyond data aggregation is realizing there is significant value by also connecting our systems, processes and expertise,” Laing said. “In addition to driving down costs through digitally enabled synergies, like new well site manning models, we‘re also finding ways to improve the value of our customers’ assets, such that it is a win for everybody.”

Kawamori’s newly formed intelligent SaaS platform, Persefoni, helps organizations measure and reduce their carbon footprint. Per Kawamori, the CEO and co-founder, the platform turns consumption and emission data into action, enabling progress toward a lower organizational footprint.

“[It is a] 100% sustainability-focused software, so I think there is huge opportunity for small businesses [in the energy transition] because there aren’t enough entrepreneurs out there solving these problems around carbon reduction and sustainability. I think companies, especially in energy, are not going to have any other choice other than radically improving their sustainability especially if regulators force them to,” he added.

Laing noted that as SaaS and cloud have become more agile, the days of monolithic software applications installed in the industry are long gone. Cloud access, he added, offers all the latest optimizations and capabilities with the same technology that once required running an additional application.

“Instead of having major updates to capabilities on a monthly basis, we’re able to do that dynamically on the fly so that it is a continuous implementation and deployment process,” he said.

Links within the supply chain process also are seeing incremental change to reimagine the transmission of oil and gas from extraction to the end consumer. The deployment of new tech at each level can now target both discrete processes in addition to the overall goal of the system.

“Supply chain processes are about to be revolutionized—[and] not supply chain in a traditional sense but rather an interconnected supply chain of equipment, people, services, opportunities and removing the gap between planning and execution so that it becomes a seamless activity of continuous improvement,” Laing said.

There is significant waste in the process that could be removed if the industry thought about supply chain more holistically, he said. Shifting the traditional supply chain into an integrated value chain would achieve an important part of the digital transformation: connecting and communicating through a shared data ecosystem.

“The key to digital is not to get hung up on the technology because you’re not getting value from it; you get value from the solutions that you are able to build on and incorporate on top of that technology. Digital is a capability that creates an endless stream of opportunities to improve on our operating model as well as the efficiencies and value generated from it,” Laing said. “We’re seeing an exponential growth in capabilities built on top of those platforms that we can’t even possibly imagine the solutions that we will be considering in five years’ time, which is why velocity is so important to your digital strategy. You have to be able to execute quickly, fail fast and succeed quickly so you can move and continuously innovate.”

Companies that proactively develop a digital strategy are well positioned to not only survive but flourish along the digital evolution happening in the industry. A critical starting point is ramping up investment in IoT, AI, SaaS and other innovative tools. The sooner the adoption, the quicker companies can see improvement in productivity, increased efficiencies and cost savings. While adapting, it is equally important to avoid succumbing to traditional orthodoxies that plague change, considering the very foundation of the digital transformation relies on it.

Recommended Reading

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

2024-04-25 - Henry Hub blues: CNX Resources and other Appalachia producers are slashing production and deferring well completions as natural gas spot prices hover near record lows.

Chevron’s Tengiz Oil Field Operations Start Up in Kazakhstan

2024-04-25 - The final phase of Chevron’s project will produce about 260,000 bbl/d.

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.