It's no secret that the level of operator activity in the Eagle Ford decreased substantially over the course of the supply glut from 2014 to 2016. In the process, many Eagle Ford operators with diversified play portfolios have been high-grading their assets and focusing resources to their core, top-tier locations elsewhere.

It's no secret that the level of operator activity in the Eagle Ford decreased substantially over the course of the supply glut from 2014 to 2016. In the process, many Eagle Ford operators with diversified play portfolios have been high-grading their assets and focusing resources to their core, top-tier locations elsewhere.

Enter EXCO Resources Inc. After receiving notice from the New York Stock Exchange in mid-January that its shares were trading below the minimum threshold to remain listed, EXCO has expressed interest to divest all properties located in Dimmit, Frio and Zavala counties, Texas, (roughly 50,860 net acres).

Additional motivation behind selling Eagle Ford assets is based on the company’s stance on maintaining its higher producing assets in the Haynesville formation with the liquidity created from the sale.

Looking at some of the specs of EXCO’s core assets within the Haynesville play, it becomes more obvious as to why the operator is looking to bolster its position in the region and supply extra capital from its impending divestiture of the less impressive Eagle Ford holdings. The company currently has 96,300 net acres, 87% held by production (HBP), in its East Texas/North Louisiana operation, with average daily production of 209 million cubic feet equivalent per day (MMcfe/d) and proved reserves totaling 1,110 billion cubic feet equivalent (Bcfe). By way of comparison, the South Texas assets encompass 49,300 net acres (95% HBP) with average daily production of 27 MMcfe/d and proved reserves estimated at 155 Bcfe. Seeing that the Haynesville is currently producing almost 8x the output of EXCO’S Eagle Ford assets, with reserves potential being approximately 7x greater in the Haynesville, the operator clearly has some justification in the decision to shore up its East Texas/North Louisiana acreage.

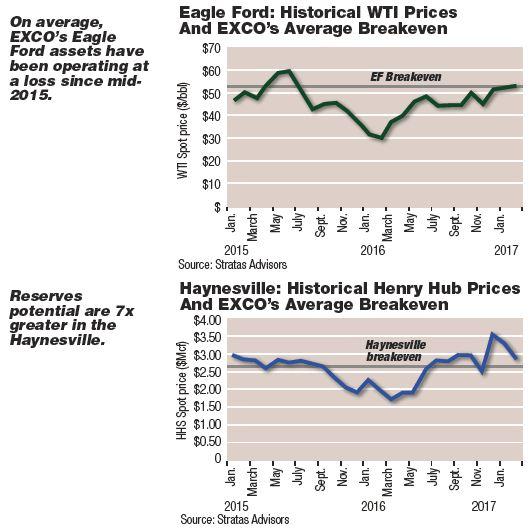

EXCO’s Haynesville operations have shown significant upside potential since mid-2016, while its Eagle Ford assets on average have been operating at a loss since mid-2015. With commodity prices continuously parrying with increased U.S. output and the lack of stabilization above $50 oil, tied in with lackluster potential from its Eagle Ford position, it seems that the company is making the smart play in high-grading to the Haynesville.

Even though the Eagle Ford position has proven non-ideal for the operator’s long-term portfolio, there is potential upside for those operators with contiguous acreage in Dimmit, Zavala and Frio counties. The 50,860-acre leasehold reportedly holds more than 300 gross drilling locations in the Eagle Ford—more than 50% of which are currently undeveloped, and smaller proven inventories in the adjacent Buda, Austin Chalk and Georgetown formations. The position is predominantly located in the oil window of the play with more than 90% of production currently being oil and almost completely HBP. The right operator making the purchase, given the structure and layout of their leasehold, has the possibility to achieve lateral lengths upward of 10,000 feet in certain portions of the area.

Given that EXCO needs liquidity in order to strengthen its premier Haynesville assets, the operator simply does not have the resources to build up its Eagle Ford position that is mostly undeveloped at this point in time. By completing this sale, EXCO mitigates the risk of stretching its portfolio too thin, generates cash flow for its top-tier locations in the Haynesville and opens the door for Eagle Ford operators heavily invested in the counties of interest to bolt on some valuable acreage in the process.

Recommended Reading

Kimmeridge Fast Forwards on SilverBow with Takeover Bid

2024-03-13 - Investment firm Kimmeridge Energy Management, which first asked for additional SilverBow Resources board seats, has followed up with a buyout offer. A deal would make a nearly 1 Bcfe/d Eagle Ford pureplay.

Laredo Oil Subsidiary, Erehwon Enter Into Drilling Agreement with Texakoma

2024-03-14 - The agreement with Lustre Oil and Erehwon Oil & Gas would allow Texakoma to participate in the development of 7,375 net acres of mineral rights in Valley County, Montana.

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-21 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

Oil and Gas Chain Reaction: E&P M&A Begets OFS Consolidation

2024-04-26 - Record-breaking E&P consolidation is rippling into oilfield services, with much more M&A on the way.

From Restructuring to Reinvention, Weatherford Upbeat on Upcycle

2024-02-11 - Weatherford CEO Girish Saligram charts course for growth as the company looks to enter the third year of what appears to be a long upcycle.