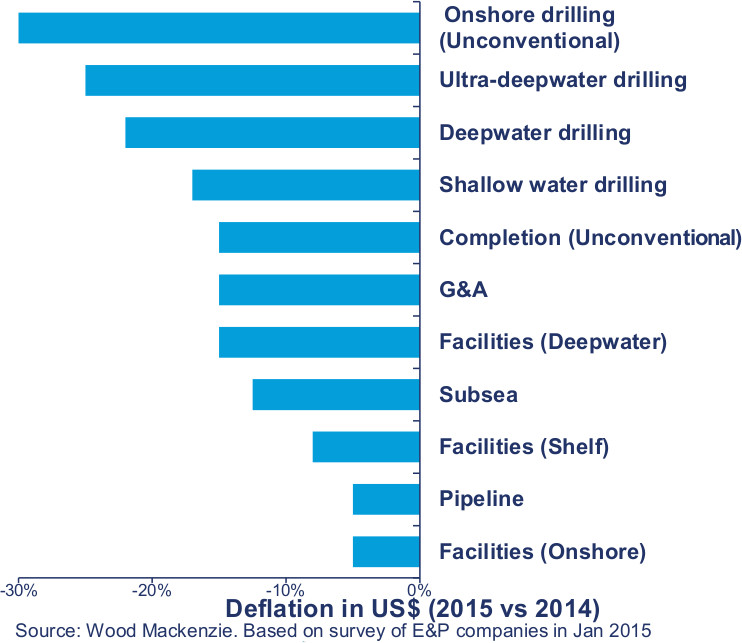

According to a report by Wood Mackenzie (WoodMac) into the impact of cost deflation on the upstream oil and gas sector, the industry is looking to achieve cost reductions of up to 30%. But that alone will not be enough, it said, as just putting the squeeze on the service sector and supply chain costs will achieve only about 10% to 15% on average.

The need to find a combined solution that works is clearly vital; the analyst estimated that a huge $1.5 trillion of investment in future new presanction and tight oil projects worldwide remains locked away, simply uneconomic at an oil price of about $50/bbl.

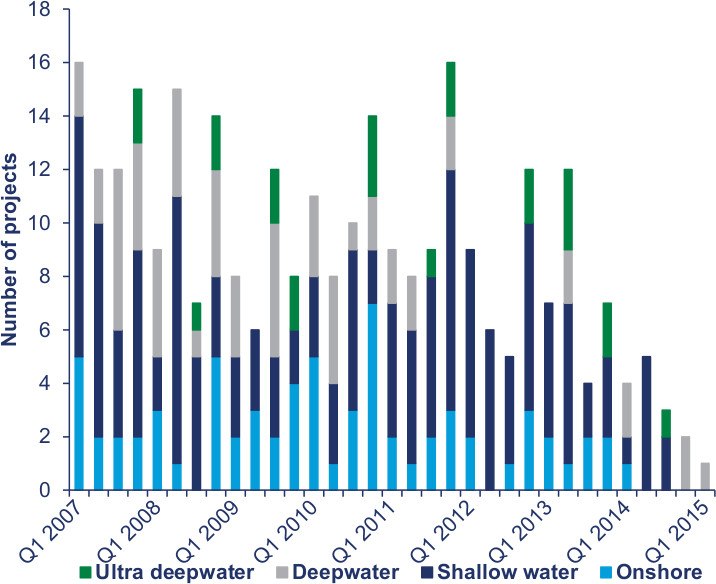

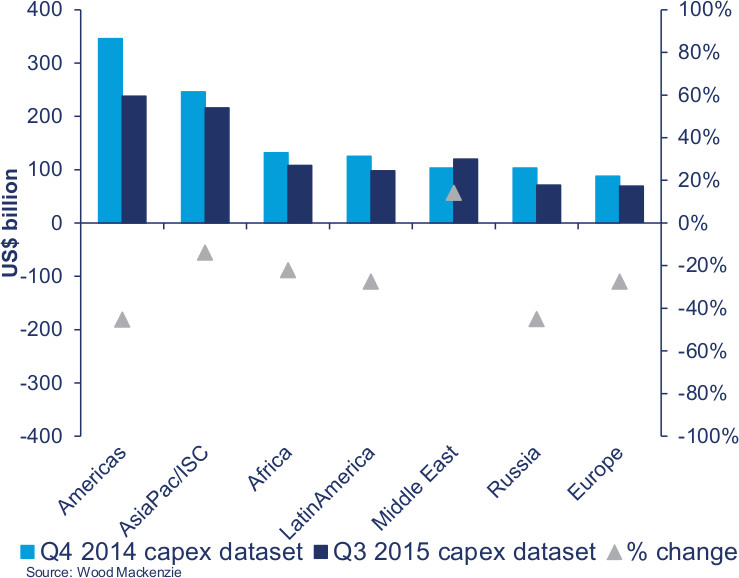

Forecast investment already has plummeted by an estimated $220 billion for the period of 2015 to 2016 compared to WoodMac’s pre-oil price crash projections, with 46 projects outside North America deferred as a result along with the severely reduced activity that has taken place onshore North America.

Ultracompetitive bidding

Obo Idornigie, principal upstream research analyst at WoodMac, pointed out that the company expected just six new projects to get the go-ahead before year-end 2015, with perhaps up to 10 in 2016. This is already resulting in ultracompetitive bidding by the service sector as it negotiates hard with operators looking for best prices from presanction projects. Idornigie said prefinal investment decision offshore projects, for example, could benefit from such negotiations to the tune of between 10% and 15% in reduced capex through the resulting supply chain savings alone.

The analyst said the key to finding the other potential 15% in cost savings will be down to factors such as project optimization, the reworking of development plans, the adoption of smarter ways of working with the service sector and a more innovative approach to project management.

Idornigie said the potential cost savings are achievable through supply chain and project optimization improvements but stressed that operators have been responding over the past year and still continue to do so. “A lot of the low-hanging fruit has been cut. Job cuts have had to be made too, unfortunately. But operators can do more too: Reworking field development plans, optimizing project design and more innovative approaches to project management will all play important parts.

“The recently sanctioned Appomattox deepwater field in the Gulf of Mexico shows what’s achievable. Total project costs were reduced by 20%, of which 75% was related to project scope and efficiency gains. Currency depreciation also has been a significant bonus for some countries, notably Russia.”

North America fastest to react

Geographically, WoodMac said North American unconventional business has been the fastest reacting area so far. The flexibility to rapidly dial back investment in unconventionals at low prices has provided a competitive advantage for U.S. independents with the bigger positions, while majors and international players lack exposure to this flexible investment. The U.S. Lower 48 cost deflation was expected to average 20% over the 2015 to 2016 period, with some projects achieving more than 30% in savings.

“The industry’s responsiveness and innovation will have cut costs by as much as 30% by year-end 2015, and there is scope for further efficiency gains. But deepwater and more technically challenging sectors such as HP/HT are playing catch-up,” Idornigie said in November 2015.

But it is the shelf and deepwater sectors that have the greatest scope to capture additional savings over the course of the next 12 months, according to WoodMac. For shelf projects, drilling accounts for about 40% of overall capex. For deep water, drilling costs, subsea systems and facilities account for about one-third each of overall capex. The analyst said unsanctioned deepwater fields could see some of the largest falls in costs over the next year, “though the sector remains expensive to develop, and more structural progress is needed.”

This survey of E&P companies earlier in 2015 outlines the industry’s initial expectations of development cost deflation by category, with the biggest savings of up to 30% forecast for unconventional onshore drilling (almost entirely in North America). (Source: Wood Mackenzie)

The declining number of sanctioned projects and activity is promoting cyclical deflation from the supply chain. (Source: Wood Mackenzie)

By the end of third-quarter 2015, companies had reduced their upstream capex by $220 billion for the 2015 to 2016 period compared to their stated plans as of year-end 2014. The two biggest declines are in the Americas and Russia, although the Middle East bucks the trend with capex forecast to rise by close to 20%. (Source: Wood Mackenzie)

Alliances, partnerships

The recent growth in merger activity, alliances and joint ventures (JVs) between several of the major drilling and service companies is seen as a strong indicator that further efficiencies will be achieved.

According to Idornigie, this is part of the much-needed underlying deep structural change that is required to lower the industry’s cost base to where it needs to be. He highlighted service sector moves such as Halliburton’s ongoing acquisition of Baker Hughes and Schlumberger’s acquisition of Cameron as clear examples of the way ahead, while partnerships such as the Forsys JV between Technip and FMC also represented great opportunities for further savings and efficiencies due to having more complimentary services and less “like for like” offerings from each participant.

“The service sector, previously so very fragmented, could see huge savings coming through in due course from partnerships with ‘one stop shop’ solutions like this,” he said. “This has been the argument from the service industry for some time. [These companies] have previously not been brought in mostly until a field development has been approved. Then the operator brings

the service company in later and the service company says, ‘This will not work.’ But getting them in earlier in the planning stage, as joint venture partnerships or alliances or as companies with wider service offerings than before, is what they have all been pushing for. We expect to see these types of alliances and partnerships continue to emerge.”

More efficiency

WoodMac is still forecasting a sharp rise in oil prices from 2017, accompanied by a “real risk” that cost inflation pressures also could then return. Because of this, the company said stronger collaboration between operators and service companies will be crucial in driving more efficient practices.

“Resetting the cost base is the name of the game,” Idornigie said.

WoodMac also warns that the E&P industry needs to ensure it strikes the right balance between near- and long-term drivers. Pushing the service sector too hard in the short term will only shore up problems once more attractive fundamentals return, the company said, while the increasingly severe job cuts mean the industry also is losing skilled resources that will take time to attract back when prices recover.

The winners, according to WoodMac, are likely to be operators with a strong pipeline of near-term, near-economic projects close to sanction that are able to take advantage of the trough in costs now and throughout 2016. The ability to lock in those lower supply chain costs before oil prices recover and investment starts to flow back into the sector is seen as a crucial advantage.

_________________________________________________________________________________________

Appomattox: project optimization in action

• Shell’s ultradeepwater Appomattox discovery in the Norphlet play was the first standalone development to receive a final investment decision in the U.S. Gulf of Mexico (GoM) in July 2015.

• The total project cost for what will be Shell’s eighth and largest floating platform in the GoM was reduced by 20% during the design stage through supply chain savings, design optimization and efficiency gains.

• WoodMac analysis suggested that of this reduction, 75% came from the optimized development solution based on the operator’s repeated use of a four-column production semisubmersible facility, most recently used on its Mars B Olympus tension-leg platform facility. The redesign of the project included a reduced well count and a corresponding reduction in subsea kit.

• Drilling contracts already are locked in, so there is limited scope to benefit from cost savings from rig rates.

• The remaining reductions can be assumed to be from supply chain savings.

• Cyclical savings represent only 25% of the capex reduction.

• Shell currently estimates the go-forward project breakeven price at about $55/boe.

Shell’s Appomattox Field currently under development has been held up as an example of what can be done at the design stage to reduce project costs. The operator estimates it has saved 20% through design optimization, supply chain savings and improved efficiency thanks to experience gained on its previous seven GoM floating platforms, most recently the Olympus tension-leg platform. (Source: Shell)

Recommended Reading

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

Sangomar FPSO Arrives Offshore Senegal

2024-02-13 - Woodside’s Sangomar Field on track to start production in mid-2024.

BP: Gimi FLNG Vessel Arrival Marks GTA Project Milestone

2024-02-15 - The BP-operated Greater Tortue Ahmeyim project on the Mauritania and Senegal maritime border is expected to produce 2.3 million tonnes per annum during it’s initial phase.

Exxon Mobil Green-lights $12.7B Whiptail Project Offshore Guyana

2024-04-12 - Exxon Mobil’s sixth development in the Stabroek Block will add 250,000 bbl/d capacity when it starts production in 2027.

E&P Highlights: April 1, 2024

2024-04-01 - Here’s a roundup of the latest E&P headlines, including new contract awards.